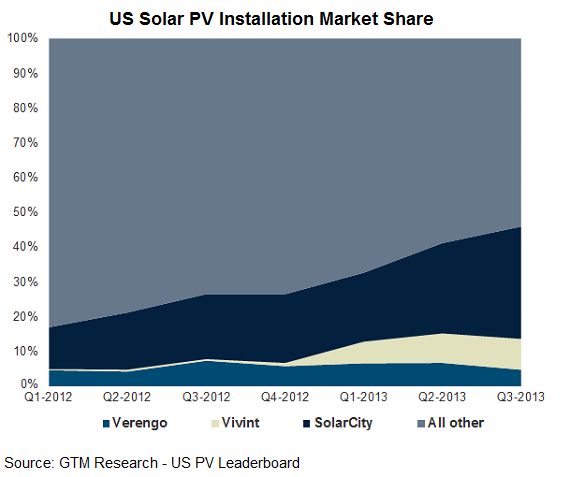

SolarCity had a dynamic 2013. The distributed energy financier acquired Zep Solar for its mounting equipment and acquired Paramount for its skill in gaining customers. The company launched the first securitized solar note, is brewing a crowdfunding mechanism of sorts via which individuals can invest in solar projects, and made retail deals with Costco, while also growing to claim around a 30 percent share of the residential solar market.

The firm discussed its 2013 business and Q1 2014 outlook on SolarCity's second Q4 earnings call this year. Revenue and EPS exceeded consensus. The stock is down 2 percent in after-hours trading.

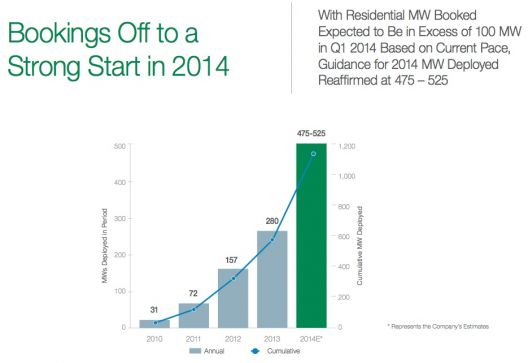

Lyndon Rive, SolarCity CEO, led off the call noting that the company was close to cash flow break-even for the entire year. He called attention to "record" January bookings, which were exceeded by February bookings. He expects the firm to exceed 100 megawatts of residential solar bookings alone in Q1.

A few tidbits from the call:

- Rive said that it cost SolarCity $2,000 to $3,000 to gain each of its customers. It didn't sound as if he expected that price to drop quickly any time soon.

- SolarCity ended 2013 with $1.68 billion worth of leased/to-be-leased solar systems (up more than 70 percent), $246 million in long-term debt, $53 million worth of solar asset-backed notes, and $230 million worth of convertible senior notes.

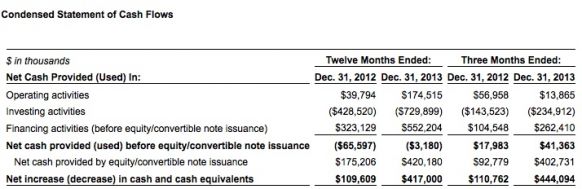

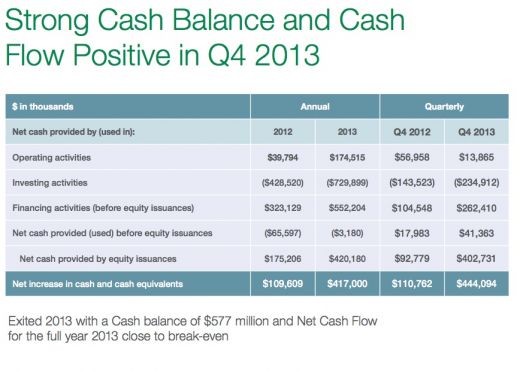

- CFO Robert Kelly said the company was cash flow-positive for the fourth quarter and "within $3 million of being cash flow-positive for the entire year."

- Lyndon Rive noted that California accounts for a little less than half of SolarCity's business.

- Rive was "comfortable" in his forecast that costs will continue to decline regardless of the tariff decision on Chinese modules. Co-founder and CTO Peter Rive estimated the drop in costs to be 5 percent in 2014.

- The CFO suggested that the cost of capital for rooftop solar should approach that of a prime mortgage. He said to look at the cost of fifteen-year mortgages for the eventual cost of solar securities.

- The company ended the year with a cash balance of $577 million.

The CFO said that "the economic value of the business" is highlighted in the cash flow summary.

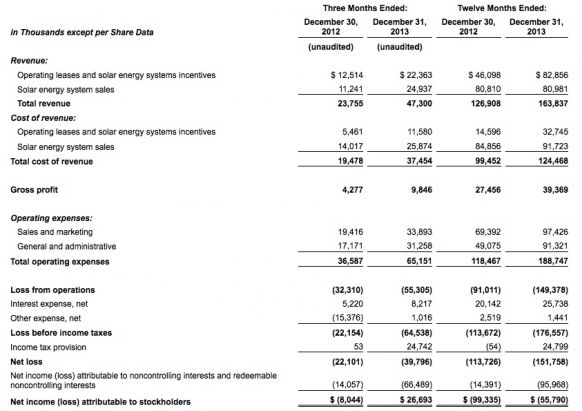

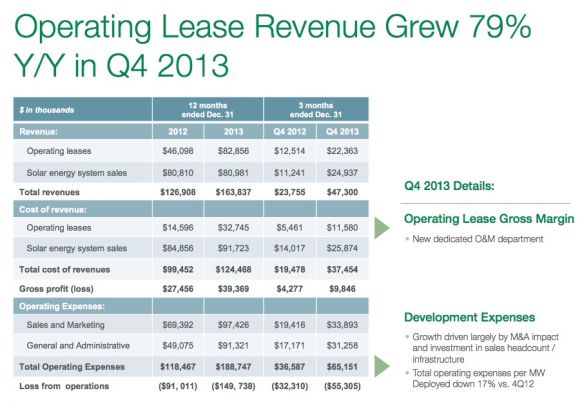

"Investments are production capacity --- and the lower the installed cost the better," said the CFO. Consolidated gross profit margin was 21 percent for the quarter. Loss from operations in the fourth quarter of 2013 was $55.3 million as compared to $32.3 million in the fourth quarter of 2012.

The CFO noted that a higher percentage of PPAs in the mix meant that SolarCity's business would experience more seasonality.

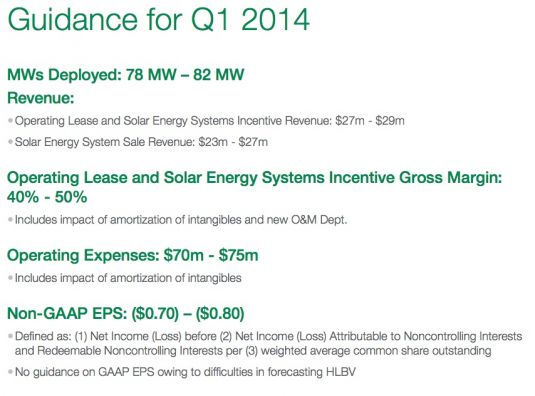

Guidance for Q1 and 2014

Lyndon Rive said that Q1 residential bookings in excess of 100 megawatts gave him confidence that the company will achieve the affirmed guidance of 475 megawatts to 525 megawatts deployed in 2014. The company expects to generate positive cash flow for the full year 2014.

Chart from GTM Research's U.S. PV Leaderboard.