During last week's Q2 earnings call, SolarCity's execs had to cope with analyst questions on moving into international markets.

CEO Lyndon Rive responded, "There are many international markets where the equity value creation is really good without any incentives, so it's just pure on the fundamentals. So, yeah, we are looking at those -- and stay tuned." To another question about international markets, Rive said. "I think we have an incredible model that we are going to be able to duplicate, but we are going to do it when we are ready."

After almost a week of careful consideration, SolarCity, the leading U.S. solar installer, is ready to make its first move out of the domestic market with the acquisition of Mexico's ILIOSS, a commercial and industrial solar developer, for $10 million in cash plus additional earn-outs based on performance.

(Adam James, GTM Research's Latin America solar analyst, called this last year when he reported that the Mexican distributed generation market was extremely attractive and also suggested that there is an opportunity for a SolarCity presence in the country.)

ILIOSS will continue as an independent business unit, with ILIOSS Chairman David Arelle and COO Manuel Vegara as president and general manager, respectively, of the new business.

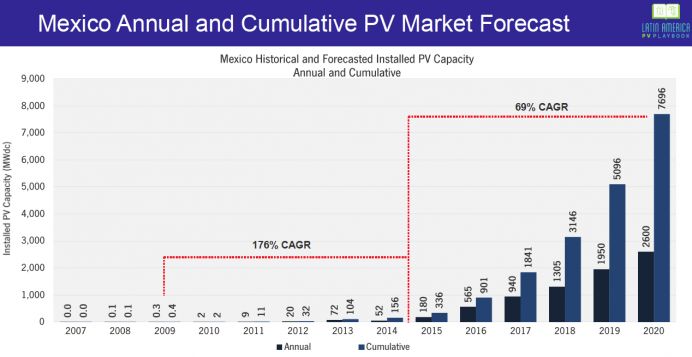

Mexico has a growing GDP and electricity demand that is driving a need for up to 22,000 megawatts of new capacity by 2025, according to GTM Research. Net metering was enacted in Mexico in 2007 and is administered by the Comisión Federal de Electricidad (CFE), Mexico’s state-owned electric utility.

SolarCity and ILIOSS "expect to be able to allow many commercial and industrial customers in Mexico to pay less for solar power than they currently pay for electricity."

GTM Research notes, "The commercial solar market (Tariffs 2 and 3) is being driven by the economics of net metering and/or self-consumption, given volumetric power prices of $0.09 per kilowatt-hour to $0.17 per kilowatt-hour. Some solar companies are bundling T2 and T3 clients under the self-supply scheme. GTM Research analysis indicates a break-even PPA rate for consumers is $0.15 per kilowatt-hour (T2) and $0.07 per kilowatt-hour (T3) due to higher demand charges."

Marco Krapels, SolarCity senior VP of strategy and global expansion, initiated and managed the acquisition and spoke with GTM on Tuesday afternoon. He said, "With ILIOSS, we are acquiring a company that has pioneered the PPA in commercial and industrial, with an installed base of more than a dozen projects."

CEO Rive said that low module, labor and permitting costs allow the numbers to work in Mexico "without any incentives" and suggests that that means "we've hit the crossover point."

Krapels said that ILIOSS is going after big-box retailers in Mexico such as Soriana and that CFE is welcoming SolarCity into the market. Mexican utilities "are not that excited about building generation," according to Krapels, and view solar as a good way of growing the grid.

SolarCity booked 395 megawatts in Q2 and installed 189 megawatts, while adding 44,900 customers for a cumulative total of 262,495.

Mexico has high electricity rates, favorable solar economics and strong solar resources -- making it one of the most promising solar markets in the world. Mexico installed 67 megawatts of PV in 2014 according to data compiled by GTM Research, but its solar market has been likened to the California market of five or six years ago; by all accounts, it's poised for remarkable growth. (See GTM Research's Latin America PV Playbook for more on this topic.)

FIGURE: Mexico Annual and Cumulative PV Market Forecast