"We really had an amazing quarter" was how SolarCity CEO Lyndon Rive opened up this afternoon's second-quarter earnings call.

The highlights, according to the CEO, were:

- 218 megawatts booked in Q2, a 216 percent jump. Rive said that this volume of bookings wasn't expected until the fourth quarter.

- SolarCity "added 30,000 customers in one quarter."

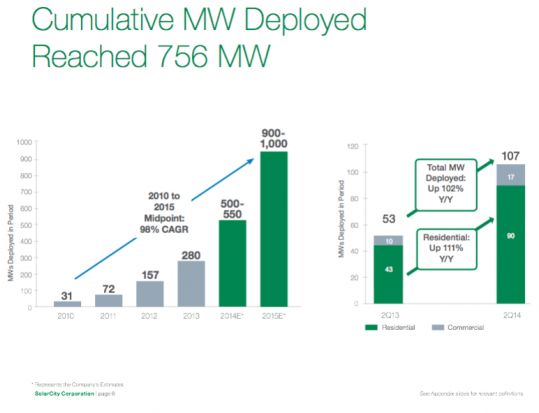

- The installer/financier grew its Q2 installed capacity to 107 megawatts

- "The third securitization highlights the depth of available low-cost capital," according to the firm. The third securitization raised $201 million with $160 million at 4.03 percent and was rated BBB+ by S&P.

- The Silevo acquisition closes at the end of August. The manufacturing site in New York is being selected.

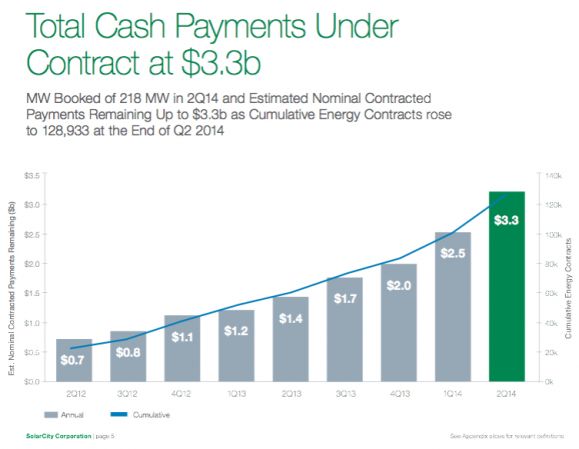

Rive said that the company has more than "$3.3 billion of customer payments coming to us in the next twenty years. We've added $800 million in one quarter. This growth, and the demand for the product, has really exceeded any of our previous forecasts."

He said, "We find ourselves in a very exciting situation," adding, "Now's the time to capture the market and grow as fast as we can."

SolarCity installed 1.2 megawatts of rooftop solar per day "every day of the quarter" in Q2, according to COO Tanguy Serra. He contrasted that to the ten days it used to take SolarCity to install the same 1 megawatt in 2010.

He said the 102 percent improvement is due to an "increase in the productivity of our crews." He attributed that improvement to the Zep mounting hardware, more efficient scheduling and more attractive incentive structures.

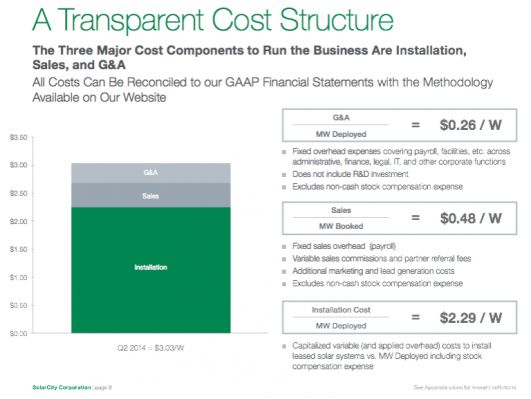

Some really good stuff on SolarCity's cost structure from COO Tanguy Serra (prices in dollar per watt)

-

The COO noted that the firm is "reducing cost twice as fast as our goal."

-

"In an effort to increase the transparency of our cost structure, we have reconciled the GAAP numbers from our 10-Q to our unit costs."

-

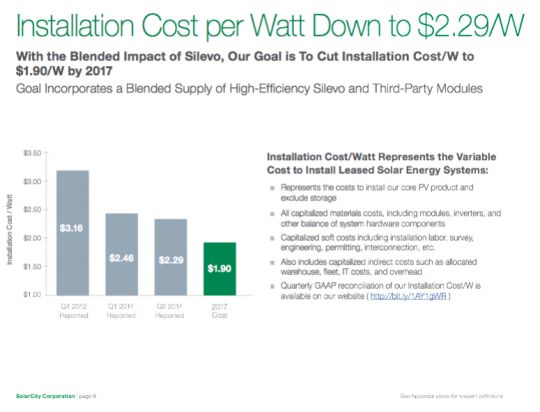

"On average we spend $2.29 [per watt] to build a solar system -- this includes the panels, the inverters, our proprietary Zep mounting hardware, the balance of system, the labor cost, the call centers, the processing and engineering functions, as well as all the infrastructure, vehicles and warehouses necessary to install a solar asset. So $2.29 installed cost."

-

"We are currently at 48 cents [per watt] acquisition costs."

-

Adding installed cost plus acquisition cost yields $2.77 per watt, "the total marginal cost of growing the asset base."

-

It typically takes less than a day to get a job installed.

-

The goal is to get installation cost down to $1.90 per watt.

-

The company currently has an installation cycle, the time from contract signing to interconnection, of 60 days.

Lyndon Rive, the CEO, also acknowledged that the firm is "testing different products on the solar loan side," adding, "Once we have come up with the absolute best product out there, we'll make a big announcement on what it will look like."

Guidance for Q3 2014: 135 megawatts to 150 megawatts deployed.

Guidance for 2014: 500 megawatts to 550 megawatts deployed.

Guidance for 2015: 900 megawatts to 1,000 megawatts deployed.