Solar carports were a hot topic at last week’s Solar Power International 2014 conference in Las Vegas, with carport structures prominently on display across the trade show floor. As discussed in GTM Research’s recent report, the U.S. Solar Carport Market 2010-2018: Landscape, Outlook and Leading Companies, the secret about this opportunity is out, and companies have begun strategically planning around the carport market and looking for ways to gain market share and lower costs. GTM expects that the market will surpass 200 megawatts in 2015 on its way to achieving more than 300 megawatts of added installations in 2017.

On the heels of the show in Las Vegas, SolarCity announced the ZS Beam. The product is part of the SolarCity Zep Solar line and aims to reduce installation costs by allowing modules to be installed from below with a newly designed clamp. The system incorporates integrated grounding, which reduces costs by limiting the use of expensive copper grounding wire in the solar array.

Cost reduction opportunities

Because the majority of carport structure costs are tied to commodity steel prices, cost reductions to carport structures are dependent on operational efficiencies that lower installation costs and optimize system design. As GTM Research outlined in the U.S. Solar Carport Market report, keeping installers underneath the carport structure is a reliable way to lower costs and ensure safety on carport jobsites. An additional method of doing this is to use slide-in channeling that enables modules to be slid into place rather than being individually mounted. Some installers, however, claim that aspects of this approach could prove to be problematic if a module needs to be replaced.

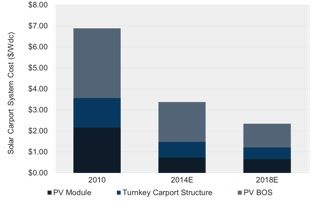

GTM Research forecasts that carport structural costs will fall 24 percent from 2014 to 2018. Many companies have identified vertical integration and stacking margins across the system as the only ways to bring down carport structure costs to those targeted levels. However, there is still room for independent structure providers to lower cost through improved efficiency and design. EPC firms often view installation efficiency as paramount to a project and seek to work with vendors that lower system costs across the entire installation, not just on the structure itself. Accordingly, GTM Research expects that installers and EPCs will move away from the vertical integration model in order to maintain supply chain flexibility while working with preferred structural providers.

FIGURE 1: Average PV Carport System Cost Declines

Source: GTM Research's report U.S. Solar Carport Market 2010-2018: Landscape, Outlook and Leading Companies

Continuously expanding landscape

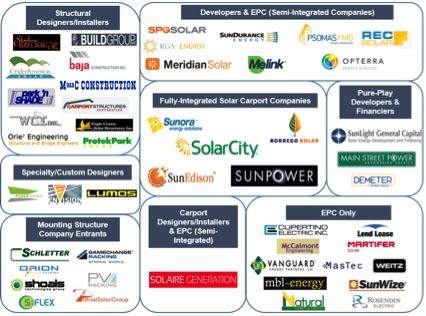

The solar carport landscape is becoming ever more crowded, and SolarCity is not the only company with a new product on the market. In recent weeks, the U.S. subsidiary of German mounting structures company S:Flex announced a new carport product, as did pure-play carport vendor and installer Solaire Generation, which announced an alternative version of its no-frills carport designed for West Coast markets.

Mounting structure firms such as S:Flex have had a difficult time gaining market share among carport structural vendors. The market has been dominated by large steel construction firms that have a competitive advantage in procuring and installing steel at scale, as well as vertically integrated solar companies like SolarCity and SunPower that have their own installation capabilities. We expect to see more vendors enter the market, but those companies must offer differentiated products that lower installation costs if they hope to compete with the large turnkey providers.

FIGURE 2: U.S. Solar Carport Landscape

Source: GTM Research U.S. Solar Carport Market 2010-2018: Landscape, Outlook and Leading Companies