In its first earnings call since its IPO, SolarCity, the solar installer and financier, just announced its fourth quarter and 2012 financial results.

The company's revenue is surging, but so are its losses.

The income structure of a company like SolarCity, with a business model based on solar leasing and power purchase agreements for rooftop solar, is complex. Stripped of the small detail of distributed energy, the business is about the velocity of money. The specifics of the firm's finances are here.

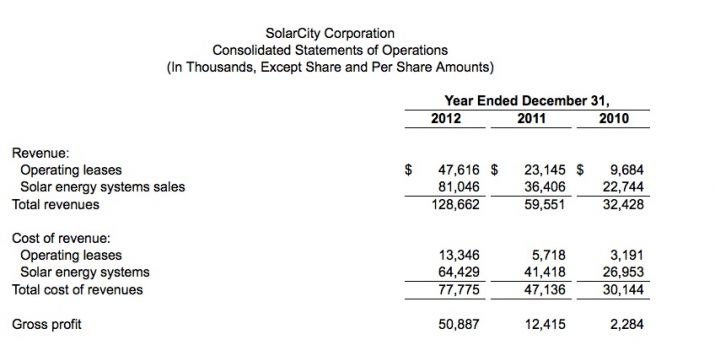

According to the income statement, total revenues, however defined, were $128 million, more than double the previous year. Gross margin increased to 40 percent.

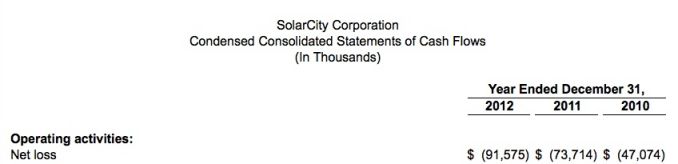

But losses also surged to $91.5 million in 2012.

SolarCity's "investments in distributed PV generation" were $449.1 million in 2012. The firm's customer base increased 243 percent to 30,950 total customers in 2012 with 15,425 transactions from "other energy products and services" which includes energy efficiency audits and energy storage deployments, a leap of 315 percent from the previous year. The firm has more than $1 billion in "nominal contracted payments remaining," an increase of 124 percent from 2011.

CEO Lyndon Rive, in an earlier statement, guided 2013 deployments at 250 megawatts -- 190 megawatts of residential and 60 megawatts in the commercial sector. That's up from 157 megawatts in 2012.

Shares in SolarCity debuted at $8 in December of last year and closed at $19.27 on Wednesday, but shares have fallen sharply in after-hours trading on news of a revenue miss and increased losses.

We covered SolarCity's IPO pricing travails here. Check out our interview with SolarCity CEO Lyndon Rive here and here.