The Department of Commerce (DOC) recently ruled that China’s financial support to its solar manufacturers constitutes a violation of World Trade Organization (WTO) rules. DOC imposed protective tariffs of 2 percent to 5 percent. A second decision, potentially imposing further and higher tariffs, is expected May 17.

Tariffs enforce WTO rules and protect U.S. solar manufacturers, but could also drive up solar costs or touch off a U.S.-China trade war. Center for American Progress China energy and policy analyst Melanie Hart and Grape Solar founder Ocean Yuan debated the wisdom of tariffs at the GTM solar summit.

“Three things are of growing concern,” Hart said. Fossil-fuel-backed U.S. political leaders are not supporting renewables, she said, while China “has a forward-looking five-year strategy” and is “dedicating a lot of money to growing solar, particularly manufacturing.”

Second, she said, “China’s policy process is not transparent.” When accusations are leveled, “we start to assume that perhaps what we don’t see is also problematic. There is growing suspicion.”

Third, she said, “China is reaching a point where everything it does matters to us [and] we can’t afford to feel we’re on the losing end of such a critical trade relationship.” But, Hart said, “we have a non-political arena for laying out evidence of whether a foreign government is engaging in illegal subsidization and allowing some non-political, calm head in the Department of Commerce to make that decision.”

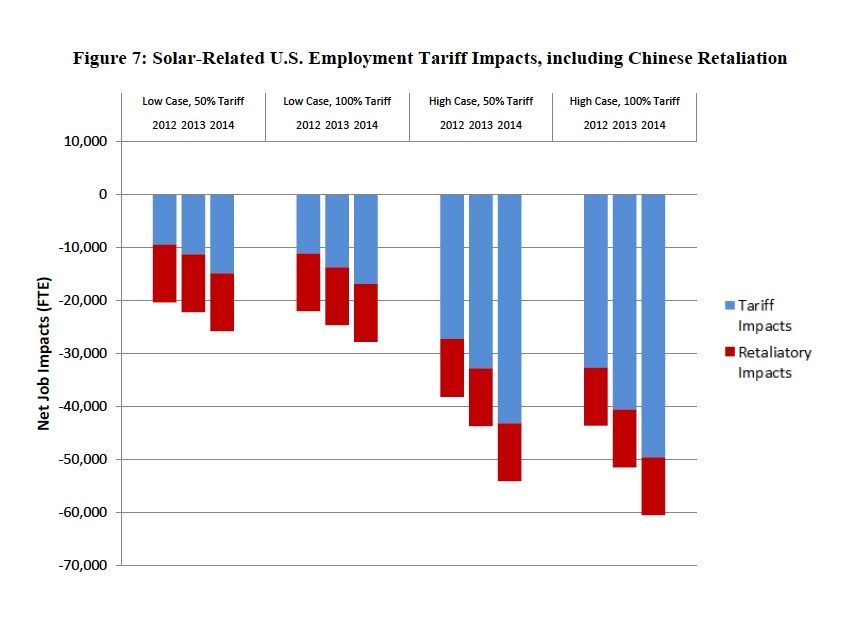

(Chart data from The Brattle Group)

“I can only speak about my own experience,” Yuan said. Grape Solar “received a series of notices from the Port of Seattle and the Port of Portland two weeks ago, and they demanded a cash payment the next day. We immediately sent a check to our customs broker. Otherwise, they can confiscate property, including panels.”

“Installers, importers, distributors, and developers,” Yuan said, will be affected by tariffs, and “nobody will benefit.” Many U.S. manufacturers and the entire consumer-oriented part of the solar sector benefit from low costs, he said, adding, “We should be competing with the traditional fossil fuel generators, not fighting amongst ourselves.”

Hart agreed, noting that fossil fuel interests invested $16 million in Q1 2012 to oppose Obama's clean energy policies. But, she added, “If we allow local government policies such as these subsidies to determine who comes out on top in such a critical global energy as solar, it could reduce our ability to compete against fossil fuels in the long term.”

“Our relationship is too important,” Hart continued. “We should be addressing these problems in a legal-judicial fashion, to make sure we not only have cheap solar panels today but a long stable renewable energy partnership that can keep us going for the next five to ten years and beyond.”

For the past 30 years, Yuan replied, China has been encouraging government support for all manufacturing, not just solar, because, Yuan explained, when China opened up to the West and Deng Xiaoping visited the U.S., he asked what China’s new role should be. "‘You make things,’ he was told, ‘and we will buy them.’"

“That,” Yuan said, “led to today’s China. Now all of a sudden, the U.S. says, ‘I have fed the beast and it has grown into a monster.’ The U.S. wants to punish China for doing what it was told to do,” Yuan added. “And the market between these two countries is only $6 billion. Solar panel imports are less than $2 billion.”

Greentech Media Research Managing Director Shayle Kann posed to each debater “one of the more compelling arguments on either side.” To Yuan, he asked, from “the pro-tariff side,” whether the U.S., on the assumption that China is violating WTO rules, should pursue enforcement even if it has a negative short-term impact on U.S. solar panel makers. Shouldn’t the DOC “enforce the rules?”

“Assuming China is breaking the rules is a wrong assumption,” Yuan said. In his view, "The DOC is essentially saying, ‘I make the rules. You are breaking my rules.’ How fair is that?”

Also, he added, “if you are trying to make anything in the U.S. and there is no uniqueness of your product, and if you try to compete with low-cost countries,” he said, “it’s simple math. With no technological advantage, how can you compete? You cannot. Face it. Do something else.”

On “the anti-tariff side,” Kann asked Hart, won’t the tariff mechanism simply hurt the industry by driving up costs? “The likelihood is most top-tier manufacturers will skirt the tariffs,” Kann said, by setting up in Taiwan or Mexico. “U.S. prices won’t be hugely different.”

“The goal here isn’t to protect U.S. manufacturers from competition,” Hart said. “The goal is to raise the price of cheating,” and “to make local government officials think twice before rolling out policies that might be or might appear to be WTO-illegal.”

A questioner pointed out that 74 percent of U.S. solar jobs come from the industry segment most impacted by tariff-induced higher panel prices. “Why would we put a China-U.S. trade war on the back of an industry trying to compete with fossil fuels?”

“The best thing we can do to ensure innovation and the ability to compete with fossil fuels,” Hart replied, “is to make sure we have a level playing field across all manufacturers and we are developing not just cheap solar panels but better and more efficient panels.”