[pagebreak:SolarSurvivorsWinnersandLosersinCrystallineSiliconPV]

If you're a crystalline silicon-based cell or module maker, life is hard right now. Module prices have been in free fall since the fourth quarter of 2008, plummeting from $4.00/W in September to $2.25/W at present. At the same time, demand has trended sharply downwards as well during this time (so much for short-term price elasticity, right?). And that's just the beginning of their woes: year-end cell crystalline silicon capacity for 2009 is estimated at over 14 gigawatts. When one reconciles that with around 6 gigawatts or so of demand (and it remains to be seen if we'll even get there), of which 1 gigawatt or so will be installations using First Solar modules, it doesn't make for a pretty picture. And if things couldn't get any worse, many of these companies have millions in debt repayments due over the course of the next twelve months (unlike a number of thin-film firms, which are venture-funded).

Put this all together and you have a struggle for survival of Darwinian proportions; much blood will be spilled, and not everyone will make it through to the other side. Over the next few years, the market will be increasingly restricted to only to those companies with the best products, lowest cost structures, and most successful business models. The task, then, is to identify which crystalline silicon-based technologies, business models, and companies will be in a position of strength to weather the storms versus those most likely to be at risk from the shakeout that is currently well underway in the PV industry.

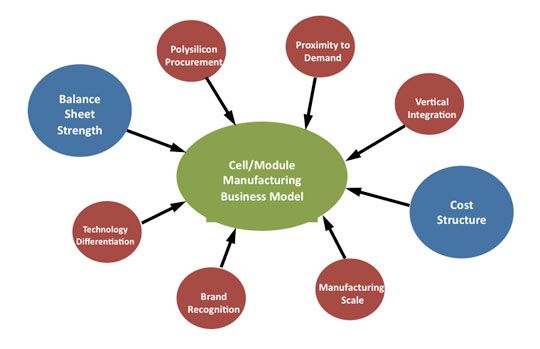

This question framed the considerations of GTM Research's recently published report, Surviving the Shakeout: Winners and Losers in Crystalline Silicon PV. Aiming to comprehensively lay out what it will take for a crystalline silicon-based cell/module manufacturer to succeed over the next two years, it conducts a comparative analysis of the 50 most prominent crystalline silicon-based cell and module manufacturers in the market over eight key performance metrics, namely:

1. Degree and nature of vertical integration

2. Cost structure

3. Balance sheet strength

4. Polysilicon procurement arrangements

5. Technology differentiation

6. Manufacturing scale

7. Proximity to demand

8. Brand recognition

Figure 1: Determining Metrics for Crystalline Silicon Cell/Module Manufacturing Business Model

A quantitative assessment was carried out for each metric for each crystalline silicon cell and module manufacturer, and companies were ranked based on a weighted average calculation. Cost structure and balance sheet strength (as indicated by the larger circles in Figure 1) are considered as first-order drivers, meaning that they were weighted higher in the final assessment than other factors. To whet the appetite, below is a sample section from the report.

Technology Differentiation

As pertains to PV, the term "technology differentiation" is largely synonymous with one variable: conversion efficiency at the cell and module levels. Efficiency matters for the following reasons:

1. Gains in efficiency drive cost reductions at all steps of the manufacturing process on a dollar-per-watt basis, from the cost of the feedstock to module conversion: all else equal, higher efficiency means higher energy output for the same cost.

2. Efficiency gains also lower area-related or balance-of-system costs (i.e., wiring, foundations, labor, etc.). BOS costs scale inversely with module efficiency, since higher efficiency means fewer panels are required for the same output. Therefore, given equal module cost, higher efficiency drives a lower installed cost, and thus lower cost of electricity.

3. Efficiency becomes a key consideration when space is a constraint – meaning that in such cases, higher efficiency technologies will obtain a premium and differentiate a company's product. This is precisely the value proposition of "super mono" technologies such as SunPower's back-contact cell and Sanyo's HIT product.

[pagebreak:Solar Survivors Cont'd]

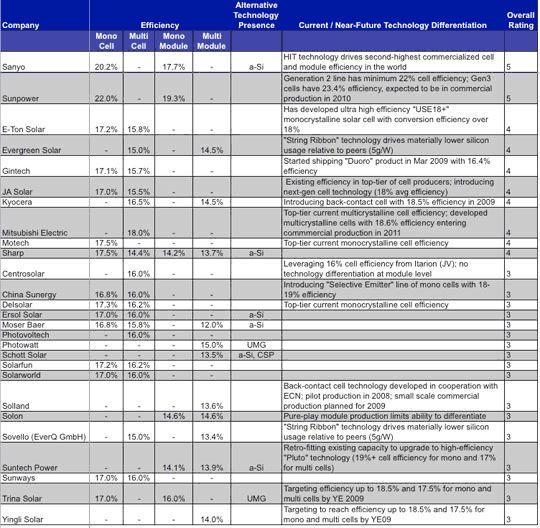

Figure 2 assesses technology differentiation for the top 25 companies on a five-point scale. Aside from current cell and module efficiencies, two other factors were taken into consideration in the final analysis:

1. Near-term technology roadmap: Even though this report has a 12 to 18 month focus, it is necessary to take into account near-term targets and innovations into the analysis, as most cell and module manufacturers are striving to continuously improve efficiencies. Examples include Suntech, which will be retrofitting its existing capacity with its high-efficiency (19%+ monocrystalline cell) "Pluto" technology over the course of the year, and Gintech's 16.4% efficiency "Duoro" product, which it began shipping in March 2009.

2. Alternative technology presence: many producers have placed side bets on other technologies as well, whether through internal divisions, subsidiaries or joint ventures with other firms. These investments serve as a hedge against the rise of alternatives to traditional crystalline silicon-based technologies, and would allow them to take advantage of a scenario where one of these alternatives emerges as a market leader. This factor only really comes into play, however, if the alternative can scale to material levels in the near-term, and not all options are equally viable. As illustrations, Sharp's amorphous silicon division (2009 capacity of 160 megawatts) is considerably more meaningful at the moment than Q-Cells' CIGS presence (6 megawatts) through its subsidiary Solibro, and the value proposition of upgraded metallurgical silicon (UMG) technology has been significantly compressed following the sharp drop in polysilicon prices of late.

Figure 2: Crystalline Silicon PV Technology Differentiation Assessment, Top 25 Firms

The full report contains similarly data-driven and in-depth analysis of each of the eight metrics discussed above, along with conclusions pertaining both to individual companies and business models, and final rankings for the top 50 crystalline silicon PV manufacturers in the industry that allow a crystalline silicon-based manufacturer to accurately assess its competitive position in relation to its peers.