Solar-plus-storage is already competitive with the world's most efficient form of gas generation in Morocco and Jordan, according to new research from Wood Mackenzie Power & Renewables.

Solar on its own is much cheaper than combined-cycle gas turbines (CCGTs) in both markets, states the Solar-Plus-Storage in the Middle East and Africa market opportunity assessment published this month.

The fact that solar was still competitive with the most efficient gas technology after adding battery storage, which bumps up the cost by 126 percent, was “quite big news,” said Rory McCarthy, senior storage analyst for Wood Mackenzie Power & Renewables.

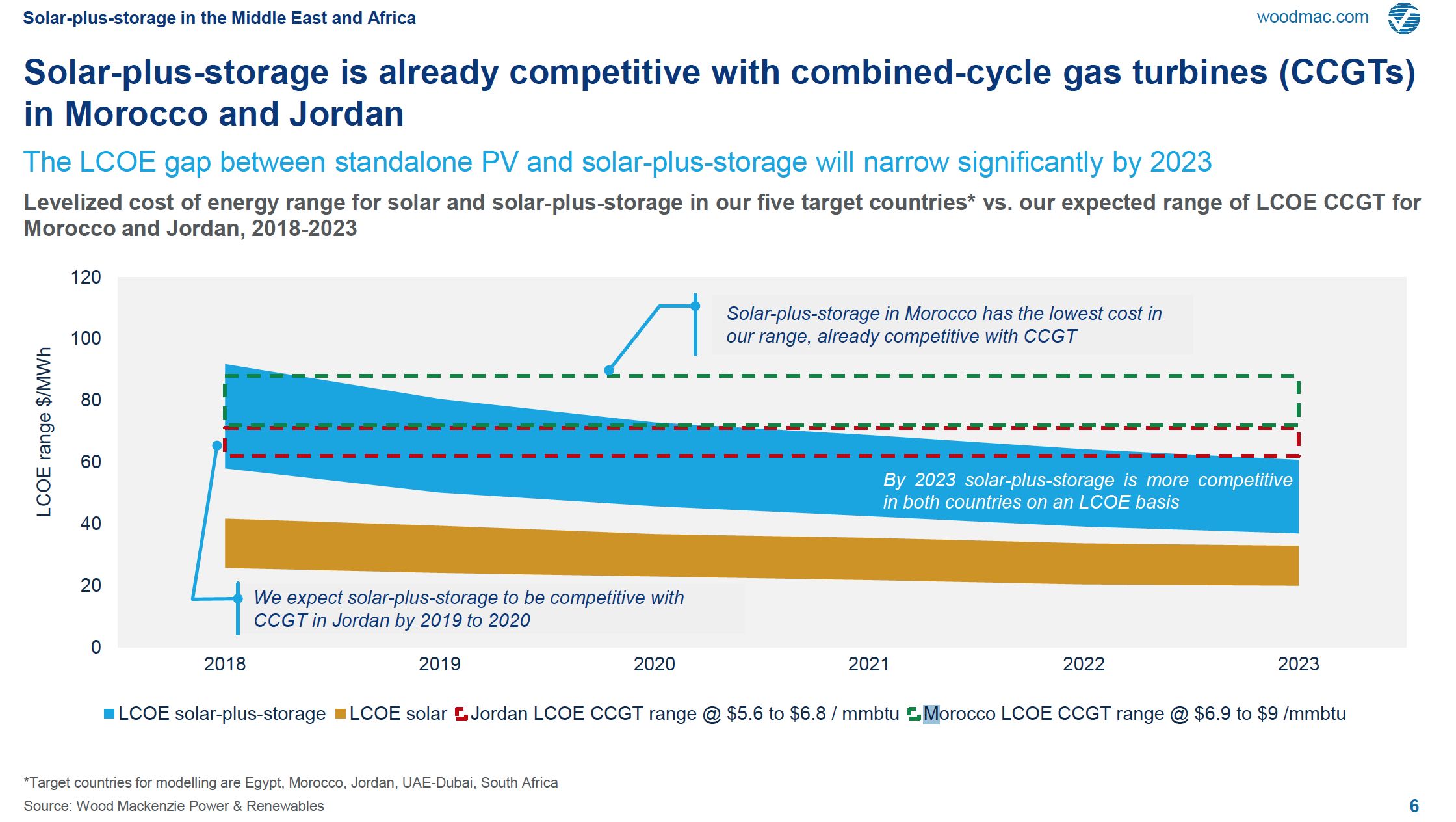

The firm’s latest figures show the levelized cost of energy for solar-plus-storage ranging between around $60 and $100 per megawatt-hour across five Middle East and African countries: Egypt, Jordan, Morocco, South Africa and the United Arab Emirates.

This puts the combination of solar and batteries on level footing today with CCGTs in Morocco, which have a fuel cost of $6.90 to $9 per million btu, and starting this year in Jordan, where the fuel cost is from $5.60 to $6.80 per mmbtu. In Egypt, for comparison, the gas price to the power sector is currently $3 per mmbtu.

"For gas-poor countries like Morrocco and Jordan, solar-plus-storage will be driven by the need to reduce reliance on expensive gas imports," the report states.

Wood Mackenzie predicts that by 2023, the cost premium for storage will have dropped to 85 percent, and solar's levelized cost of energy (LCOE) will have come down, too.

In South Africa, the most expensive market surveyed, Wood Mackenzie expects solar LCOEs to go from $41.70 per megawatt-hour today down to $32.90 in 2023. And in the United Arab Emirates, the lowest-cost market for solar among those surveyed, PV LCOEs are forecast to drop from $25.70 to $20 per megawatt-hour.

These cost reductions mean that by 2023 the LCOEs of PV with batteries will have fallen to between $40 and $60 per megawatt-hour, beating CCGTs in all of the countries surveyed except for Egypt. Egyptian solar-plus-storage will remain unable to compete with CCGTs because of the low cost of gas in the country, which is expected to be a net gas exporter between now and 2023.

And while PV and batteries are expected to reach cost-competitiveness in four of the five spotlight countries, analysts say it's unlikely that demand will spike, due largely to the duration limits of energy storage. The Wood Mackenzie report modeled PV coupled with four hours of lithium-ion battery storage.

For comparison, the authors also looked at the competitiveness of concentrated solar power (CSP) plus thermal storage in Morocco, South Africa and the UAE.

The report noted that CSP thermal stores are typically designed for long-duration discharge applications, with up to 15 hours of storage. “If tenders are designed for long-duration storage, lithium-ion projects may find it difficult to scale and compete at this level,” the report states.

“However, if tenders are modeled based on a technology-neutral approach, solar-plus-storage could compete and win on an LCOE basis after the expected cost reductions have come to fruition for four-hour systems.”

McCarthy noted that in pitting solar-plus storage against CCGTs, the analyst team was not intending to carry out an apples-to-apples comparison, since the gas turbines are designed for baseload operation. Instead, the aim of the study was to chart how far solar-plus-storage had come in terms of competitiveness in the Middle East and Africa.

“CCGTs are arguably the most efficient fossil-fuel plants out there,” McCarthy said.

Still, the report shows that solar-plus-storage, which was a very expensive combination until recently, "is beating the most cost-effective fossil-fuel plants in areas where fossil fuels are among the cheapest in the world," he said. "Five years ago, you would have been called crazy to say this was in the cards for 2019.”

It remains to be seen whether Middle East and African policymakers will take note, though.

Although appetite for PV is booming, with capacity expected to almost double this year, only 147 megawatts of front-of-the-meter storage has so far been commissioned or contracted across the whole of the Middle East and Africa, according to Wood Mackenzie. Around 38 megawatts of this is made up of co-located PV and battery storage.

“It’s unlikely that solar-plus-storage will see the same growth pattern in the region as standalone PV, as many of the market fundamentals are yet to be introduced," the report states. “But in markets that will face grid-balancing issues from high-penetration renewables or are in the process of phasing out gas subsidies, it is likely that PV projects will increasingly co-site battery storage where grid services are valued.”

***

Learn more about the Wood Mackenzie report here.