Please forgive us the journalistic conceit of collecting these year-end trends -- it's a necessary evil we all put ourselves through. In solar, this year is a bit more nerve-wracking than last. Here are ten trends in a particularly dynamic and pivotal year that will echo into 2012.

In no particular order:

Solar PV panel pricing has plummetted

Some will attribute it to economies of scale, others to Moore's law, and others to China dumping panels at below cost prices, but the bottom line is solar module pricing dropped 30 percent in 2011.

David Crane, the president and CEO of NRG Energy observed, "In the last two years, the delivered cost of energy from PV was cut in half. NRG expects the cost to fall in half again in the next two years, which would make solar power less expensive than retail electricity in roughly 20 states, he said. The expected drop in solar costs has "the potential to revolutionize the hub-and-spoke power system, which currently makes up the power industry," quoted in Platts.

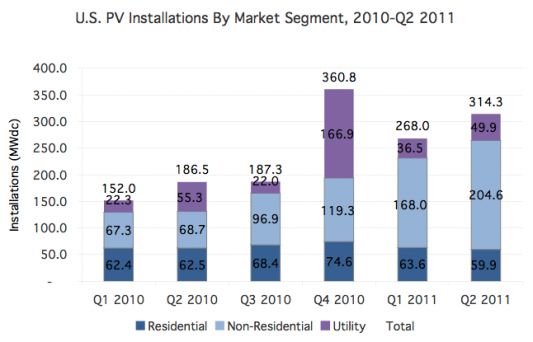

The U.S. joins the one gigawatt club

The United States finally passed the one gigawatt of PV installed in a year mark, a barrier long eclipsed by Germany and Italy.

The third quarter was a record with the U.S. installing 449 megawatts of PV, more than the U.S. installed in all of 2009. 2011 looks like it will finish with more than 1.5 gigawatts installed in the U.S., a massive increase due to utility deployments, the 1603 Treasury grant, and a viable third-party residential finance mechanism, up from the 887 megawatts installed in 2010.

The U.S. solar energy industry was one of the fastest-growing sectors of the American economy in 2011. In total, cumulative grid-connected solar electric installations have reached more than 3 gigawatts.

On October 19, SolarWorld and some unnamed solar companies, acting as CASM, the Coalition of American Solar Manufacturers filed an official claim with the U.S.Department of Commerce and the International Trade Commission alleging that China was dumping solar panels in the U.S. and providing unfair subsidies to its solar industries. We have covered the issue extensively, ranging from claims by CASM to counterclaims by CASE. Obama weighed in on the matter as did CASE's Jigar Shah, SolarWorld's Gordon Brinser as well as the Chinese module vendors. Chinese organizations have accused the U.S. of dumping polysilicon in China.

This is uncharted territory for U.S. solar and the impact on the growth of the U.S. and global industry as well as jobs is unpredictable. The claim happened in 2011 but the ripples will be felt in 2012. Here is the case calender:

Solyndra's bankruptcy and political firestorm

Solyndra was the DOE loan guarantee recipient and bankruptcy that finally brought solar power into the public consciousness -- in precisely the opposite way from that which the solar industry would have preferred. Everyone including Fox News and Congress had an opinion.

This was a solar company that should not have received VC funding and should not have received a DOE loan guarantee. Not because of China's pricing or alleged crony capitalism but because it was a lousy design. More than 1,100 employees lost their jobs as did a few DOE employees and a few other projects like SolarCity's SolarStrong felt the impact. On a positive note, the echoes of this story are starting to fade, although they might re-emerge as the U.S. presidential race heats up. We've written scores of articles on the topic if you'd like the gory details. The company's website is still up. We detailed a recent auction at their site here.

A year ago First Solar's stock was trading at $130.00, the firm had hefty margins and was held up as the standard bearer of success in the solar industry from an execution as well as a technological standpoint. All this from an American thin-film firm, no less. Fast forward a year later and the stock is at $31.80, the firm has a market cap of $2.84 billion, has experienced a shaky CEO shift, and is potentially a takeover target.

Earlier this week, the firm's shares closed at a record low of 0.65 times book value, (the value of its assets minus liabilities), cheaper than every renewable energy equipment maker with a market value greater than $1 billion except for wind turbine manufacturer Vestas Wind, according to data from Bloomberg. Paging GE, Siemens, Samsung, or any Asian private equity firm flush with cash.

But don't write the First Solar eulogy just yet. First Solar still has the most impressive cost per watt and gross margin of any solar module manufacturer on earth and still has a vertically-integrated business model that can weather this solar storm. First Solar might choose to get through this wilderness on its own.

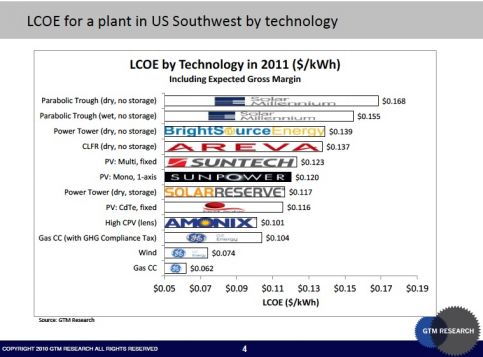

CSP projects, especially trough technology, shift to PV

Firms like Solar Trust, now called Solar Millennium, (now called bankrupt) have had to transform solar plants like the 500-megawatt solar thermal power plant it had been planning in Blythe, California into a 500-megawatt plant photovoltaic deployment.

The shift comes because of "improved market conditions" for building power plants with low-priced dollar-per-watt PV modules. Switching to PV also lets firms build plants in smaller increments and PV plants are just plain easier to build than CSP plants. A total of 3 gigawatts of solar thermal projects have been converted to PV projects, according to GTM CSP industry analyst Brett Prior. Earlier this year, Prior estimated that the installed cost of a thermal plants might be around $5.79 per watt, while the installed cost for utility-scale PV plants is closer to $2.50 per watt.

The advantage that CSP does have is the potential for thermal storage to level out intermittency and provide power after dark. Power tower architectures, like those of IPO-aspirant and DOE loan guarantee-recipient BrightSource Energy, seem to have an LCOE advantage over trough systems, according to the company and Prior's calculations below.

Prior estimates that SolarReserve, a power tower vendor which, unlike, BSE, has designed in storage from the very start has an LCOE lower than BrightSource and even lower than some solar photovoltaics.

Korea makes its move into solar

China's recent dominance of the solar manufacturing industry is obvious. More nuanced are the efforts that Korea has taken to advance its renewable energy presence. There's Hanwa Solar which bought a controlling interest in China's SolarFun in 2010. Keep in mind that Samsung announced a $5.5 billion investment in their photovoltaics business between now and 2020. And lately we've seen earlier stage investments by large Korean companies in small American thin-film CIGS startups. A reeling HelioVolt received a white knight investment from Korea's SK Innovation for its CIGS technology in September. Just this month Stion, also a CIGS vendor, received a major investment from Korean equity firms as it establishes a Korean subsidiary.

As we've reported in PVNews, Korea is expected to be a region of interest, particularly for c-Si cells, as producers in these regions (Shinsung Holdings, Millinet, Hyundai Heavy Industries, Samsung) have planned significant investments in cell manufacturing for 2011 and beyond.

The End of the 1603 Tax Grant Program?

The 1603 Treasury Grant program has been one of the drivers of a thriving U.S. solar industry -- but it is set to expire at the end of 2011. Originally structured as a tax credit, it was changed to a grant as part of the Recovery Act and was intended to fill a gap in tax equity financing, providing solar deployments easier access to capital until the tax-equity market recovered. Without 1603, many small solar developers could fail and the growth of the U.S. solar industry could stall. In the absence of a 1603 Treasury Grant extension, the big question will be how much tax equity is available, and at what price? As it currently stands, the somewhat limited crop of tax equity investors (around 17 that are currently active) appear likely to be in a position of power with the ability to increase yield requirements and squeeze project returns. However, the entrance of new tax equity financiers such as Google, PG&E and Chevron is a positive sign that the total supply of tax equity could improve.

SEIA believes that there is a good chance of getting the 1603 cash grant program extended. Rhone Resch, SEIA's President said that "1603 is a big deal and we need to let our voice be known." He noted that it went through last year and if it goes through this year, it will happen in classic Washington, D.C. fashion as part of a tax-extender bill. Resch noted that the Super Committee is going to support a tax extenders bill that applies across 100 different taxes supported by Republicans and Democrats. "We'll see an extenders bill created in December and possibly passed early next year," along with a retroactive grant, according to Resch.

The Solar Shakeout has just begun

This year has seen plant closures, bankruptcies, or fire sales declared by BP Solar, Evergreen Solar Millennium, Soliant, Solon, Solyndra, SpectraWatt, and Stirling Energy Systems. 2010 saw the closure of VC-funded Wakonda, Senergen, Solasta, and Optisolar. This is just the tip of the iceberg that will reveal itself in 2012.

As GTM Research Solar Analyst Shyam Mehta said, "In summary, the unrelenting, prolonged shakeout that was originally predicted for 2009 seems increasingly likely to manifest itself beginning in early 2011. All signs point to a period of severe upheaval (i.e., restructurings, acquisitions, insolvencies) for high-cost manufacturers; unlike in 2009, however, there will be no Germany to step in, and no quick respite or return to the status quo. To survive, these firms will have to undergo significant transformation as far as their business models are concerned. Those that resist change will likely be pushed out of the market -- and this time, there will be no turning back."

The Majority of Modules Installed in the U.S. are Chinese Made

_624_452_80.jpg)

Source: California Solar Initiative, GTM Research

Note: Modules produced by Suntech Power Holdings were categorized as originating from the U.S. in 2011, and from China prior to 2011 for the purpose of this analysis, as the company’s module assembly facility in Arizona came online towards the end of 2010.

It's no surprise that the cheapest modules are being installed in larger quantities than more expensive, domestically produced products. The figure above is only representative of California, but additional anaylsis including datasets from other major state markets shows that Chinese product accounted for 41 percent of all U.S. residential and commercial installations compared only 20 percent American made in Q3 2011. Expect the Chinese percentage to grow in Q4 2011 and Q1 2012 as Chinese manufacturers aggressively move product into the U.S. to avoid potential tariffs and help developers complete projects at pre-tariff price points.

Andrew Krulewitz contributed to this article.