2018 is the year of the solar loan.

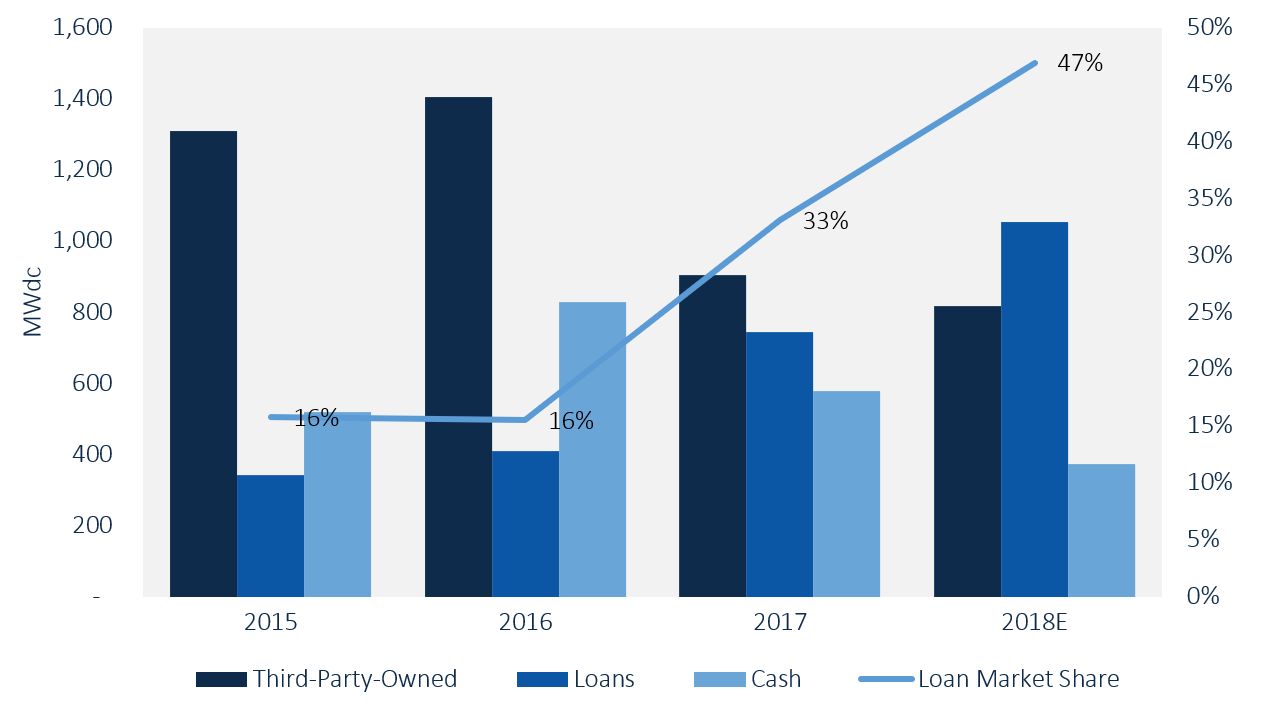

Despite rising interest rates affecting all consumer lending, GTM Research forecasts in its latest report, Bringing Scale, Profitability and Value to the Residential Solar Market, that solar lending will become the No. 1 consumer finance solution for residential solar systems in 2018.

Source: Bringing Scale, Profitability and Value to the Residential Solar Market

This increase in solar lending comes at the expense of both the third-party-owned (TPO) and cash markets, which includes personal and home equity lending. The TPO market hit its peak in 2016 as companies like SolarCity and Vivint Solar spent tens of millions of dollars acquiring customers through purchased leads, door-to-door sales, and selling via big-box retailers.

But starting in 2016 and throughout 2017, these same companies had to grapple with increased pressure from investors to become profitable, marking a stark change in focus for these and other large residential solar installers. In 2016, 83 percent of systems installed by SolarCity were third-party owned. By 2017, that figure had dropped to 61 percent.

The drop in SolarCity’s TPO business in particular contributed to the 15 percent market decline of the residential solar industry in 2017 over 2016 (and a 36 percent decline for the national TPO market). Even the cash market fell 30 percent in 2017 as struggles with customer acquisition plagued both national installers and the long tail.

Meanwhile, the loan market had a breakthrough year in 2017. The rise of solar lending companies such as Mosaic and Sunlight Financial contributed to 81 percent annual growth in the loan market. Much of this growth can be contributed to SolarCity's and Vivint Solar’s use of these solar lending companies, though other lenders such as Dividend Finance achieved explosive growth through partnerships with the long tail of installers.

Many of today’s solar loan products combine the benefits of leasing with system ownership. Like the leasing products, many solar loans require no money down and allow for annual savings on a customer’s electric bill, especially with longer-term loans. And like a cash sale, loans allow homeowners to own the system and take advantage of the 30 percent federal Investment Tax Credit, while also allowing them to enjoy the benefits of the power produced by the system after the loan is paid off.

The solar loan market is expected to continue to grow through 2023, though at a decreased pace as solar lenders must grapple with the same sorts of challenges faced by the major TPO providers. Most solar lenders have been able to grow quickly thus far at the expense of earning profits, though investors and capital sources are likely to tighten the reins on these companies in the coming years. Rising interest rates are forcing lenders to re-evaluate their pricing models, and potentially to move to methods that produce fewer but more profitable sales.

Solar lenders also face increasing headwinds as the recent IRS guidance on commence-construction rules will allow major TPO providers to procure equipment up to four years in advance to safe-harbor materials that qualify for the full Investment Tax Credit before it steps down. In theory, a TPO provider such as Sunrun could use this strategy to claim a 30 percent ITC on a system installed as late as 2023. No such safe-harboring exists for customer-owned systems, though, which could hinder the competitiveness of solar loans during the ITC step-down years.

While many challenges lie ahead for solar lenders, 2018 is gearing up to be another year of impressive loan market growth. Like the few remaining TPO players, solar lending companies must compete to offer customer savings while maintaining sufficient margins to appease investors.

***

Get access to all of GTM Research's U.S. residential and commercial reports and data with a subscription to our U.S. Distributed Solar Service.

GTM Research is now Wood Mackenzie Power & Renewables. The electrification of new sectors is affecting power markets. Drive innovation with market intelligence across solar, wind, energy storage and grid edge technologies and markets. Wood Mackenzie Power & Renewables research will enable you to make informed, strategic decisions in an increasingly decarbonized and decentralized electricity market. Learn more about us here.