Global clean energy investment has rallied from a months-long slump, thanks to solar.

The second quarter of 2017 saw $64.8 billion invested in clean energy around the world, up 21 percent from the first quarter of this year, according to the latest figures from Bloomberg New Energy Finance (BNEF). This marks the highest for any quarter since Q2 2016.

The financing of two enormous photovoltaic projects in the United Arab Emirates helped to drive a recovery in global clean energy investment. The 800-megawatt Sheikh Mohammed Bin Rashid Al-Maktoum III plant in Dubai and the 1.2 gigawatt Marubeni JinkoSolar and Adwea Sweihan project in Abu Dhabi contributed a collective $1.9 billion to the global investment total last quarter.

While these project investments represent an enormous sum, the power prices for these large-scale solar projects are some of the lowest ever recorded.

When Masdar was selected last year to build the third phase of the Mohammed bin Rashid Al-Maktoum Solar Park, its bid was heralded as the lowest-priced solar PPA in the world at 2.99 cents per kilowatt-hour. GranSolar, Acciona and Ghella were awarded the engineering, procurement and construction (EPC) contract for the 800-megawatt project in January. EDF Group, via its subsidiary EDF Energies Nouvelles, joined the Masdar-led consortium in March. Financing for the project closed in June.

Since the Dubai PPA was signed, however, prices have dropped even further, with tenders for the Sweihan project coming in as low as 2.42 cents per kilowatt-hour. Development teams were initially competing to build a 350-megawatt solar array, but the Abu Dhabi Electricity and Water Authority (ADWEA) invited bidders to submit bids for a larger project if they wished, as PV Magazine reported. Earlier this year, JinkoSolar and the Marubeni Corporation consortium signed a 25-year PPA with ADWEA to build the 1.2-gigawatt PV power plant.

“The UAE deals are the largest in that country to date by far, and show that its auction programs are leading to the commitment of hard cash by banks and equity providers," said Victoria Cuming, head of policy for Europe, Middle East and Africa at BNEF. "They also signal that oil-producing countries are warming to renewables as part of moves to diversify their economies.”

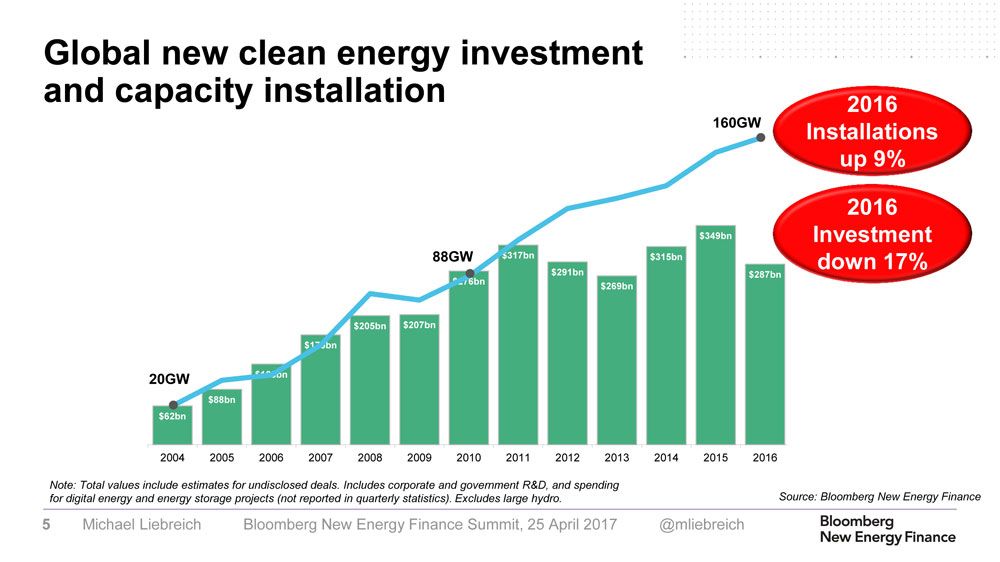

Falling prices -- for solar and other technologies -- constitute a big part of the reason why overall clean energy investment numbers have declined in recent quarters. Lower spending hides the improved economics and strong market demand for renewables. In 2016, for instance, BNEF found global investments in clean energy fell by 17 percent, while installations rose by 9 percent.

Sector-by-sector performance

While the $64.8 billion invested in clean energy worldwide in the second quarter of 2017 signals a spending rebound, it's actually down 12 percent compared to the second quarter of 2016. That's largely due to sharp reductions in project costs.

BNEF estimates that global capital costs for solar PV and onshore wind have dropped by 15 percent and 14 percent respectively in the last 12 months, due to technology improvements as well as fierce competition in manufacturing.

“The $64.8 billion investment total in 2Q was quite firm given that backdrop of falling costs," said Abraham Louw, clean energy economics analyst at BNEF. "There was also a good spread of big projects financed in different countries, and less reliance on European offshore wind than in some recent quarters.”

There were only two large offshore wind arrays financed in Europe in the second quarter: the 200-megawatt Borkum West II and 112-megawatt Albatros projects off the coast of Germany, at $918 million and $532 million, respectively. Other notable deals include two 300-megawatt offshore wind arrays in Chinese waters, Three Gorges Dafeng and Three Gorges Zhuanghe, costing a combined $1.8 billion, as well as the 396-megawatt Juchitan de Zaragoza onshore wind farm in Mexico at $721 million, and the 400-megawatt Avangrid La Joya onshore wind park in the U.S. at an estimated $620 million.

Other clean energy sectors had relatively weak quarters. Investment in biomass and waste-to-energy totaled $387 million, down 76 percent year-over-year; small hydro totaled $595 million, down 20 percent; geothermal totaled $423 million, down 24 percent; and investment in energy smart technology companies (including smart grid, energy storage and electric vehicles) was $1.5 billion, down 50 percent.

In this context, solar emerged as the true shining star. The sector attracted investments totaling $35.6 billion, up 19 percent year-over-year and up 20 percent quarter-over-quarter. Wind had a weaker performance by comparison, with investments totaling $26.2 billion -- up 43 percent over the first quarter, but down 29 percent year-over-year.

In a separate report, Mercom Capital Group, a global clean energy communications and consulting firm, found that global corporate funding for solar (including venture capital funding, public market and debt financing) totaled about $4.6 billion in the first half of 2017. That's up slightly from $4.5 billion raised during the same period in 2016. There were 97 deals in H1 2017 compared to the 79 deals in H1 2016, according to the report.

It's not all good news, however. Global corporate investment in solar actually slipped in the second quarter of 2017, following a strong start to the year. At least part of that is attributable to uncertainty around the pending outcome of Suniva’s Section 201 trade case in the United States.

“There is a great deal of uncertainty in the solar markets right now, which is reflected in funding activity. However, solar public companies, especially on the U.S. stock markets, have done well this year. A lot is riding on how the Suniva anti-dumping case plays out as it will dictate market dynamics going forward,” commented Raj Prabhu, CEO of Mercom Capital Group.

Country-by-country performance

In addition to tracking investments in specific clean energy sectors, the BNEF Q2 report tracked investments in multiple countries and regions.

The highlights include a bounce-back in investment over the past three months in China and the U.S., and increased funding for projects in Mexico, Australia and Sweden. Egypt and Argentina, two emerging markets for renewables, saw record quarterly figures. The U.K., meanwhile, saw investment plummet by more than 90 percent compared to the second quarter of 2016.

Taking all investment categories together, BNEF's country-level results for the second quarter include:

- China: $23.3 billion, down 16 percent compared to Q2 2016, up 32 percent from Q1 2017.

- The U.S.: $14.7 billion, up 6 percent year-on-year, up 51 percent quarter-on-quarter.

- Europe: $8.8 billion, down 49 percent year-on-year, up 10 percent quarter-on-quarter.

- Germany: $3.2 billion, down 34 percent year-on-year, down 7 percent quarter-on-quarter.

- Japan: $2.9 billion, up 12 percent year-on-year, down 11 percent quarter-on-quarter.

- India: $2.6 billion, up 11 percent year-on-year, down 4 percent quarter-on-quarter.

- UAE: $2.1 billion, up from almost nothing in Q2 2016 and Q1 2017.

- Brazil: $1.9 billion, down 1 percent year-on-year, up 10 percent quarter-on-quarter.

- Mexico: $1.8 billion, up 261 percent year-on-year, down 10 percent quarter-on-quarter.

- Australia: $1.5 billion, up 77 percent year-on-year, down 29 percent quarter-on-quarter.

- Sweden: $887 million, up 213 percent year-on-year, and up from almost nothing in Q1.

- France: $845 million, up 43 percent year-on-year, down 1 percent quarter-on-quarter.

- Egypt: $805 million, up from almost nothing in Q2 2016 and Q1 2017.

- Argentina: $464 million, up from almost nothing in Q2 2016 and Q1 2017.

- The U.K.: $407 million, down 93 percent year-on-year, down 60 percent quarter-on-quarter.