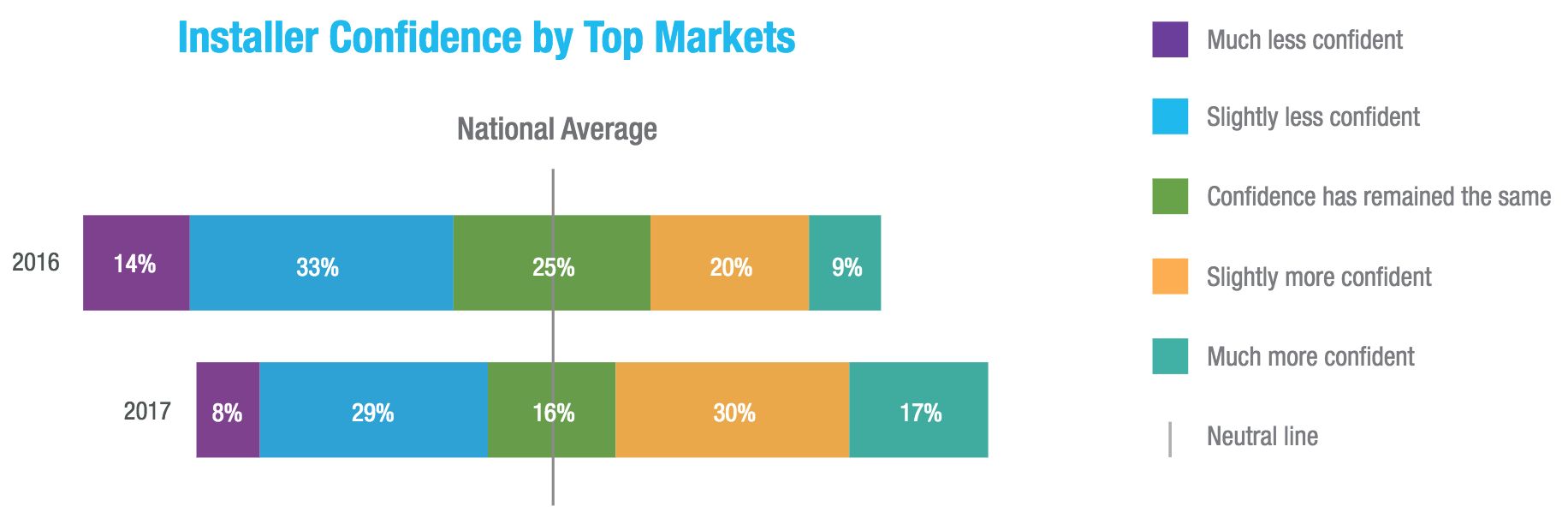

Even as U.S. solar faced a tumultuous year, installer confidence "improved significantly" over 2016, according to a survey conducted by EnergySage and the installer certification organization the North American Board of Certified Energy Practitioners.

"From speaking with our installers across the country, we believe there are several reasons for continued optimism,” said Vikram Aggarwal, EnergySage’s CEO and founder, in a statement. “Given that prices remain competitive and the solar tariff is expected to have only a limited short-term impact, solar installers have much to look forward to in 2018 and beyond."

EnergySage collected the data on December 14, 2017 and January 13, 2018.

Though confidence also increased in 2016, installers saw ups and downs that year, including the December 2015 extension of the federal Investment Tax Credit and the election of a president unfriendly to clean energy.

“This year’s more optimistic results may signal that many of the industry’s worst fears from late 2016 did not come to fruition,” reads the report.

There are always challenges in solar, however.

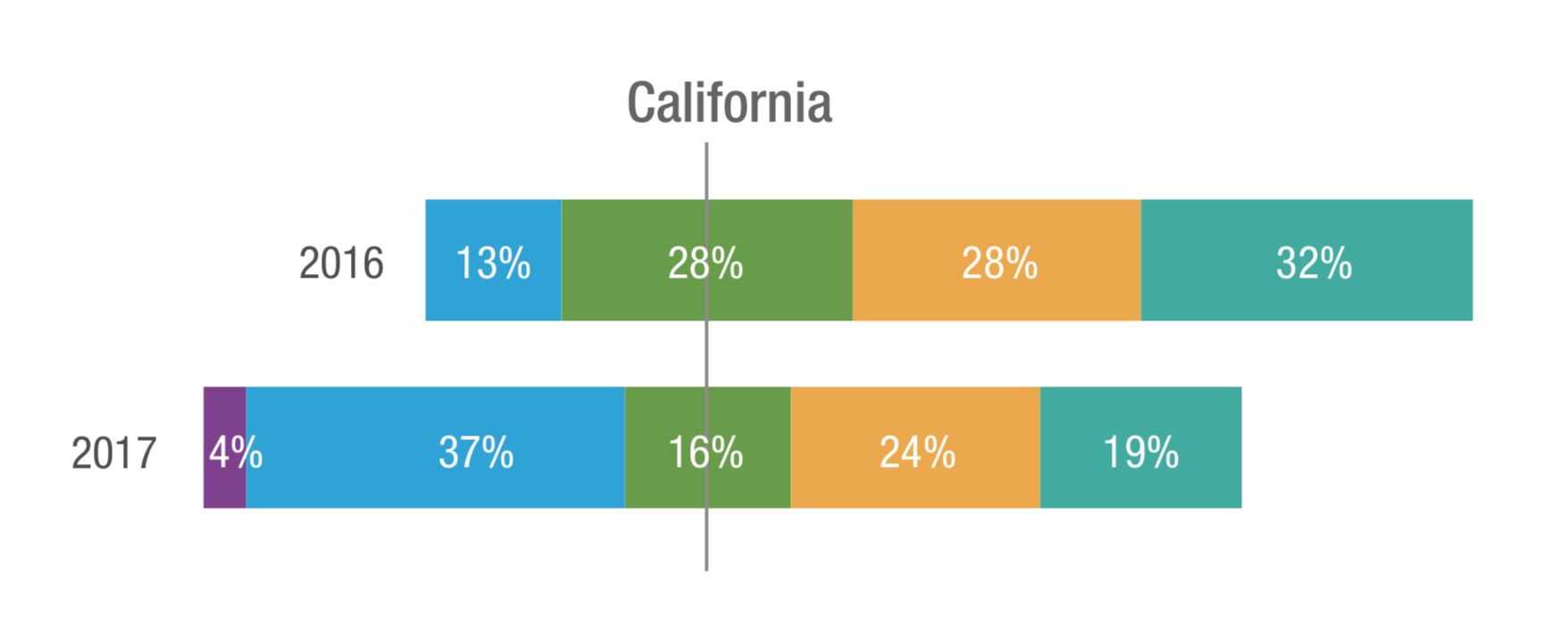

A shift in confidence in California, the country’s largest market, spurred by regulatory hurdles and difficulties signing on new customers, reflects those challenges.

Source: EnergySage and NABCEP

Between 2016 and 2017, the percentage of installers in California "much more" confident in the industry dropped by 13 percent, while the installers who said they were "slightly less" or "much less" confident increased threefold.

That resulted from a slowdown in growth, as California’s residential installers exhausted the early-adopter market. GTM Research attributes the pullback in California to rising customer acquisition costs, complications around its transition to a new net-metering policy, and sales declines from SolarCity and Vivint.

Looking to understand this slowdown in top markets? Want to know which markets are the most attractive? Come to GTM's Solar Summit in San Diego on May 1-2. The conference features all the top solar companies, investors, utilities and policymakers. You don't want to miss it.

Source: EnergySage and NABCEP

California’s angst doesn’t necessarily translate to other areas of the country, though. Fewer installers in the national average reported feeling much less or slightly less confident than in 2016. The percentage of installers "slightly more" confident or "much more" confident also grew.

In a followup survey the week after the Trump administration announced solar tariffs, two-thirds of companies said they would absorb all or some of the tariff rather than passing it on to customers. Only 31 percent said they would pass on the full cost of the tariff to customers.

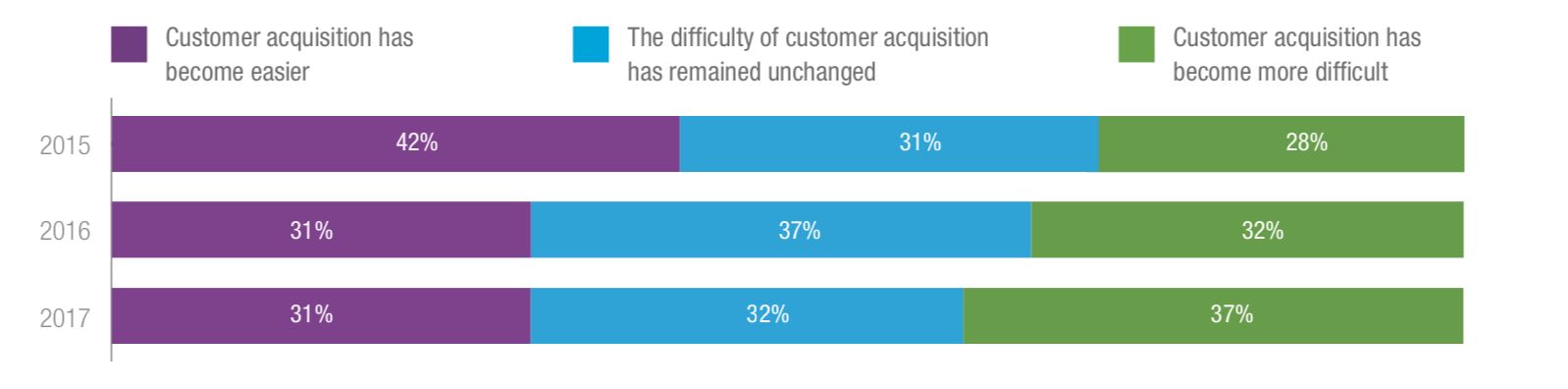

That decision reflects confidence in the market; however, the process of winning those customers is becoming more onerous as installers move beyond early adopters in more markets.

From 2015 to 2016, the percentage of installers reporting that customer acquisition has become easier dropped. Five percent more installers said customer acquisition became more difficult, a figure that’s grown each year in EnergySage's survey.

Source: EnergySage and NABCEP

According to installers, customer interest remains high but closing sales and generating leads is trickier. Most installers ranked consumer interest -- the beginning of the sales process -- as the least challenging aspect of closing deals.

At the same time, 18 percent of installers cited lead generation as most challenging, and 14 percent said closing sales is the most difficult part of the business.

That could be because consumers are getting savvier.

In 2017, 11 percent of installers noted that their customers reviewed quotes from four or more installers, compared to 8 percent in 2016 and 3 percent in 2015. Installers are also facing competition. More respondents said they were competing against 21 to 40 companies.

Despite headwinds, there's a belief that growth will continue. Over half the survey’s respondents said they expect the number of installers to continue growing. Half said they expect small, local installers to gain market share in the future.

More installers -- 37 percent in 2017 over 32 percent in 2016 -- are expanding regionally. At the same time, 4 percent more installers are working on growing market share.

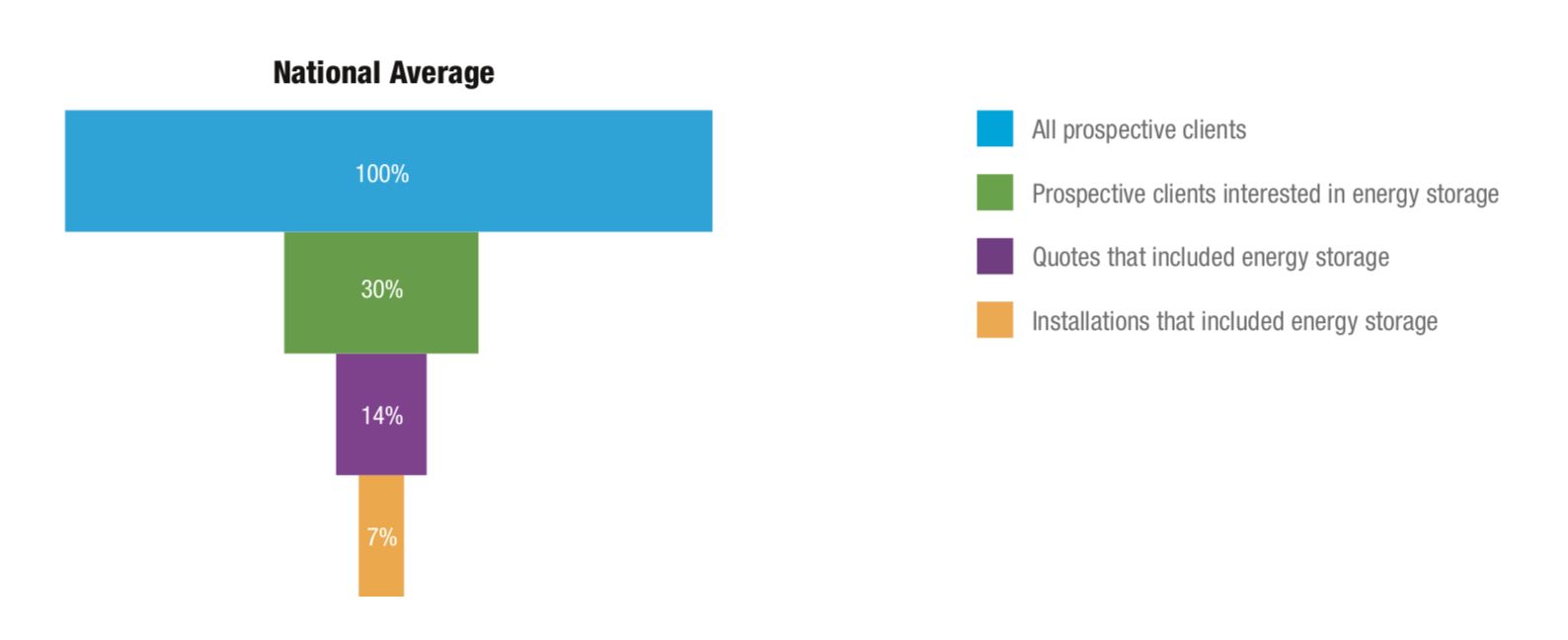

EnergySage also notes that the widening interest in solar-plus-storage is “remarkable,” with one in three customers interested in battery storage along with their solar system.

Source: EnergySage and NABCEP

A full 63 percent of installers now offer storage, with 12 percent more saying they’ll add the service in the next year. EnergySage said those numbers set installers up for a positive 2018.

“Consumer interest in solar energy and home energy storage has never been higher,” said Aggarwal.

The solar business is constantly changing. GTM is here to help you understand the trends -- before they happen. Come to our Solar Summit in San Diego on May 1-2 to understand how the market forces at work will impact your company in 2018 and beyond.