The clean energy industry, while pushing its own products, has ramped up efforts to stop new gas plant construction.

Solar advocates filed comments Friday opposing a new 1,100-megawatt combined-cycle gas plant that utility DTE Energy wants to build in St. Clair County, Michigan by 2023. It would replace generation from retiring coal plants -- but solar groups say it's not clean enough.

The framing of DTE's analysis distorted the outcome in favor of the large gas plant, wrote Kevin Lucas, director of rate design at the Solar Energy Industries Association.

"DTE erroneously assumes that a resource must be dispatchable to be reliable," he argued in the testimony. "This results in the unjustified discounting of a portfolio of distributed assets comprised of solar, wind, energy efficiency and demand response as 'unreliable' and unable to meet DTE’s resource adequacy needs."

The testimony says that DTE used outdated price forecasts for renewables and chose the least efficient system design for solar energy, producing less favorable modeling of a clean energy portfolio. On the other hand, it argues, the utility underrepresented the risks associated with the $1 billion gas plant. Vote Solar claims renewable energy alternatives could save DTE customers $339 million to $1.2 billion.

The showdown comes on the heels of an all-source solicitation by Xcel Energy in Colorado, which produced groundbreakingly cheap bids for several combinations of renewables and energy storage. The results raised a question for utilities trying to build new gas plants: Have they investigated whether a suite of clean energy technologies could do the same job, even cheaper?

California regulators last week ordered utility PG&E to solicit storage and other distributed assets to replace the reliability duties of three existing gas plants. The groups in Michigan are asking for something similar, but before the plant gets approved.

Necessary or not?

DTE must prove that the gas plant is the "most reasonable and prudent" means of meeting the identified capacity need, which is to replace 1,822 megawatts of coal generation slated for retirement between 2020 and 2030.

The utility argues that to fulfill its reliability obligations, it must build dispatchable capacity.

Lucas, on behalf of SEIA, Vote Solar, the Union of Concerned Scientists and the Environmental Law and Policy Center, counters that the obligation is to meet the Midcontinent Independent System Operator's resource adequacy requirements, which can be done through assets other than dispatchable power plants.

The testimony suggests an alternative portfolio that it says satisfies the reliability requirements: 1,100 megawatts of new solar capacity, 1,100 megawatts of wind, 253 megawatts of demand response and an increase in energy efficiency. (DTE has 71.5 megawatts-DC of solar operating currently, according to GTM Research.)

Regulators wanted to see alternatives to the proposed plan, but the utility doesn't appear to have considered such portfolios. Instead, it offered a perfunctory comparison between its gas plant and a "no-build" scenario, where it does nothing and buys energy and capacity from the markets when it encounters shortfalls. DTE ruled that option out as infeasible.

"They didn’t actually seek bids for something other than a gas plant," said Becky Stanfield, senior director for Western states at Vote Solar. "To me, that’s the most telling sign."

It's hard to know how cost-competitive other options would be without taking a moment to examine them. That insight drove California regulators to call for an expedited procurement for distributed alternatives to the proposed Puente gas plant in Oxnard, which would have added 262 megawatts of capacity.

Michigan regulators will have to decide whether they want to see more options on the table.

Finding the right mix

That's not to say that the package proposed by the solar advocates is necessarily the right fit.

Keen readers may have noticed the list of proposed reliability assets lacks any dispatchable generation. That's an intentional omission.

The solar industry groups insist that intermittent solar and wind, plus consumption reductions from efficiency and demand response, can keep the lights on just as well as a baseload gas plant, at a lower price for ratepayers. DTE, based on years of experience, trusts a big gas plant to fire up when it needs a bunch of capacity.

Setting aside the question of whether the utility appropriately considered alternatives, there's a real debate here about the nature of reliability in a rapidly changing grid.

The solar folks argue that a distributed fleet lowers the risk that an unplanned outage could knock out a major power plant's capacity at a time of high demand; pursuing the portfolio approach avoids a single point of failure.

Then again, this approach has to contend with things like the sun going down, or winds falling slack. Geographical diversity provides some insurance against low production across the fleet, but it doesn't always work.

In Michigan, most of the existing and proposed wind farms sit in the "Thumb" region, where wind speeds and capacity factors are highest, said Wade Schauer, research director at Wood Mackenzie's Americas Power & Renewables team.

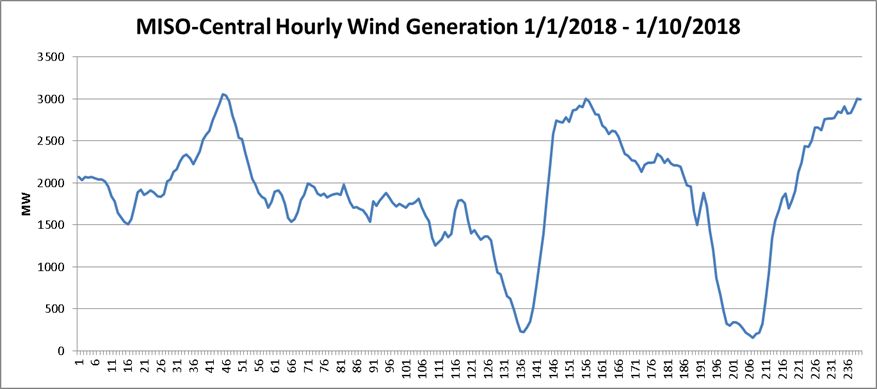

That concentration produces frequent periods of simultaneous high and low wind generation in the Michigan and DTE service territory. That's visible in wind generation patterns from the first 10 days of this year in the MISO-Central region, which includes Michigan.

Wind generated in Michigan's Thumb is prone to simultaneous peaks and troughs of production (graphic courtesy of Wood Mackenzie)

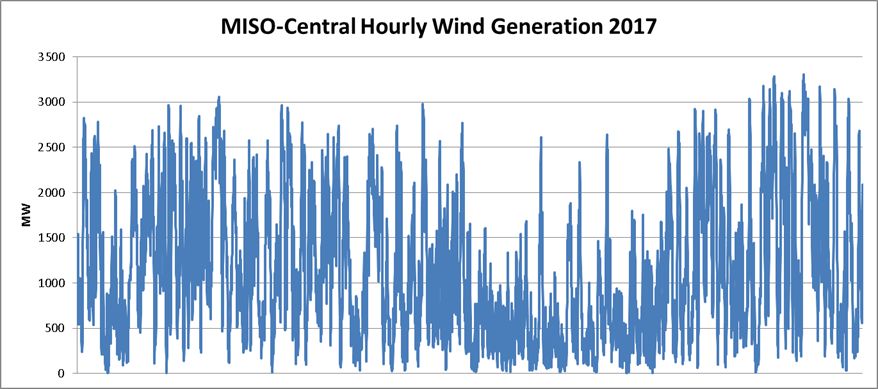

Michigan wind generation is much lower on average during the summer than the winter, Schauer added. MISO calculates a 12.6 percent dependable capacity value for wind in the summer, based on its average reliability.

"In reality, again based upon actual historical hourly generation data, there are many instances when it can be much lower than 12.6 percent during high summer demand periods," Schauer said. "Similarly, on those same hot, humid summer days with low wind, air conditioning loads remain high late into the evening, when solar falls off to zero."

It's up to the regulators to determine how much or how little dispatchable capacity they want on hand for such moments.

Note the average drop in wind generation during the summer months, when peak capacity will likely be needed (graphic courtesy of Wood Mackenzie)

Notably absent from the solar testimony was the issue of energy storage, which has stepped up to deliver local reliability elsewhere, and can do so with stored solar or wind energy.

Lithium-ion batteries turn solar and wind power into firmed plants that can deliver peak power on demand. But they also increase the upfront cost compared to standalone solar or wind, and might have muddied the ratepayer-savings argument the solar advocates were making.

Storage can be hard to model, because battery costs have been dropping so rapidly and limited pricing data is publicly available. The most reliable way to gauge the cost to ratepayers of storage-backed renewables for grid reliability is a competitive solicitation. That hasn't happened yet in Michigan's case, but it could.

--

Join us for the 11th annual Solar Summit 2018 in San Diego, May 1-2. Powered by the unique blend of research and economic analysis from the GTM Research team, this year's agenda will feature themes from beyond traditional project finance to innovations in solar and the transformation of electricity.