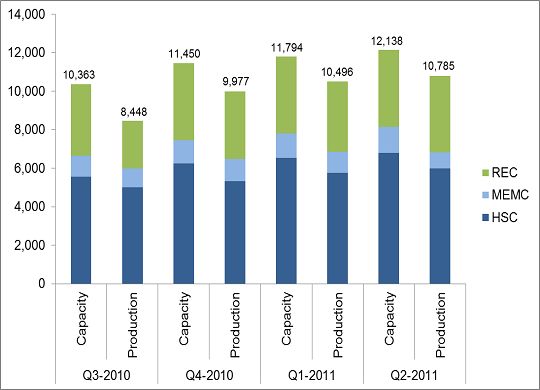

Solar grade polysilicon capacity and production in the United States grew just three percent in the second quarter of 2011, according to GTM Research and the Solar Energy Industries Association’s latest quarterly U.S. Solar Market Insight report.

The U.S. polysilicon industry is highly consolidated with only three plants of note: Hemlock’s plant in Michigan, MEMC’s plant in Texas, and REC’s plant in Washington.

Together these facilities produced 10,785 metric tons of polysilicon in the second quarter of 2011. The flatness of U.S. polysilicon production from the first to second quarter was influenced by a combination of factors. The end of 2010 and beginning of 2011 saw strong initial demand as customers tried to lock in polysilicon purchases, expecting high demand to continue throughout the year.

However, with the slowdown of the German and Italian markets, global sales slumped, leading to a buildup in inventory across the value chain.

Source: GTM Research - Solar Market Insight Report

Expansion at existing plants and construction of new facilities is expected to increase U.S. polysilicon capacity through 2011 and beyond. Though demand has remained weak into the third quarter and average polysilicon spot prices have dropped below $40 per kilogram, plans to increase U.S. capacity seem to be on track.

Construction continues on Hemlock's new polysilicon production plant in Clarksville, Tennessee. Expected to begin production in late 2012, the company is in the process of hiring 500 full-time employees to operate the plant. Such capacity expansion is important if the U.S. seeks to maintain its share of global polysilicon manufacturing, especially as an increasing number of Chinese producers enter the market.