The utility industry is largely seen as a dinosaur in its speed of information technology adoption, and it has a relatively small worldwide share of the IT market. But the latest study from International Data Corporation, an IT research company, is predicting that the utility industry will adopt IT at a higher rate than the general business community in 2011, second only to healthcare.

The expected growth of 5.3 percent is only a fraction higher than other industries, which average about 5 percent, according to IDC’s Energy Insights. The reason for that moderate bump is that although most of the ARRA funds have been allocated, much of the funding will be put to work in 2011. And don’t look to water and gas; the electricity sector will lead the spending.

The uptick in IT investment should come as no surprise to anyone who is watching the interest in smart grid developments, including distribution automation and meter data management (including security issues) and energy management services for the commercial and residential sectors.

Why not a higher rate of growth? IDC predicts that both energy consumption and energy prices will be flat in 2011, which will be a limitation.

Here are some of the other predictions IDC had about the utility market:

- Smart building will herald the next wave in IT spending. Certainly building IT, including energy efficiency and demand management programs are already in vogue, and there is no lack of vendors gunning to provide the services. The area is ripe for acquisition and it has already started in the previous year. IDC predicts that utilities will provide financial incentives for smart building technologies to drive the market for advanced building automation systems. However, many systems are designed to have an ROI of two to three years, and businesses will likely move forward even without utility incentives.

- There will be more than 60,000 plug-in electric vehicles in North America in 2011. The first wave will encourage utilities to adopt PEV-specific charging plans to encourage off-peak charging. IDC sees electric vehicles as a game-changer for the industry that will bring consumer awareness to their relationship with their utility. However, that’s only a trickle of people, at best, in the next few years, and so the revolution should not be expected by 2012. And certainly there is still a lot of debate whether there will be an EV revolution at all.

- The first market-based energy storage will be launched. IDC believes that the first systems that have loans, but not government subsidies, will be announced. In some ways, the prediction has already come to fruition. The analysts pointed to the $17.1 million loan guarantee from the Department of Energy for AES’s 20-megawatt energy storage system using advanced lithium-ion batteries in Johnson City, New York.

- Solar PV installation will double in North America.

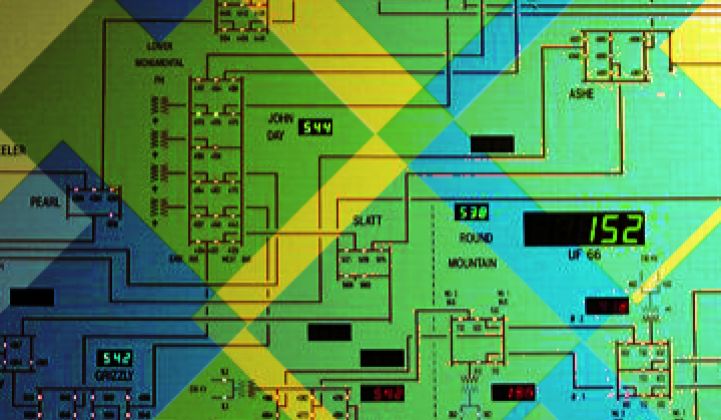

- Smart grid investment in distribution management and automation will accelerate. This one is kind of a no-brainer. There has already been increased interest in DA and utilities have repeatedly said that it is a priority in the coming years. For regions with aggressive renewable goals, it will be mandatory.

- Consumer and regulatory resistance will have a minimal impact on smart meter deployment. While this may be true on paper, utilities that ignore customer concerns, from accuracy to safety and security, do so at their own peril. If 2010 taught us anything, it’s that the consumer matters more than ever in the utility space.

- The first AC to DC transmission line will be announced. Like the need for DA, large-scale wind and solar will require new solutions, and IDC is sure that somewhere in North America one of these projects will be announced in the coming year.