Shayle Kann, GTM's senior VP of research, kicked off a packed Solar Summit last week with his take on "The State of Solar."

Here's a summary of his presentation. (For access to the full presentation and video of all our panel discussions from the Solar Summit, become a Square.)

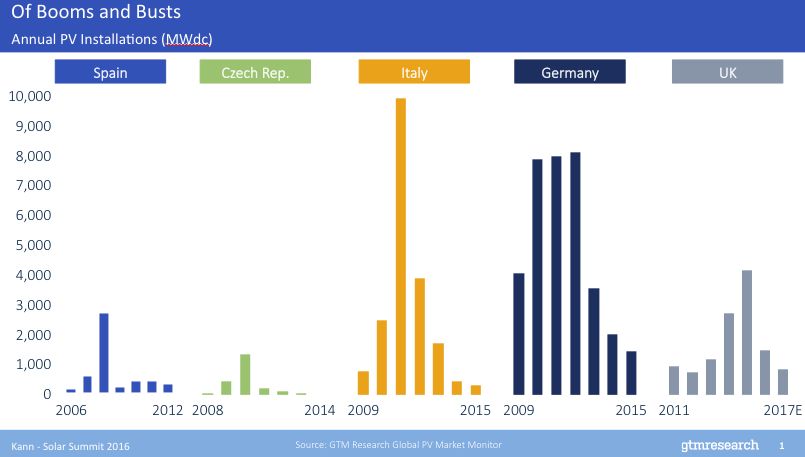

Boom and bust

Kann spoke of "a virus plaguing the global solar industry for over a decade: the boom-bust cycle."

- He noted that it first happened in Spain in 2008. The country installed 3 gigawatts, spurred on by a feed-in tariff (FIT), which promptly got pulled back as the market overheated. According to Kann, "The market crashed and has never recovered."

- In 2009, the Czech Republic experienced the same phenomenon but on a smaller scale. The country went from no solar market to 2 gigawatts installed. The FIT was reduced and the market took a fatal plunge.

- Italy had a huge boom-bust in 2011 with almost 10 gigawatts installed, much of which didn't come on-line. Kann called it "a messy time," with inverters being switched from project to project to claim the FIT, which has since been reduced. Not surprisingly, the Italian market also "crashed and has never recovered."

- Germany had a "much more extended boom" and served as "the bedrock of the solar market" for three years -- "a good run," according to Kann, with 8 gigawatts deployed per year. The German government is looking for "a 3- to 4-gigawatt growth corridor." Again, the market has crashed and has not recovered.

- Kann said that we are now in the midst of the crash of the U.K. solar market.

Kann noted that these EU country boom-bust cycles shared a similar policy mechanism: a generous and uncapped feed-in tariff. He noted that "solar gets cheaper faster than governments expect" and that political pushback causes governments to overcorrect or kill the program, and "the market then falls apart."

What Kann described as "particularly pernicious" is the fact that none of these markets have seen a recovery. He pointed out that while housing market busts are followed by an eventual recovery, these solar busts have left "stagnant markets" behind them.

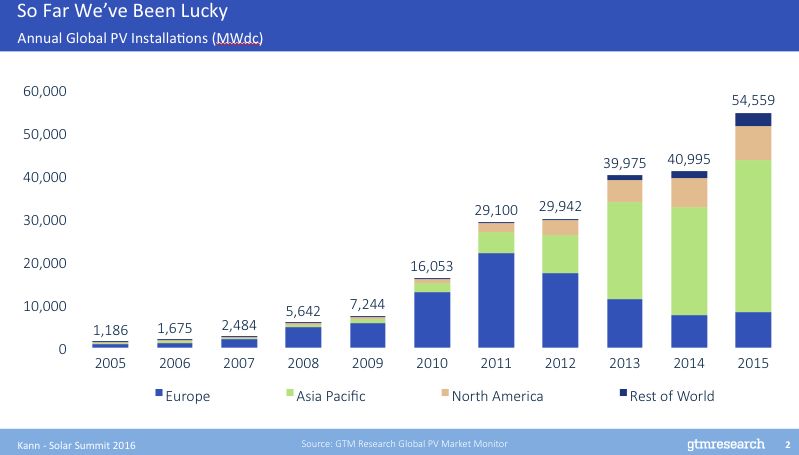

That's no way to build long-term, sustainable growth markets for solar, said GTM's VP. Kann considers the solar industry "lucky," saying, "Every time one of these markets starts to crash, another market is on the upswing." He noted that solar has not seen a "down year" in recent history.

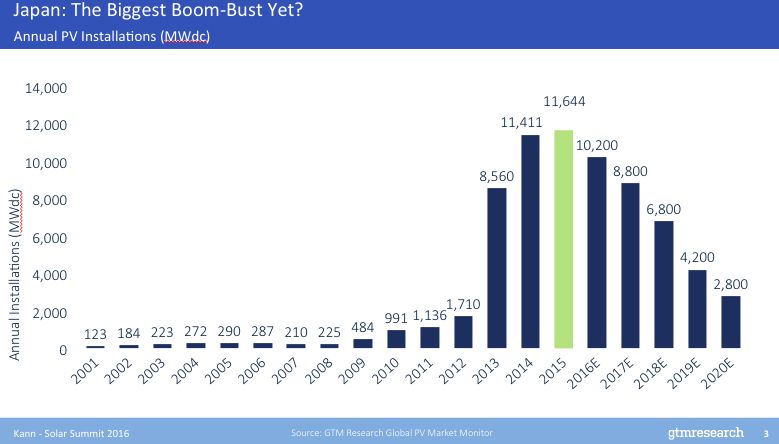

"Right now, we're at the very end of the boom of what may be the biggest boom-bust that we've seen yet -- and that's Japan," said Kann. This was another uncapped FIT market for large projects that drove 11 gigawatts' worth of installations. Kann said that although it was a "prolonged decline," it can be considered "a bust nonetheless."

Kann believes that the solar industry needs to get out of this cycle if solar is truly to have a long-term future and a meaningful impact on climate change.

How do you get past this cycle? Kann's answer: solar has to get cheap enough that you don't need a feed-in tariff.

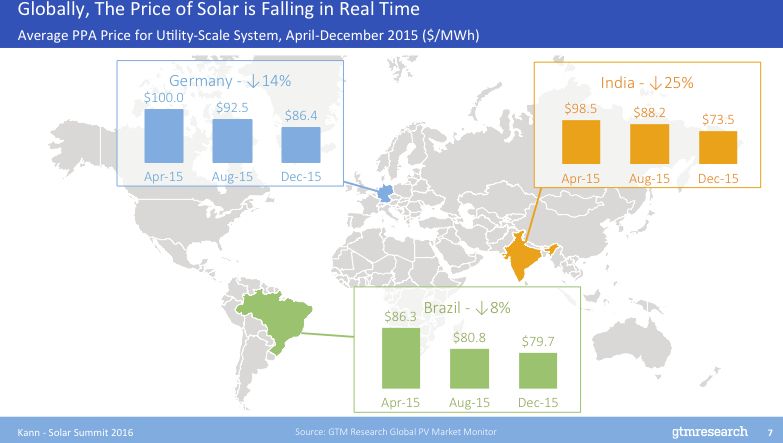

GTM Research's cost analysis shows that the average power-purchase agreement (PPA) price for utility-scale solar over a nine-month period in Brazil and India continues to drop steeply. Even Germany's mature market saw a 14 percent reduction in cost over just nine months.

Kann said, "The transition we're seeing globally is away from markets based on a fixed-price contract feed-in tariff" toward one "with competitive tenders" where solar competes against solar or another technology and the competitive price wins. That makes for a more sustainable market and incentivizes cost reduction, according to GTM's SVP.

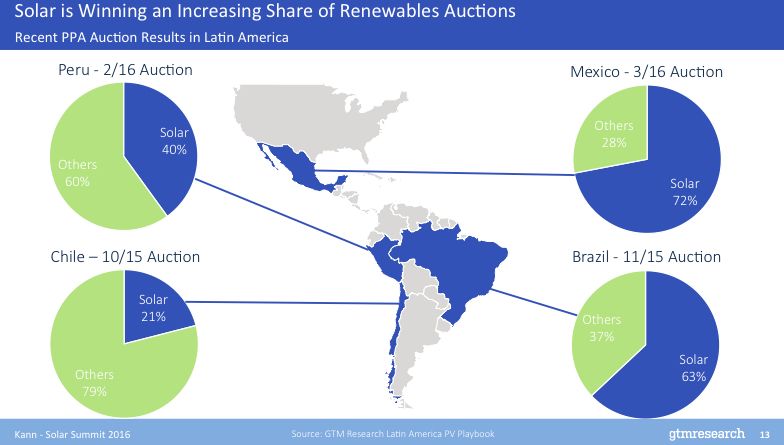

There's a lot of this going on in Latin America.

Recent auctions with competitive tenders in Chile, Peru and Mexico have resulted in awards for surprising volumes of solar at surprisingly low prices. Kann said that we're in the early stages of the a transformation where solar starts to compete at an effectively lower price than other technologies, adding that it's going to be a slow shift that won't happen overnight. But, he said he "wanted to show these numbers to prove it's real and it's already happening across many countries globally."

"You put solar on that stage where it's not dependent on a single government incentive program, not dependent on subsidies of any kind, and all of a sudden, the market potential of solar jumps an order of magnitude."

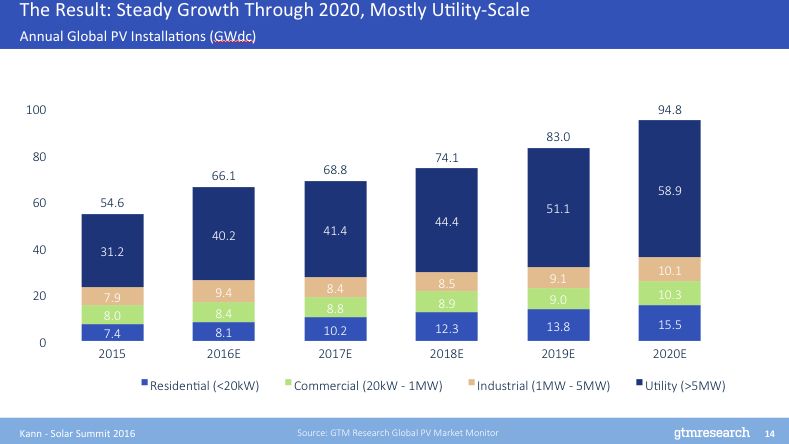

We'll see meaningful growth, moving from 66 gigawatts this year to nearly 100 gigawatts by the end of the decade. But "right now, we're in this sort of growing-pain stage, figuring out how solar can compete on its own two legs."

Kann noted that the U.S. spends a lot of time talking about distributed solar, but with the exceptions of Japan, Germany and Australia, distributed solar is largely a U.S. phenomenon.

In the rest of the world -- it's really about the utility scale.

"U.S. solar is unique and a little bit weird," according to Kann.

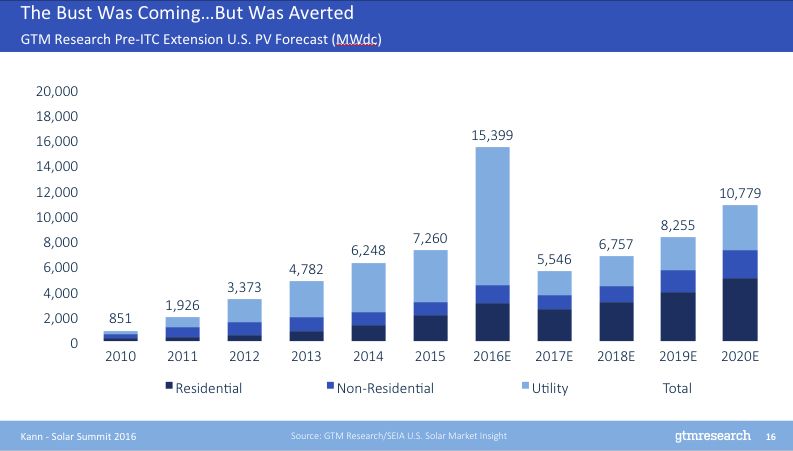

A bust was coming our way, but with the ITC expiration averted, the boom remains.

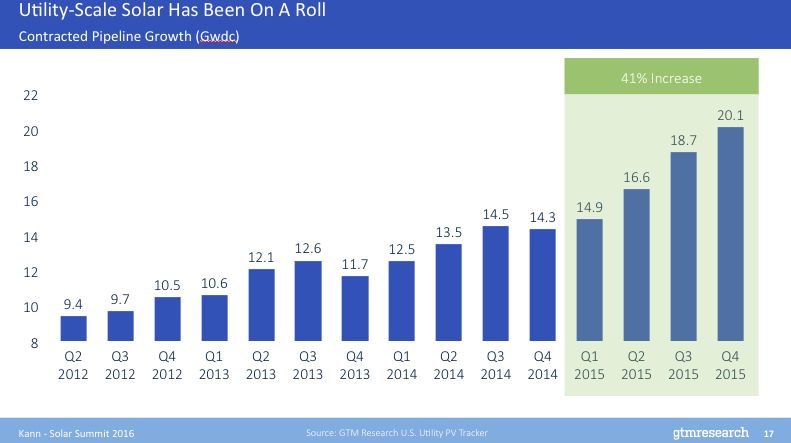

The U.S. has a "huge 20-gigawatt pipeline," said Kann.

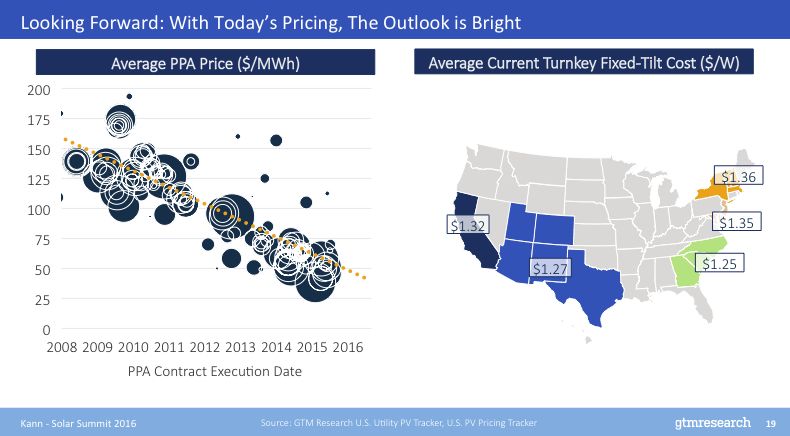

Utility-scale solar in the U.S. is "extraordinarily competitive now" with average PPA prices for utility-scale projects falling below 6 cents per kilowatt-hour in 2015 (including the ITC). This year, the average PPA price could be below 5 cents per kilowatt-hour, creating an enormous potential for demand.

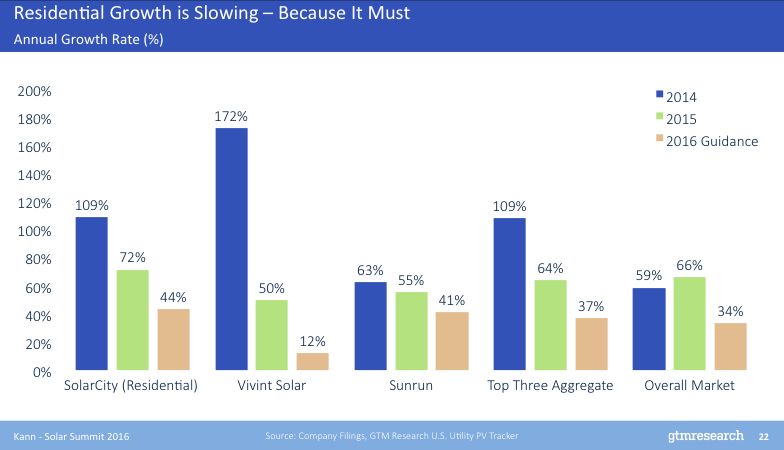

The residential solar market has been growing at a rate of 50 percent per year for years. "That's going to slow down, in part, because it has to," said Kann, and that will result in a more sustainable growth pace. (Below is SunPower CEO Tom Werner's least favorite GTM slide.)

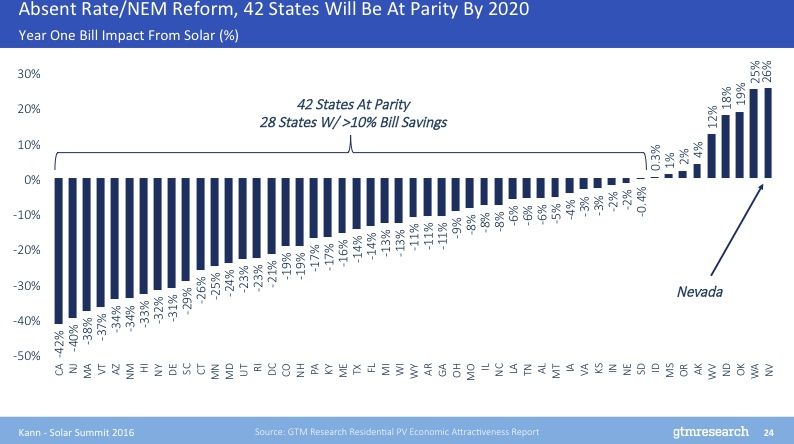

In 2020, if solar costs continue to fall and nothing else changes, 42 states will be at grid parity and 28 states will be at the 10-percent-savings tipping point, according to Kann.

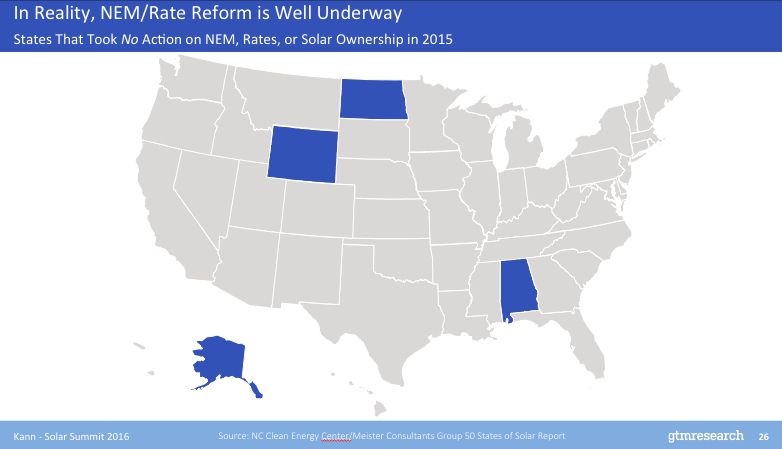

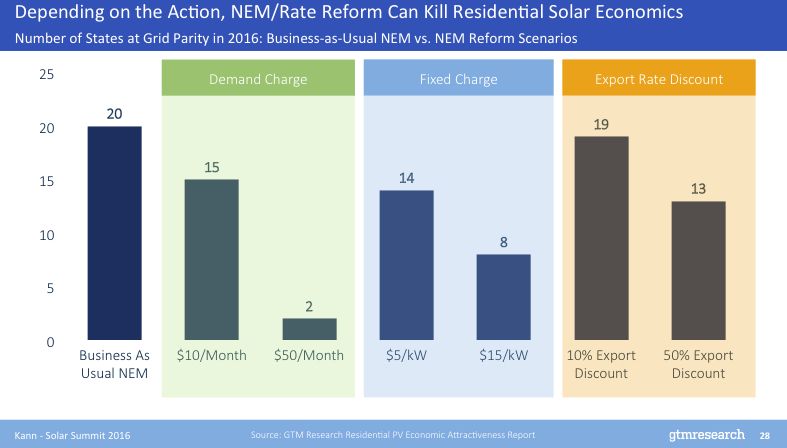

But things are changing -- especially in rate structures and net energy metering.

"These changes aren't always killing the market, but they certainly can," said Kann. If you look at the states that are at grid parity today, a small demand charge or excessive fixed charge or NEM change can kill state solar markets.

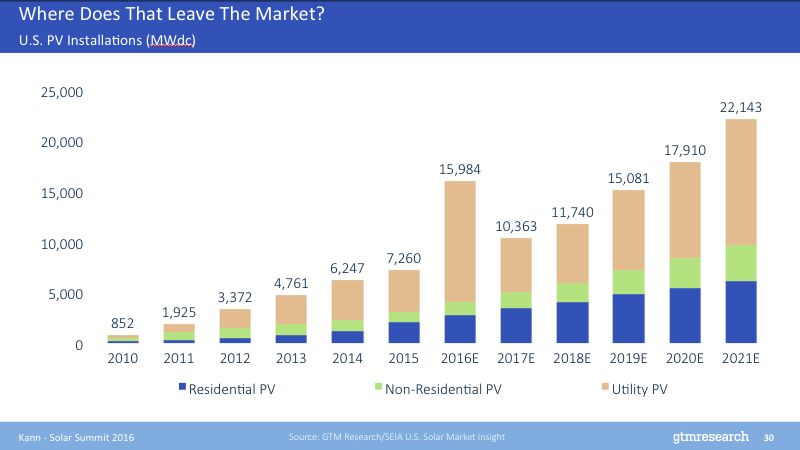

In closing, Kann said, "We're still going to look like we have a little bit of a boom-bust in the U.S. I wouldn't pay too much attention to it -- it just means we're going to build a lot of utility-scale solar this year."

"Our expectation is that the market continues to grow. We see no reason why [there will be] a halting of growth in solar in the U.S. over the next few years, across all sectors. This includes the commercial market. We keep predicting that it's going to grow each year -- and one of these times we're going to be right.

"By the end of this decade, we're going to be approaching 20 gigawatts a year. We hit 20 gigawatts cumulative last year, and we're going to be doing that every year by around the end of this decade.

"It's an extraordinarily exciting time for solar in the U.S.," Kann concluded.

You can watch the full video below (and all GTM event videos if you're a Square).