Shayle Kann, SVP of Research at GTM, presented on solar's disruption of the wholesale energy market in Germany and the U.S. at the kickoff of the GTM Solar Summit in Phoenix, Arizona. It's an important presentation, and you can view it here.

But the next section of his presentation really connects the dots between the growth in solar and DG and the looming existential threat to utilities.

How to disrupt a retail energy market

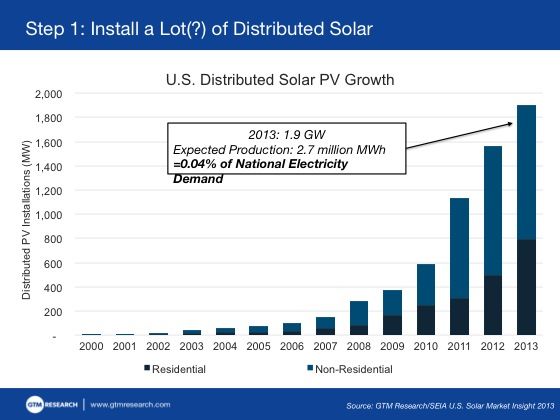

Step one for disruption is to install a lot of solar.

The following slide shows the phenomenal growth in residential and commercial solar, along with the 1.9 gigawatts of distributed solar installed in 2013.

But here's the kicker: that 1.9 gigawatts of solar, which is producing 2.7 million megawatt-hours, accounts for only 0.04 percent of national electricity demand. Why would utilities be impacted or worried by that small sliver of solar?

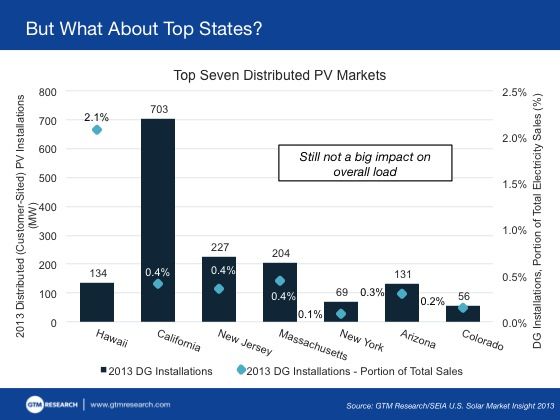

Kann next turned his attention to the top solar states -- perhaps the situation looks different there.

The U.S. market is still very concentrated, with the top seven states accounting for 88 percent of the market. But, with the exception of Hawaii, which remains an outlier in almost every case, even the top solar states, including California, satisfy very little of their overall load with PV.

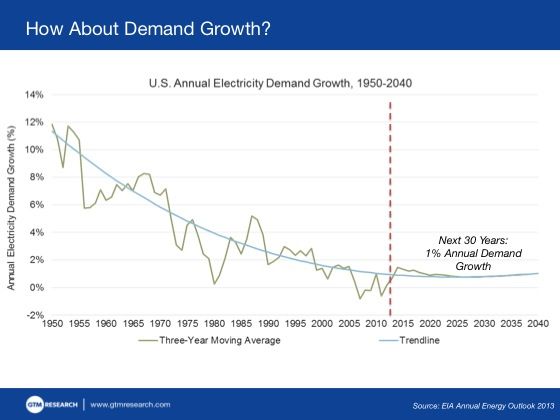

Kann switches gears here. He suggests that we stop looking at total electrical generation.

He notes that utilities have historically made their money from load growth. But load growth has fallen steadily since 1950, and going forward, the EIA sees 1 percent load growth for the next 30 years. Except for Hawaii.

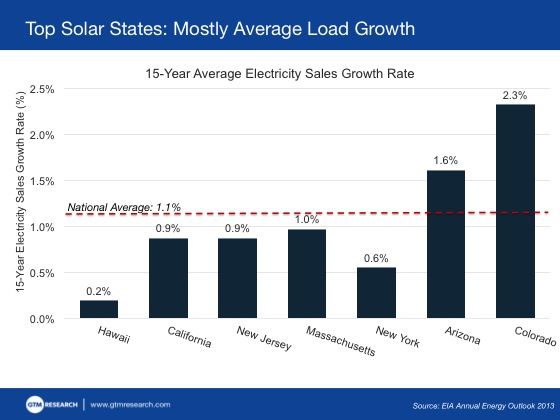

That 1 percent average applies to the top solar states as well. Except for Hawaii.

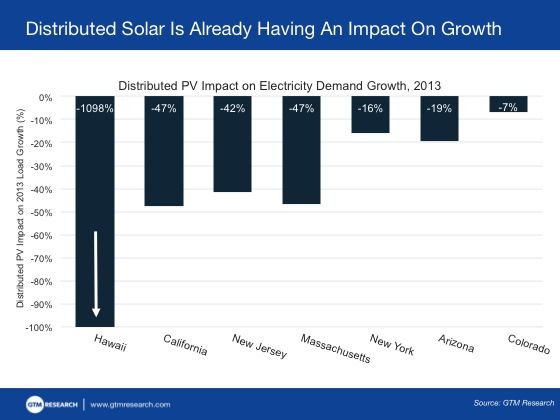

Through this lens, distributed solar's impact on 2013 load growth is already being felt. California, New Jersey and Massachusetts all saw their load growth cut in half by distributed solar.

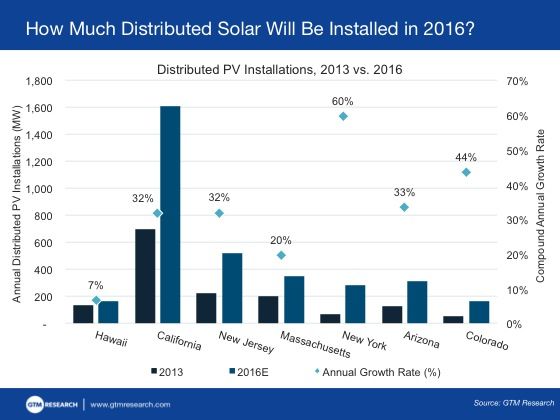

Looking forward to 2016, Kann makes what he calls "conservative" growth estimates for distributed solar.

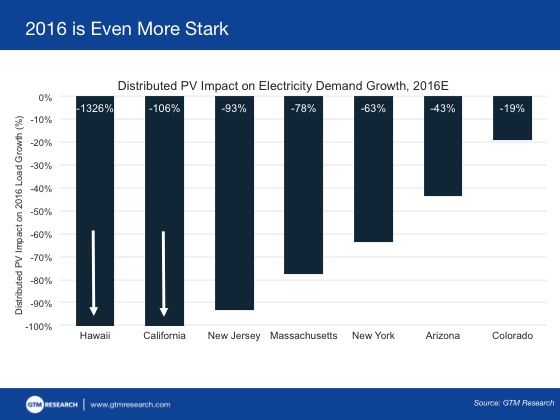

And based on those conservative forecasts, 2016 demand growth looks even more stark for utilities. He said, "You could see negative demand growth in California and almost [the same situation] in New Jersey."

"If you are a utility, this is potentially disruptive and very meaningful," he added.

Kann asked, "If you worked for a Hawaiian utility, wouldn't you be terrified?"

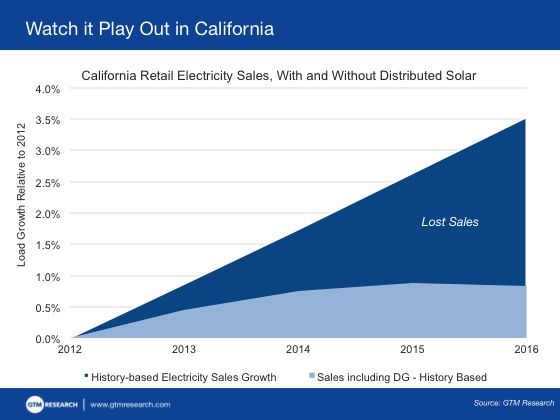

The last slide shows California retail electricity sales that have been and will soon be lost to solar.

"At its most destructive, you could call this the 'utility death spiral,'" particularly for an industry accustomed to recovering fixed costs through rates over 30 years.

In the face of a utility disruption of unknown consequence, Kann suggested that the solar industry needs to foster this disruption by building a sustainable business, saying, "We want to have a solar market in 30 years."

Instead of focusing solely on near-term buildup, Kann said, "We need to maintain a long-term view."

Confronted with the possibility of increasing numbers of wealthier people opting for solar or even potentially disconnecting from the grid, Kann added, "We need to maintain a strong eye toward equitable growth."

"The last thing we want to do is create an energy divide."

Watch Kann explain retail energy market disruption:

Watch the full presentation on Greentech Media's Ustream channel