It’s been barely a month since the U.S. Department of Commerce announced its preliminary decision to levy additional anti-subsidy tariffs on Chinese modules, and the solar market is already feeling the effects. Along with a generous helping of analysis from GTM Research’s recently released report on the U.S.-China solar trade case, here are six of the most prominent trends that have resulted from the tariffs so far.

Chinese module pricing

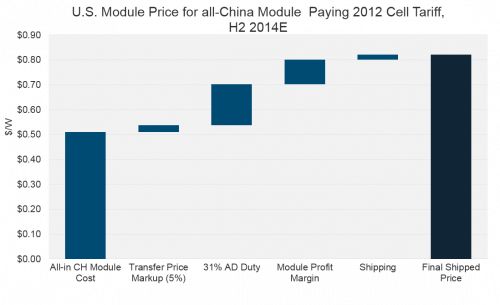

Unlike the 2012 ruling on modules containing Chinese cells, which resulted in a very marginal (3 percent to 4 percent) increase in the price of Chinese modules sold in the U.S., the new tariff has already resulted in meaningfully higher prices being quoted by Chinese module suppliers for second-half 2014 and 2015 delivery. Quotes under the new regime vary from 75 to 80 cents per watt (with Jinko and Trina being on the lower end of the range), compared to roughly 70 cents per watt before June’s ruling. The most popular tariff mitigation strategy seems to be shipping all-Chinese product (wafer, cell and module) to the Chinese firm’s U.S. subsidiary at a small markup, paying the 2012 tariff of about 31 percent on Chinese cells, and incorporating the tariff into the final selling price to the customer.

Source: The 2014 U.S.-China Solar Trade Dispute: Status, Strategies and Market Impacts

Taiwanese cell vendor financials

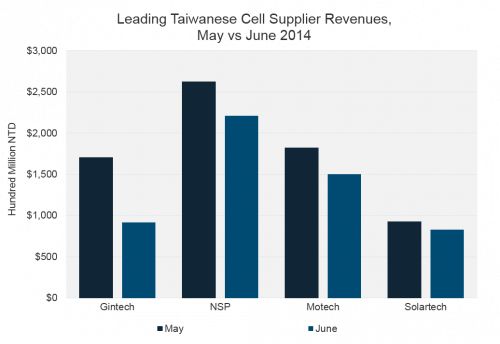

Taiwanese cell vendors were clearly the chief beneficiaries of the 2012 trade case ruling (with trade lawyers a close second). Because the tariffs associated with that ruling only applied to cell manufacturing, almost all Chinese vendors made a simple switch to buying Taiwanese cells, and business continued as before. This factor, along with a booming Japanese market, was responsible for a marked recovery in revenue and profitability levels for merchant Taiwanese cell vendors such as Motech, Neo Solar Power and Gintech from the second half of 2013 onward.

Unfortunately for these firms, Taiwan was included as a subject country in SolarWorld’s latest anti-dumping petition. Adding to that, the new CVD tariff (in its preliminary form at least) closes the “Taiwanese loophole,” since it applies to any product where two of the three value-chain steps (wafer, cell, module) are carried out in China. Most Taiwanese cells used for U.S.-shipped modules use Chinese wafers (predominantly manufactured by GCL-Poly), rendering the old tariff mitigation strategy subject to the new duties.

To no one’s surprise, therefore, most Chinese module companies stopped buying cells from across the strait after the June 3 CVD ruling, and that lost business has put a dent in revenues for Taiwanese PV vendors. After increasing continuously over the last twelve months, June revenues for four leading firms -- Neo Solar, Motech, Gintech and Solartech Energy -- were down 23 percent in total, and prices for both cells and company shares have taken a tumble in recent weeks. If the final outcome of the trade case turns out poorly for Taiwanese suppliers, it could accelerate their transition from merchant cell suppliers to OEM module producers for top-brand Korean, Japanese and European firms -- something that has already begun to take shape.

Source: GTM Research PV Pulse

U.S. rooftop market share

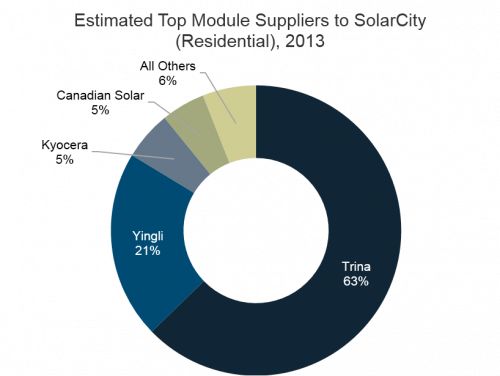

With Chinese module pricing on par with many competitors in the U.S. rooftop market and uncertainty still lingering over the trade case, several downstream U.S. customers have initiated a switch to non-Chinese modules. Already, we’ve seen SolarCity, previously a customer of Trina and Yingli, announce a supply agreement with Singapore-based REC, while RGS Energy has partnered up with SolarWorld. It is possible that other large residential and commercial installers such as Vivint, Verengo and Borrego, which have also been heavily reliant on Chinese modules up to now, could follow SolarCity’s example in coming months. Other crystalline silicon module firms that we believe could also grab Chinese market share include Suniva, Hanwha Q-Cells, and Mitsubishi.

Source: GTM Research U.S. PV Leaderboard

Utility-scale project economics

Things are a little bit more complicated in the utility-scale market, where many projects planned for 2014 and 2015 have likely penciled in modules at less than 70 cents a watt. Here, low-cost alternatives that are also bankable are practically nonexistent outside of First Solar, which could benefit by acquiring some pipeline. It’s possible that some projects that had less attractive economics to start with could be at risk, although it’s hard to put a number to them. I know of at least one relatively established developer that is now having a hard time making the numbers work and is scrambling for creative solutions.

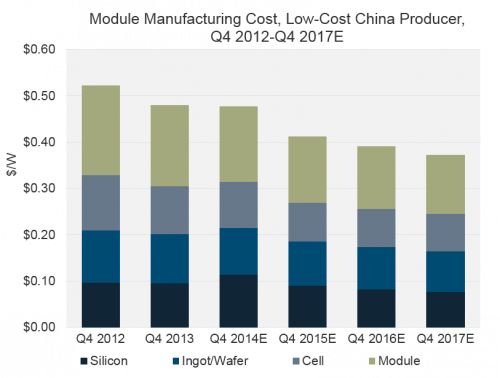

One crumb of comfort for Chinese firms is that their destiny, as far as maintaining their position in the utility segment is concerned, may be at least partly in their own hands. If they can lower manufacturing costs down to the 40-cent-per-watt level, then persisting with the currently popular strategy of using all-Chinese product and paying the 2012 cell tariff would enable sub-70 cents per watt pricing at a reasonable profit. However, GTM’s current base-case forecast doesn’t see that happening until at least 2016, and by the time the likes of Jinko and Trina eventually get there, it may be too late for some U.S. projects. If the tariff stays, it’s logical to expect that eventually other genuine competitors to the Chinese will emerge as low-cost, bankable options. Possible contenders include firms from India, CIGS thin film firms (see below), or contract manufacturers (also see below).

Source: GTM Research PV Pulse

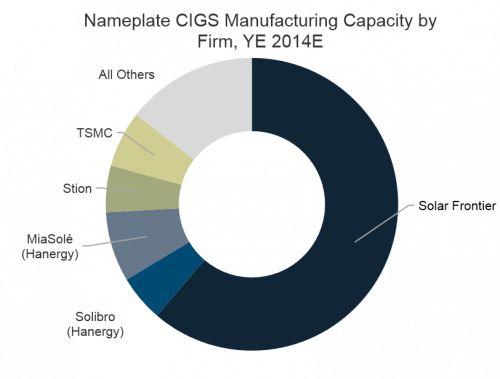

CIGS module orders

News of the tariff seems to have been a welcome development for at least a few manufacturers of that mysterious metallic compound they call CIGS PV. Giga-scale behemoth Solar Frontier reported a noticeable bump in U.S. orders back in April, and in recent months we have heard that Stion’s 100-megawatt plant in Mississippi has been running at a healthy clip as well. It’s possible that the same applies to Sunnyvale-based MiaSolé (now owned by Chinese hydro power Hanergy) and semiconductor foundry giant TSMC, which is currently in production-ramp mode. Reflecting increased demand for CIGS in particular, spot prices for thin-film modules have reached their highest levels in almost a year.

Looking further out, Hanergy’s progress in particular could be of great relevance to the U.S. market. If it can, as it currently claims to be doing, build a large-scale factory using MiaSolé’s unique sputter-on-foil technology in China, we could be talking about a super-low-cost (think First Solar but made in China), competitive efficiency (think current-generation c-Si), tariff-free (because thin film isn’t subject to the tariff) module offering. But given Hanergy’s less-than-illustrious track record with solar manufacturing projects, I’m not holding my breath. In fact, aside from constructing multiple unfinished production facilities, gobbling up every thin film firm within range of its grasp, moving money around within its web of subsidiaries and having its modules featured in the atrocity that was Johnny Depp’s last film, I’m not really sure what Hanergy has actually accomplished. I’m slowly convincing myself that the whole thing is some sort of postmodern economic experiment meant to deconstruct the concept of capital efficiency.

Source: GTM Research PV Pulse

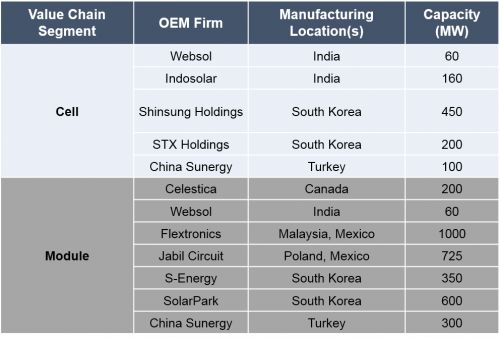

New business for contract manufacturers

OEM firms with a manufacturing presence outside China and Taiwan have also prospered from the wider scope of SolarWorld’s new petition. ReneSola, a Chinese firm that shipped more than 300 megawatts to the U.S. last year, has been working with contract partners in locations as distinct as India, Malaysia, Poland and South Korea to deliver tariff-free modules to the U.S. since April. Opportunities haven’t just been limited to large electronics conglomerates such as Flextronics and Jabil; smaller pure-play solar firms like S-Energy in South Korea and Websol in India have seen increased business as well. Overall, there’s a lot more competition for module assembly contracts -- relatively low-cost, up-to-date OEM cell capacity outside the two subject nations is hard to come by, and is mostly concentrated in India and South Korea.

Source: GTM Research PV Pulse

***

Shyam Mehta is Lead Upstream Analyst at GTM Research and the author of the recently published report, The 2014 U.S.-China Solar Trade Dispute: Status, Strategies and Market Impacts.