California’s recently enacted Renewable Auction Mechanism (RAM) is bearing fruit in the state’s southern deserts thanks to Silverado Power's embrace of the distributed generation (DG) concept for solar energy development.

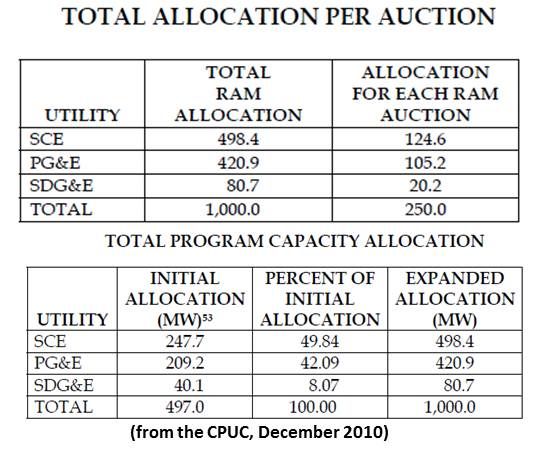

The California Public Utilities Commission created the RAM program to drive utilities to procure more distributed renewable energy generation projects of twenty megawatts or less as part of the state’s 33 percent by 2020 standard. It established a regulated auction in which developers bid to sell at their lowest price and, because such DG relies largely on existing transmission and distribution infrastructure, the CPUC also streamlined the interconnection queuing process.

Six new solar projects from Silverado Power (SP) have won power purchase agreements (PPAs) with California utilities Southern California Edison (SCE). Pacific Gas and Electric (PG&E) and San Diego Gas and Electric (SDG&E) in RAM auctions.

“Each utility had a solicitation,” explained Silverado Power Chief Operating Officer Hans Isern. “We had been developing these projects for quite some time before the RAM was finalized for the DG programs that we saw coming,” Isern explained, and, in the RAM bidding, “our projects were selected in a price competitive environment.”

The six new solar PV projects amount to a total of 41 megawatts.

Expressway A and Expressway B, each with two megawatts and holding PPAs with SCE, will be co-located in Victorville, CA.

Also co-located in Victorville are Victor Mesa Linda A, a two-megawatt project with an SCE PPA, and Victor Mesa Linda B, a five-megawatt project with an SDG&E PPA.

Not co-located but adjacent in Lancaster, CA are Western Antelope Blue Sky A, a twenty-megawatt installation with a PG&E PPA, and Western Antelope Dry Ranch, a ten-megawatt project with an SDG&E PPA.

Individually, these projects do not necessarily constitute big news. But taken together and as the earliest realization of a longstanding Silverado plan to develop lots of solar with a low profile, they mark the beginning of what could be a new trend in solar development.

Silverado is laying out small projects all over the western Mojave Desert. Supported by the RAM program, such limited scale projects could minimize impacts, streamline planning and keep construction crews working for years.

“Right now, we’re working on finalizing the plans to build several hundred megawatts in the Antelope Valley and San Bernardino County region,” Isern said. “Ultimately we have ambitions to go much larger.”

Co-location of smaller projects, Isern explained, “allows us to save on some of the costs for a solar project and pass those savings on to utilities and their ratepayers.” And, he added, “If you have two systems next to each other, it is a lower impact than two systems that are separated.”

Silverado is keenly aware, Isern said, of “stories of large legacy solar plants that go out and destroy pristine habitats. Our projects are sited in the right way. We have very minimal impacts. I think that is a benefit to the local communities because we are preserving a lot of the value to those areas.”

Silverado has just begun efforts to minimize impacts on the affected locals through outreach efforts with surrounding communities. The firm will first introduce itself and its plan to nearby town councils and business organizations, said SP spokesperson Chelsea Minor, and subsequently use the feedback it gets to generate a statement of “what our approach is going to be to address local concerns.”

Indicative of SP’s larger, longer-term intent is a just-announced $50 million deposit, made in conjunction with investment partner Martifer Solar, a multinational Portuguese renewables construction firm, to “protect the company’s position in the California Independent System Operator (CAISO) generator interconnection queue.”

Such deposits are used by utilities to build system upgrades and new interconnection facilities. The money is provided, SP pointed out, “by developers with the most viable projects in the queue.”

“Martifer has been an outstanding partner for all of our development activities,” Isern said. “The partnership allows Martifer to make a big investment in the U.S.,” he explained. “The company has been investing in us and we are able to turn that into investment in the local communities where we operate.”

Land needed for the project, estimated at five to seven acres per megawatt, has been retained through “forward sale” arrangements. “It’s all owned by individuals and businesses,” Isern said. “We’re not on federal land or public land at all. We’re not taking those pristine areas away.”

SP estimates its costs, Isern said, at “well below $3 per watt and getting closer to the $2-per-watt price range. For a two-megawatt system, you would expect it to cost anywhere from $4 million to $6 million.”

The co-located and adjacent sites will essentially be built simultaneously and provide a total of approximately 200 jobs. “We have three sets of projects,” he said. “We will probably be moving crews somewhat sequentially through. We will be providing jobs for a longer term and more jobs as we have more and more projects.”

Most of the construction, he said, will be underway next year. “We can just continue adding on projects and keep the construction crews running to the end of 2014 and into 2015 and 2016 and so on. That’s our long-term vision for the company.”