In part one of this two-part series, we described the differences between PV operations and maintenance (O&M) and asset management. Some solar PV companies choose to perform asset management and O&M of their PV plants/portfolios internally, others prefer to outsource these activities to service providers, and many opt for intermediate scenarios that combine in-sourcing and outsourcing. This article discusses typical approaches and key decision factors as presented in the latest GTM Research report, Megawatt-Scale PV O&M and Asset Management: Services, Markets and Competitors 2014-2018.

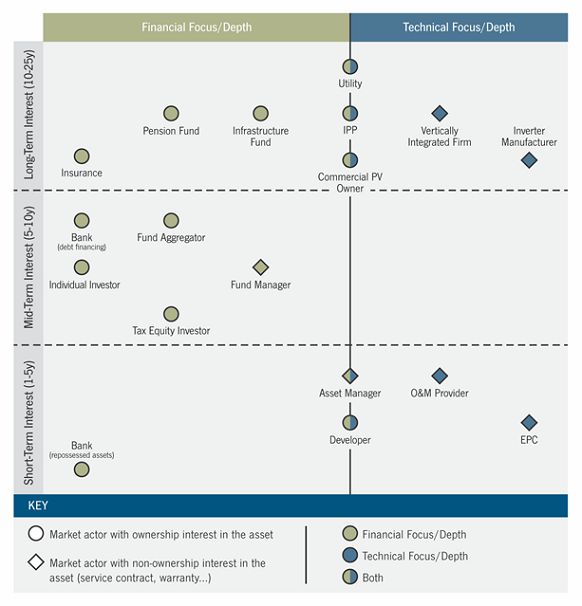

The figure below maps the main types of market actors involved directly or indirectly in asset management and O&M activities (whether as owners or as service/warranty providers).

FIGURE: Asset Management and O&M Ecosystem -- A Map of Market Actor Categories

Source: Megawatt-Scale PV O&M and Asset Management: Services, Markets and Competitors 2014-2018

Figure credit: 3megawatt GmbH and SoliChamba Consulting

Actors shown on the left part of the map have more financial depth and focus (such as banks, funds and other investors), while those shown on the right have more technical depth and focus (such as inverter manufacturers, EPCs and O&M providers). Actors shown on the bottom part of the map tend to have only a short-term interest (one to five years) in the asset, such as EPCs, developers, and banks (as when they end up owning distressed assets after debt payment defaults). Actors shown in the middle part of the map tend to have a mid-term (five to ten years) interest in the asset, in the manner of most investors and funds. Actors located in the top portion of the map have a long-term (ten to 25 years) interest in the asset, in the manner of utilities, IPPs and infrastructure funds (via ownership stake), as well as inverter manufacturers (via long-term warranties and/or service contracts). Vertically integrated firms also operate in the domain represented by the top part of the map, since they often sign long-term O&M contracts (typically twenty years in duration), unlike developers and EPCs, which usually sign two-year to five-year contracts. Asset managers and O&M providers are usually engaged for one-year to five-year contracts.

The chart above helps identify those actors which are more likely to perform asset management and O&M in-house and those which are more likely to outsource it. O&M requires more technical skills, so actors shown on the left part of the map are better candidates to perform it in-house. Asset management requires a blend of financial and technical skills, so actors shown close to the center part of the map are more prone to doing it themselves. In both cases, long-term interest adds to the likelihood of in-sourcing. (For a definition of O&M and asset management activities, the reader may refer to the first article of this series.)

In-house vs. outsourced O&M

Financial asset owners such as investment funds usually do not perform O&M activities in-house because they consider it to be too far outside the domain of their core competencies. But as portfolio sizes grow beyond 100 megawatts, some investors revisit the in-sourcing option, especially in European markets where retroactive cuts were applied to feed-in tariffs, heightening the need to reduce operational expenses.

IPPs often perform O&M activities in-house, especially if they already operate and maintain other generation assets such wind power plants. Some decide to outsource these functions until they grow a significant portfolio that justifies investment in PV-specific expertise. Others consider solar PV maintenance activity to be too minor in terms of significance to justify the investment (as compared to the large number of existing coal and gas plants that require much more maintenance).

In practical terms, the majority of O&M costs are labor costs (for maintenance) and infrastructure costs (data center and control room for ongoing supervision and operations, software, etc.). This means that scale is an essential factor that drives cost-competitiveness for an O&M organization. The size and density of the plants in a company’s portfolio also play an important role. In-sourcing is more likely to make sense for portfolios with a high density of plants located in the same area, which allows for staffing optimization.

An intermediate scenario consists of in-sourcing operations management functions while contracting out on-site maintenance activities. However, this model may not provide significant cost savings, since a large share of O&M costs come from on-site maintenance and spare parts after warranty expiration.

In-house vs. outsourced asset management

Asset management bears a strong resemblance to the core business functions of many megawatt-scale PV asset owners. Most IPPs, financial investors, and large commercial buyers of PV systems already possess the core competencies necessary to be the asset managers of their portfolios. However, they often underestimate the amount of work involved in solar PV asset management, as well as the number of tools and processes required. Simply assigning PV asset management to existing staff without fully understanding what this entails is a common pitfall and can lead to issues with the ongoing operation and performance of a PV portfolio.

In this area as well, scale matters. But the amount of work involved in asset management is not accurately measured merely by counting megawatts. While a portfolio’s capacity is a good indication of the amount of technical supervision involved, since it drives the number of inverters, modules, trackers, and other components that will require attention, megawatts alone cannot convey the amount of back-office work required for financial/commercial asset management. For these activities, the number of unique contracts, SPVs, suppliers, and equity/debt holders are much better indicators of the effort and cost involved. But the PV industry likes to focus on megawatts, so most prices for asset management services are quoted in dollars or euros per megawatt per year, even if they are actually calculated based on other factors.

One of the challenges involved in deciding between in-sourcing vs. outsourcing asset management activities lies in the very nature of the work involved, namely, administrative and financial tasks. This work is performed by white-collar workers who are usually budgeted as part of general and administrative expenses and whose time allocation to specific activities is not tracked. Consequently, it is difficult to properly assess internal costs and compare them with a quote from an external asset management company.

***

For more information about O&M and asset management, including market size and forecasts, activities and strategies, costs, competitive landscapes, vendor services, and future outlook, please refer to the GTM Research report Megawatt-Scale PV O&M and Asset Management: Services, Markets and Competitors 2014-2018.