Royal Dutch Shell this week offered more details on a partnership in its New Energies division that draws together subscription energy seller Sparkfund and smart buildings platform GridPoint. The offering, Shell Energy Inside, offers a bundled energy service for commercial buildings that includes lighting, EV charging and retail power, among other technologies.

The venture comes as another indication that the European energy company, while not dumping large percentages of its spending into clean energy, will continue to deploy strategic capital to maintain an edge in the evolving energy industry.

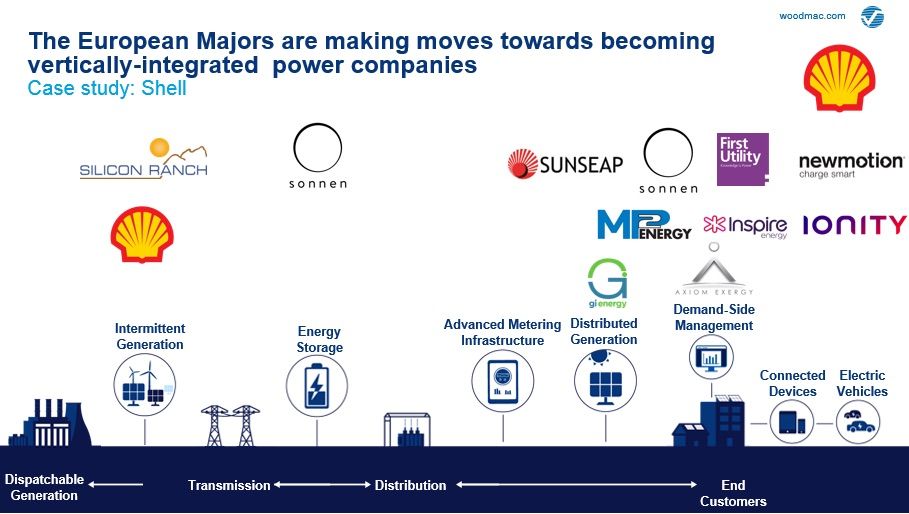

“Shell has made acquisitions or investments right along the power market value chain and now has access to a number of innovative technologies and business models within this space,” said Tom Heggarty, a senior solar analyst with Wood Mackenzie Power & Renewables who has written on oil and gas majors investing in wind and solar.

The major said the partnership lines up with its “strategy to partner with leading companies to deliver more and cleaner energy solutions to new and existing customers.”

“This offering enables us to help businesses meet their cost, sustainability and resiliency goals,” said Brian Davis, Shell’s vice president of energy solutions, in a statement.

Shell created its New Energies division in 2016 as part of a pivot to invest in growing segments of the energy industry. It plans to invest up to $2 billion per year through 2020. To date, it has invested in companies including battery company sonnen, EV charging company NewMotion, and another subscription energy provider, Inspire.

According to WoodMac, the investments indicate that European majors like Shell are on their way to becoming vertically integrated power companies. Heggarty said that although the individual investments aren’t entirely shocking, the speed at which Shell is moving is a surprise.

Source: Wood Mackenzie Power & Renewables

So far Shell has scattered its money across the industry. But most of its investments have clustered closer to customers, around the downstream end of the market.

Sparkfund CEO Pier LaFarge said Shell Energy Inside differs from the company’s other investments, like solar development, because it demonstrates interest in investing in the end-to-end production and delivery of power. He said the announcement should be taken as a “huge statement” on the future of energy subscriptions from one of the world’s largest energy companies.

“What [Sparkfund is] planning for is really to reimagine and reshape how energy services are delivered to commercial customers, full stop,” said LaFarge. “This is a big shift. […] It’s notable that this trend is not starting with small energy companies or regional energy companies. It’s starting with a global oil and gas major that is really placing electrons as a fourth pillar…of Shell’s global business.”

Mark Danzenbaker, GridPoint CEO, said Shell is “breaking down the walls between once-siloed energy solutions” to create a “groundbreaking team.”

Heggarty said this bundled energy approach makes sense for majors because they’re among the few companies with the scale to integrate these technologies into a single offering. Though some utilities may be able to, many don’t have the cash.

“We've been talking about how this kind of approach makes a lot of sense for the majors,” said Heggarty. “Investing and evolving downstream in power markets — closer to the point of consumption — offers better return potential to the majors than the large-scale renewable wind and solar project development, which is extremely competitive and has low barriers to entry and thin margins.”

LaFarge said the subscription service from Shell Energy Inside represents not just a new product offering, but a new business model that follows on the logic of other services like Netflix and Spotify. It will first roll out to commercial customers in North America. He said the backing of such a big player will mean more centralization and efficiency, so commercial customers can focus on their work and not on halfheartedly managing energy usage.

“For the last 30 years…we’ve been asking people to care about and manage their own energy equipment better. But it’s boring, and it’s not their core business. We keep asking [customers] to do this thing better, and it really doesn’t work,” said LaFarge. “One of the really exciting shifts here is we can do it for them, and do it way better [and] way cheaper.”