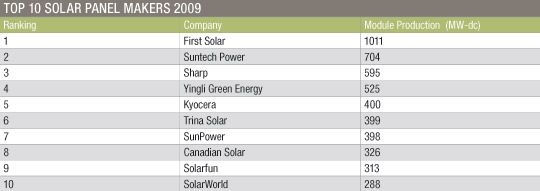

If you're going to pick two eventual winners in the thin film sweepstakes (ignoring First Solar for now), Japan's Sharp Solar and Solar Frontier need to rank high on your list. Sharp is looking to do it with amorphous silicon (a-Si) in spite of that technology's historical failings, while Solar Frontier is focused on CIGS. Sharp looks to regain its one-time number one ranking. Solar Frontier looks to climb to the top (see table).

And the curious thing, at least to my ears, is that in interviews, these Japanese firms are not being their usual diplomatic or polite selves about it. Both have expressed aggressive enthusiasm in taking on First Solar's cadmium telluride dominance of the thin-film solar market head-on.

Sharp Solar

Sharp's Eric Hafter, the Senior Vice President of their solar group, put it this way: "I love going head-to-head with First Solar. Because we're competitive."

Mind you, this is amorphous silicon (a-Si) we're talking about -- the same technology that was the undoing of Applied Materials and many of AMAT's SunFab customers.

Sharp has 320 megawatts of a-Si on-line at their Osaka factory, 430 megawatts of crystalline silicon (c-Si) capacity and, according to Hafter, has issued a guidance of one gigawatt of capacity. In amorphous silicon, the company can sell every panel it makes, according to Hafter. It comes down to bankability, said the VP, and customers prefer to work with a $30 billion, 99-year old company like Sharp. He said, "If you're not paying attention to bankability -- you're toast."

When asked about the higher price and lower efficiency of amorphous silicon, Hafter said that "efficiency is not the key" and, more antagonistically, that "We have a premium for not being carcinogenic."

(This barb was likely a direct shot at First Solar. Note that First Solar's cadmium telluride-based photovoltaics use cadmium telluride, the compound, which is a bit more benign than its separate elements. Sodium chloride is tastier than its individual elements, as well.)

Hafter spoke of the United States emerging from its recession with a bang. "There's no country that comes out of the recession better the U.S.," he said. He expects banks to start having a tax equity appetite sooner rather than later. He also spoke of the U.S. already exceeding expectations and being a one-gigawatt market in 2010. The Solar Energy Industries Association and GTM Research forecast that the U.S. could add as much as 1.13 gigawatts of solar deployments in 2010, an increase of more than 150 percent from last year, according to the U.S. Solar Market Insight Report. The report's baseline forecast projects that 944 megawatts of solar electric capacity (866 megawatts of PV and 79 megawatts of CSP) will be installed in the U.S. in 2010.

As evidence of their momentum, Sharp just announced that it will supply its tandem-junction thin-film solar panels for use in an 18.5-megawatt solar power plant in Ontario, Canada. The plant, being developed under a joint venture between SunEdison, a subsidiary of MEMC (NYSE:WFR), and SkyPower, is made up of two solar parks. Construction began in March 2010.

And as a further indication of Sharp's aggressive strategic mission, recall the firm's very recent $305 million acquisition of solar PPA and project developer, Recurrent Energy. (See GTM Reseach solar analyst Shyam Mehta's analysis of that deal here.)

Solar Frontier

Greg Ashley, Solar Frontier's COO, recently told me, "We think we're in a horse race with our cadmium telluride competitors," adding, "It will take two to three years in this race to catch them. There are competitors in the market who are intimidated. We're not intimidated." In case anyone hasn't figured it out, we're talking about solar cost leader First Solar here.

Again, this is a new style of rhetoric for a Japanese company.

Solar Frontier began research into CIGS thin-film solar in 1993, shipped 46 megawatts in 2009 and will ship more 100 megawatts in 2010.

The relatively quiet (until now, that is) firm has had product in the field since 2003 and with the backing of Shell, Showa and other big-money sources, has a sizable balance sheet. They are ready to invest billions of dollars and they're already on their way with a 900-megawatt panel factory in Miyazaki, Japan which will be one of the largest PV factories in the world when it is completed.

A press release from earlier this year had Showa Shell CEO Shigeaki Kameda making these ambitious efficiency claims: "While the aperture area efficiency of panels coming off of the assembly line today is at a competitive efficiency of around 13.0%, we expect to reach 14.2% when our third plant starts operating in 2011, and approach 15.0% by 2014."

If Solar Frontier can meet the efficiency claims and time frame they target, they will be a company to watch. That type of performance would validate the potential of CIGS and explain why even First Solar has a fifty-person CIGS initiative in Silicon Valley.

Solar Frontier just announced that it will supply General Electric (GE) with GE-branded CIGS thin-film solar modules. In return, GE will provide power plant and utility-scale expertise to Solar Frontier. It's a four-year agreement with an option to be extended, according to Ashley in an interview last week. GE is looking to sell inverters, racks, mounting equipment -- a "soup-to-nuts" solar farm with financing.

Ashley said, "We are ahead of target on every one of our goals -- on the plant, cost reduction and efficiency." The firm looks to ship 20,000 panels per day from their new factory with a 14-percent efficiency rating and a module size of 3 feet by 4 feet. Ashley expects to be at full capacity by July of next year.

***

The global solar market is no longer a boutique industry. But it's a dust mote in the eye of conventional energy generation sources like coal, natural gas and nuclear.

Solar's spectacular growth means that the market is dynamic and labile and that today's incumbents like Suntech and First Solar cannot rest on their laurels. Recently, we've seen enormous global firms start to pay close attention to the solar market -- Corning, General Electric, Hyundai, Saint Gobain and Samsung to name a few.

It's almost a certainty that the top-ten solar vendor list in five years will bear little resemblance to the list shown up above. It might still contain Sharp and it might have new players like Solar Frontier.