Why is it so difficult to win a residential solar customer in the U.S.?

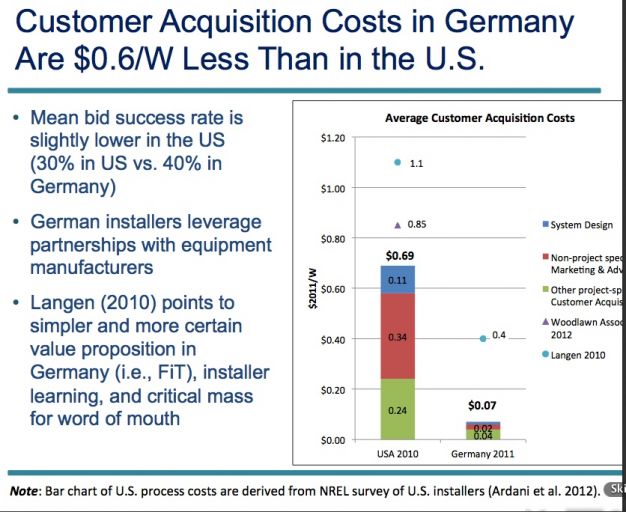

Why does it cost 49 cents per watt to acquire a customer in the U.S. while it costs less than 7 cents per watt in Germany?

That works out to about $3,000 for the typical 6-kilowatt residential rooftop, according to Nicole Litvak, GTM Solar Analyst. (The 7 cents figure is from an LBNL study on soft costs; the 49 cent figure is from the GTM Research report on customer acquisition in solar. Note that 49 cents per watt is not far from the cost of the PV module itself.)

Customer acquisition costs can account for up to 10 percent of overall residential solar costs. They also offer more near-term potential for cost reduction than any other component of solar system costs. A panel of experts at this week's sold-out U.S. SMI conference took a look at the increasingly sophisticated world of marketing solar to consumers and the volatile customer acquisition sector.

Bill Schuh, VP of Sales & Marketing at Sunrun, said, "The awareness level in most markets in the U.S. is low, and even if it's not low, a significant amount of confusion reigns about what the real costs of solar are -- and what's involved with not only purchasing solar, but then benefiting from solar energy over the life of a system."

Chris Stern, VP of Business Development at Pure Energies, said that customer acquisition costs are so high in the U.S. because "we have to find that perfect customer that has a great roof, has good credit, that's in the right utility territory, and has a high electric bill. [...] Whereas in Germany, they just need to have a roof and own the house to qualify." He said that Ontario, Canada has one-fifth the acquisition costs of the U.S.

Stern spoke of the critical mass reached in Germany because of the high penetration rates and the level of awareness instilled in the German public's consciousness.

Michael Mullen, VP of Sales at Roof Diagnostics Solar, said, "It's all about education. In Germany, they are well educated about solar. We are not educated here." He said that the public feels that solar is still too expensive.

"I think that's the key to growing this industry -- educating people." He added, "Once we get to the point of saturation [when] people understand they can go solar with no money out of pocket [and] that there are so many different ways to go solar, then you'll start seeing a lot more customers and [start] acquiring them" more quickly.

David Field, CEO of OneRoof Energy, suggested that acquisition costs actually exceed 49 cents per watt when overhead and sales management are factored in. Field said that the market is in its infancy. "The first lease was written in 2008," he observed, adding, "It's still very early-stage" and "we are still learning how to scale."

He emphasized that "people buy from people they know and brands they trust," which is one of the reasons OneRoof looks to realtors and accountants, professionals with a financial relationship to the customer, as potential solar salespeople instead of making retail partnerships.

Field suggested that most homeowners want a system, but they are "confused" by the financing and vendor choices. Field also noted that "most homeowners don't ask what type of panels go on the rooftop."

"People just want to save money" and work with "someone they trust," he added.

Shayle Kann, Vice President of Research at GTM, recently said, “We expect customer acquisition to be the next big area for innovation in residential solar and a primary determinant of whether any given installer will remain successful.”

Kann is right. Solar integrators and financiers are experimenting with door-to-door sales, phone sales, online sales, social networks, retail channels such as Best Buy or car dealers, and partnering with companies such as Nest. The list goes on.

Sunrun VP Schuh suggested that "we as an industry have not evolved to the types of selling and marketing that you'd find in much more mainstream categories." He noted that getting solar in Germany is more "an ordering process" than a process involving selection and selling. He also envisioned the process developing to be more fun and emotional.

What do you think? How can the solar industry better appeal to the customer's heart -- and wallet? How does the solar industry educate the public and make the decision-making process easy and rewarding? How does the solar industry make this into an emotional sale?

Here's the full video from the U.S. SMI session:

Chart from LBNL