Coal-fired power is an increasingly bad business for utilities and their customers.

In December 2019, Morgan Stanley noted “the fastest-growing U.S. utilities are those that are moving most aggressively toward clean energy...[while there is a large] re-rating opportunity for utilities with relatively high carbon-intensive power fleets” if they ditch coal to invest in renewables.

Utilities seeking to maximize shareholder returns are listening. Vistra is retiring 6.8 gigawatts of uneconomic coal by 2027, Duke Energy recently considered retiring all 9 GW of its North and South Carolina coal fleet within 10 years, and multiple utility earnings calls hint that more early retirements are coming. Though these plans are admirable, most coal-intensive utilities are not decarbonizing rapidly enough to ensure a safe climate future.

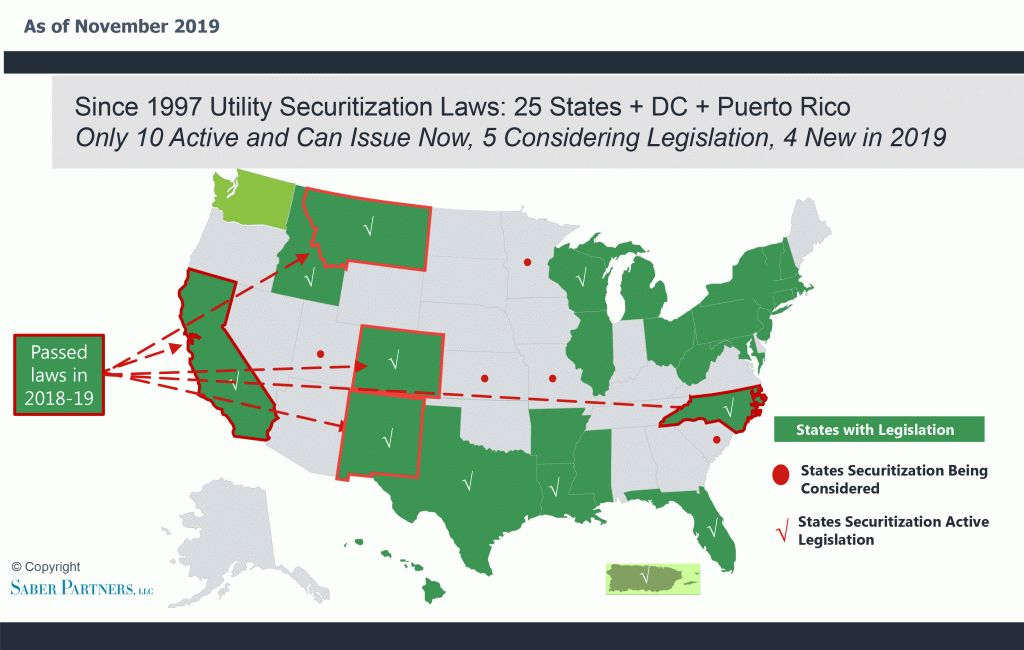

While utilities could profitably amortize uneconomic coal generation balances at a faster pace via low-cost financing and free up capital to invest in clean energy through ratepayer-backed (“securitized”) bonds, this would require legislative changes in most states.

Western states may have the answer: In 2019 Colorado, Montana, and New Mexico passed legislation authorizing securitization to refinance uneconomic but undepreciated power plants — usually coal — and protect consumers. These three laws provide lessons for other states interested in accelerating the transition to a cleaner, more economic grid.

As coal collapses, securitization could rescue utilities and their consumers

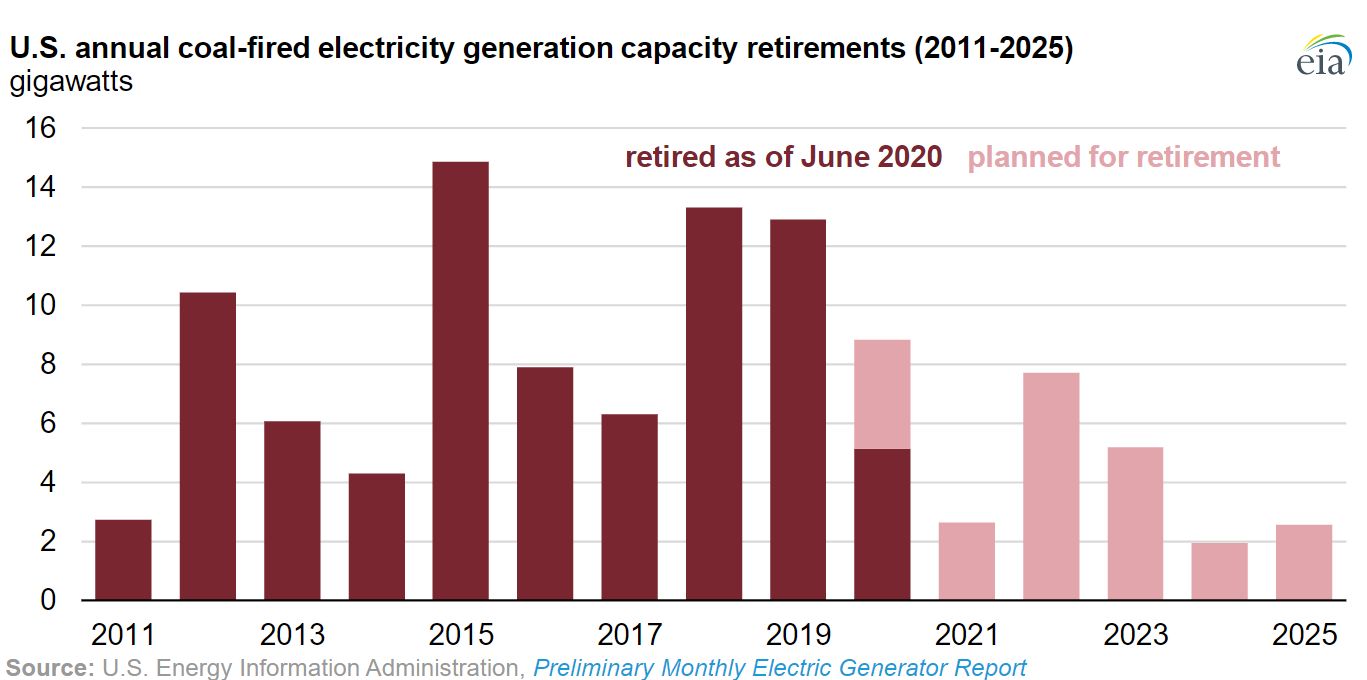

Coal is in an unquestioned collapse, and utilities are being stuck with stranded assets. From 2011 to 2020, 95 gigawatts of U.S. coal-fired capacity closed, and another 25 GW is slated to close by 2025, cutting national coal capacity by one-third from its 314 GW peak in 2011.

This trend is driven by fast-falling clean energy costs — and it’s not slowing down. As of 2018, two-thirds of the U.S. coal fleet cost more to run than building new local wind and solar, meaning that cutting emissions would create immediate savings for customers. By 2025, this number grows to three-quarters of the coal fleet.

Most of these uneconomic plants are in regulated markets without generation competition; monopoly utilities are permitted by public utility commissions to recover costs associated with these plants, shifting economic risk from the plant operators to customers. By contrast, competitive markets have shifted from coal faster than regulated monopoly markets.

While uneconomic coal plants are ubiquitous, the monopoly utilities holding onto them tend to be located in the Southeast, West and Midwest. These regions stand to benefit most from securitization legislation.

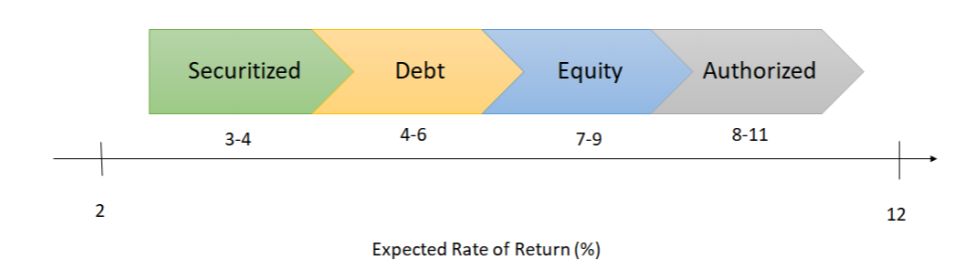

Securitized bonds can help clean energy resources overcome monopoly utility incentives to continue earning on uneconomic coal plants by paying down unrecovered coal plant balances at substantial consumer savings: AAA bond rates today fall under 3 percent, while utility regulated returns on equity can be in excess of 9 percent. A recent Consumers Energy securitization application filed in Michigan estimated interest rates for its proposed bonds could be issued at rates under 2 percent.

Securitization protects consumers while helping utilities refinance unpaid coal investments when plants close before their scheduled retirement dates. These savings also free up capital for utilities to invest in cheaper wind, solar and storage and can fund transitional assistance for impacted coal communities and workers.

Securitization isn’t new, but it’s making a major comeback

Securitization laws refer to “securitized bonds,” “ratepayer-backed bonds” or “ratepayer obligation charge bonds” as low-cost capital options for utilities to replace higher-cost corporate finance.

The idea isn’t new: These bonds retired stranded generation assets in the 1990s and early 2000s when about 20 states restructured utility markets to stimulate power sector competition, and they finance large emergency costs such as wildfire liabilities and hurricane storm damage. Some $50 billion in securitized utility bonds have been issued over the last 20 years, so institutional investors are increasingly familiar with them.

The securitization statues passed by Colorado, Montana and New Mexico each have different policy goals but all unlock a regulatory tool to reduce costs and risks of accelerating coal retirements. Securitization legislation doesn’t cause coal retirements; it helps regulators maximize consumer benefits from the clean energy transition without needlessly compensating shareholders with profits on early-retiring plants or causing consumer rate shock from accelerated depreciation schedules.

A recent Consumers Energy filing shows how securitization legislation impacts utility decisions. In September 2020, the utility filed for securitization of the unrecovered book balance on the 550-megawatt D.E. Karn coal plant, consistent with a 2019 settlement agreement to retire by 2023. Michigan’s securitization legislation was used in 2013 to securitize $390 million in unrecovered expenses from a retiring 950 MW plant. This tool eased negotiations and will free up capital for Consumers’ goal of net-zero carbon by 2040.

What constitutes effective securitization legislation?

Protecting consumers by refinancing utility investments through low-cost bonds is central to the securitization legislation advanced by Colorado, Montana and New Mexico, yet each state’s policy reflects varying attention to consumer protection and public interest outcomes. All three contain cost-containment goals, but the bills vary considerably on:

- What findings are required in commission financing orders

- Whether bonds may be issued for purposes other than refinancing early plant retirements

- Whether bond proceeds can specifically mitigate community and worker impacts when fossil plants are retired early

All three laws enable using bonds for refinancing unpaid investment in coal-fired power plants upon early plant retirements. Under each statute, utilities may voluntarily seek bonds. And all three require bonds to achieve the lowest interest rates but with varying degrees of specificity, which can significantly affect consumer costs.

In New Mexico and Colorado, securitization was part of substantial energy policy changes establishing aggressive carbon-reduction goals, so these statutes provide more robust models for states pursuing community transition and clean energy reinvestment. If utilities own a portion of replacement generation resources after a competitive procurement process, their shareholders benefit from long-term earnings on new, large-scale investments.

Colorado allows securitized bonds to include community transition funding, while New Mexico requires clean replacements to be located in the same community as the coal plant being retired and specifies funding values for community and worker mitigation. By contrast, Montana’s securitization was a standalone enactment driven by environmental advocates using ratepayer savings to motivate bipartisan support for coal retirements.

Full cost recovery for unpaid coal plant balances is not necessarily a feature of the legislation, nor should it be. Instead, legislation typically enables public utility commissions to determine whether and how much recovery will be charged to consumers.

In Colorado and Montana, utility regulators can determine recoverable asset values, depending on whether coal plant construction and operation investments were prudent. However, New Mexico’s legislation quantified recoverable amounts to be securitized for a particular coal plant. This unusual step has heightened tensions concerning the state’s utility regulator elections.

Utilities facing the coal closure wave should embrace securitization

The coal closure wave isn’t subsiding, and the economics of renewables keep improving, putting even more pressure on coal-reliant utilities. Securitization won’t push coal off the system, but it can reduce the costs of a collapsing resource and stimulate clean energy economic investment.

Every state with regulated coal plants should consider securitization legislation to ease energy transition costs and encourage reinvestment in clean energy resources and community transition. A smart financial transition plan that saves consumers money and benefits shareholders can win support, regardless of policymaker party affiliations.

***

Mike O'Boyle is director of electricity policy at Energy Innovation, a think tank. Silvio Marcacci is the group's communications director.