In April, Department Of Energy Secretary Rick Perry issued a memorandum to his staff asking pointed questions about the future of the electric grid as coal is retired off the system, including:

- “Whether wholesale energy and capacity markets are adequately compensating attributes such as on-site fuel supply and other factors that strengthen grid resilience and, if not, the extent to which this could affect grid reliability and resilience in the future; and

- The extent to which continued regulatory burdens, as well as mandates and tax and subsidy policies, are responsible for forcing the premature retirement of baseload power plants”

Given the rapid change facing America’s electricity system, these questions may seem reasonable, but they reflect an outdated world view.

DOE’s publication of this memorandum presents an opportunity to uncover many of these outdated assumptions and understand what’s driving the unstoppable transition from coal to other technologies. By taking each premise in turn and providing evidence-based analysis -- as others have done in different ways -- we can see that the projected demise of coal will result in a cleaner, cheaper and more reliable energy system.

Premise 1: “Baseload power is necessary to a well-functioning grid”

To understand whether this is true, some definitional work is needed. Baseload generation’s purpose is to meet the baseload or demand, which Edison Electric Institute defines as “the minimum load over a given period of time” in its Glossary of Electric Industry Terms. The same glossary defines baseload generation as: “Those generating facilities within a utility system that are operated to the greatest extent possible to maximize system mechanical and thermal efficiency and minimize system operating costs...designed for nearly continuous operation at or near full capacity to provide all or part of the baseload.”

In other words, baseload plants are those whose efficiency is highest when run at a designed level of power, usually maximum output, and deviations from this level of power reduce efficiency and increase costs. Baseload generation is an economic construct, not a reliability paradigm.

A system with baseload thermal generators as its backbone comes with reliability pros and cons. For example, baseload power usually has heavy generators with spinning inertia, which gives conventional generators time to respond with more power when a large generator or transmission line unexpectedly fails. But we now know how to get such responses much more quickly from customer loads, newer inverter-based resources like wind, storage and solar, and gas-fired resources.

As the Rocky Mountain Institute’s Amory Lovins recently detailed in Forbes, fuel storage may appear to provide protection from a failure of gas supplies or weather events, but stored fuel has its own set of problems and failure modes:

- The 2014 polar vortex rendered 8 of 11 gigawatts of gas-fired generators in New England unable to operate.

- Coal has serious risks of supply due to susceptible transport by rail, as over 40 percent of U.S. coal comes from a narrow rail corridor from Wyoming’s Powder River Basin.

- Extreme cold can also render on-site coal unusable, as happened during the Southwestern blackout of February 2011 that shut off power to tens of millions of customers.

- Nuclear power can be shut down or impaired by unseasonable hot weather, when cooling water is too warm and plants must be shut down for safety and to prevent mechanical damage.

So in fact, baseload units, even with fuel stored onsite, are sensitive to weather and many other failure events.

Lovins also points out that coal and nuclear baseload generators are unable to operate continuously, despite perceptions to the contrary. On average, coal-fired stations suffer unexpected “forced outages” 6 percent to 10 percent of the time, and nuclear plants experience forced outages 1 percent to 2 percent of the time, plus 6 percent to 7 percent scheduled downtime for refueling and planned maintenance.

On the flip side, solar and wind are 98 to 99 percent available when their fuel (the sun and wind) is available, and the ability to predict the weather is improving all the time. The reliability risks from fossil fuels are collectively managed today, mostly by paying to keep reserve generation running to respond when they unexpectedly fail, but this creates the need for redundancies and costs in the grid comparable to those that cover the uncertainty of weather forecasts for wind and solar power.

Premise 2: “[The] diminishing diversity of our nation's electric generation mix"

The U.S. electricity mix is seeing a trend of increasing diversity, rather than decreasing diversity. Until recently, the notion that supporting coal generation would improve diversity was nonsensical; coal was the dominant and largest source of U.S. electricity for decades, so an argument for more diversity would be an argument for reducing the use of coal.

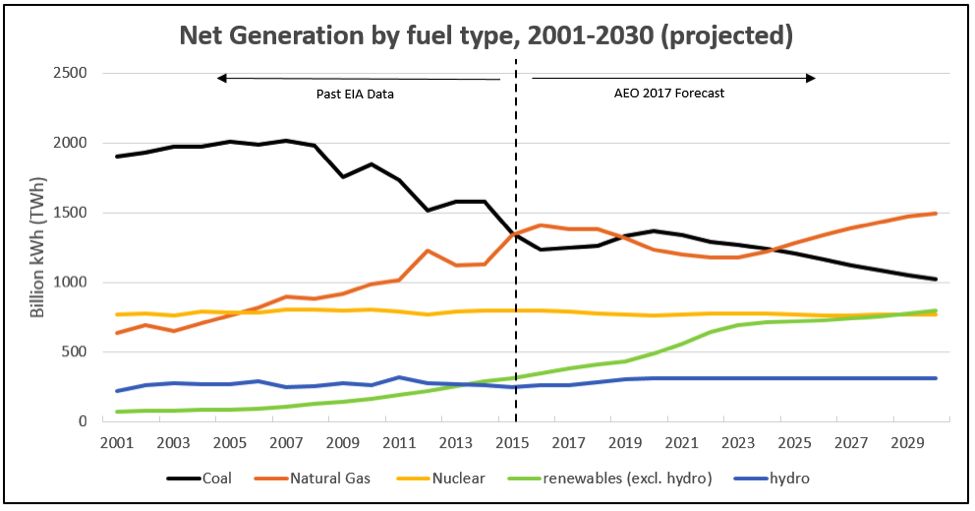

Today, coal and natural gas produce roughly equal shares of U.S. generation, while nuclear and hydropower (hidden in the renewables bucket below) are projected to continue their near-constant supporting roles. With increasing renewable fuels, driven particularly by the growth of wind, solar and biomass generation, one can see that fuel diversity has actually increased dramatically since 2001.

Source: U.S. Energy Information Administration and AEO 2017

Today, coal is declining, with more than 90 gigawatts of the more than 250-gigawatt fleet projected to retire under business-as-usual conditions by 2030, but it will remain a meaningful player in the marketplace for at least the next decade according to baseline Energy Information Administration projections. In the long term, however, whether reducing coal generation impacts fuel diversity and resilience depends more on what replaces it than whether the coal remains.

A portfolio of generation options with different characteristics insulates consumers from price risk and availability risk. Keeping some coal-fired generation on-line would help in that regard, particularly if its environmental costs are not considered. If retiring coal and nuclear are replaced mostly by natural gas, we would see a decline in fuel diversity, and that could potentially increase risk due to the characteristics of the natural gas supply.

The same would be true, for example, if we myopically rely on solar as the only technology to decarbonize the grid. Studies of the optimal mix of resources in California to meet the 50 percent renewable portfolio standard by E3 and NREL each found that geographic and technology diversity of the renewable resources will substantially reduce the cost of compliance compared to the high-solar and in-state-only cases.

But under current projections out to 2030, we are only going to see greater fuel diversity, not less, as natural gas, demand-side resources and utility-scale renewables take the place of retiring coal. This should increase the resilience and security of the system, particularly if this change is accompanied by more investment in transmission, storage and demand-side management.

Premise 3: “[Renewable] subsidies create acute and chronic problems for maintaining adequate baseload generation and have impacted reliable generators of all types”

Beyond the question of what “adequate baseload generation” actually means, it is undoubtedly true that coal and nuclear baseload units are suffering financially in both vertically integrated and restructured markets.

A recent FERC technical conference offered a forum for generators and wholesale market operators to vent their frustration in what they see as the inadequacy of markets to provide generators with sufficient revenue. But in reality, this financial pain is the effect of oversupply and intense competition. For example, despite low capacity prices in the PJM Interconnection, 5 gigawatts of new natural gas capacity cleared in the most recent auction. Coupled with stagnant demand, something has to give -- and inefficient coal plants are the more expensive and the least flexible generators that are not needed in this competitive landscape.

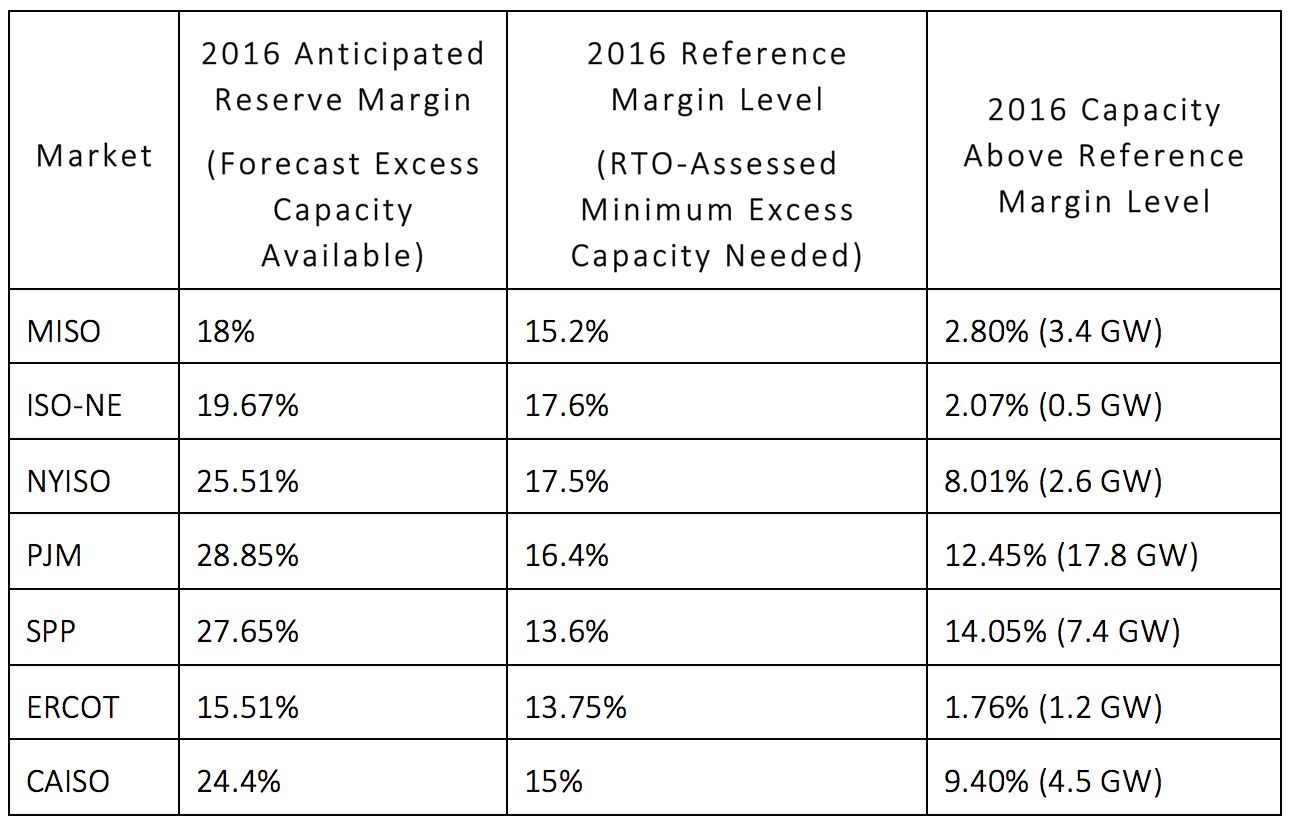

Competitive pressure from cheap gas, inexpensive renewables, and declining demand are undermining the financial viability of baseload plants, but we are far from a crisis of reliability and resilience. Consider the reserve margins and reference levels in the major markets.

Each market is oversupplied. In the case of PJM and SPP, the condition is drastic -- they have double the excess capacity they need to meet stringent federal reliability criteria. One panelist at the May FERC technical conference captured the dynamic: “PJM has reserve margins of 22 percent. I think of Yogi Berra, my favorite economist -- we’ve got so much capacity, we’re going to run out.”

A well-functioning market would allow uncompetitive generators to retire amid steep competition and declining prices, given the oversupply conditions. To blame coal’s suffering on policies supporting clean energy denies the root cause -- coal-fired generation is dying on economics alone.

Keep calm and retire on

Several premises that underlie the need for the forthcoming DOE study are false. Chief among them is a singular focus on baseload generation, particularly coal-fired power plants, as necessary for maintaining reliability. Baseload generation is an economic characteristic, not a reliability concern.

Replacing expensive, environmentally unsustainable coal is not a matter of ensuring adequate baseload -- the key will be quantifying the reliability services that are needed and ensuring that the replacement generators can provide it.

But hitting the panic button, which is what Rick Perry’s memorandum appears to do, is completely missing the picture; rather than losing diversity, our electricity mix is rapidly diversifying and our markets are vastly oversupplied with energy sources today. Any attempt to conclude otherwise will simply create unjustified roadblocks for new renewable generation, which is crucial to ensure a clean, affordable and reliable electricity system.

***

Michael O’Boyle is a power sector transformation expert for America’s Power Plan.