California has set some ambitious environmental goals, including a 40 percent reduction in greenhouse gas emissions from 1990 levels by 2030, and an 80 percent reduction by 2050. The state also wants to dramatically reduce nitrogen oxides and other health-harming pollutants by 2032.

Southern California Edison, the state’s second-largest investor-owned utility, recently released a plan for how to meet these climate change and air pollution targets. Hint: It has a lot to do with high levels of electrification. I spoke with Pedro Pizarro, president and CEO of Edison International, about the plan this week -- more on that below.

Next, we venture north, past state borders, to Canada, my native land. As some Americans consider moving north to survive in a climate-altered future, and others, more immediately, to survive the present-day political climate, we take a look at Ontario’s long-term energy plan -- something every American transplant will surely want to know about. Finally, a roundup of some of the latest state energy policy news.

The cheapest way to decarbonize California's economy

Climate change and air pollution pose serious threats to Californians, especially to those in disadvantaged communities. According to leadership at Southern California Edison, the electricity sector is not so much the cause of this risk as it is a central part of the solution.

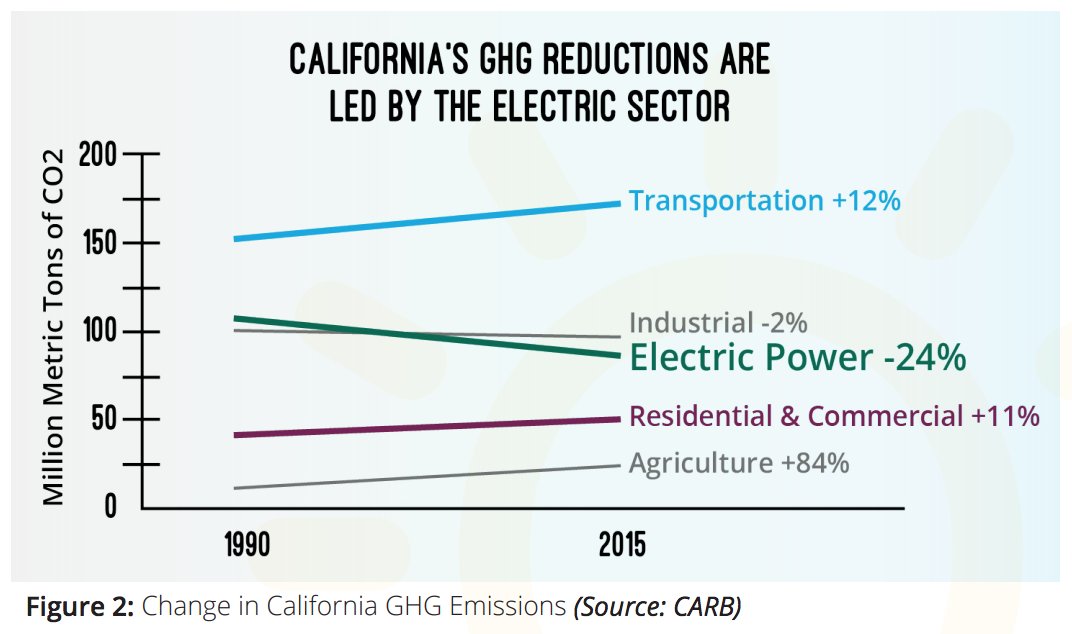

“The transportation sector, including fuel refining and fossil fuels used in space and water heating, now produce almost three times as many [greenhouse gas emissions] as the electric sector and more than 80 percent of the air pollution in California,” the utility pointed out in a new white paper.

According to the California Air Resources Board (CARB), transportation produced nearly 40 percent of the state’s greenhouse gas emissions in 2015 (the last year for which data is available). Including oil production, transportation accounts for 45 percent of emissions. The industrial sector makes up 17 percent of state emissions, which is slightly less than the 19 percent from electric power, although electricity providers have made more progress in cleaning up their act than any other economic segment.

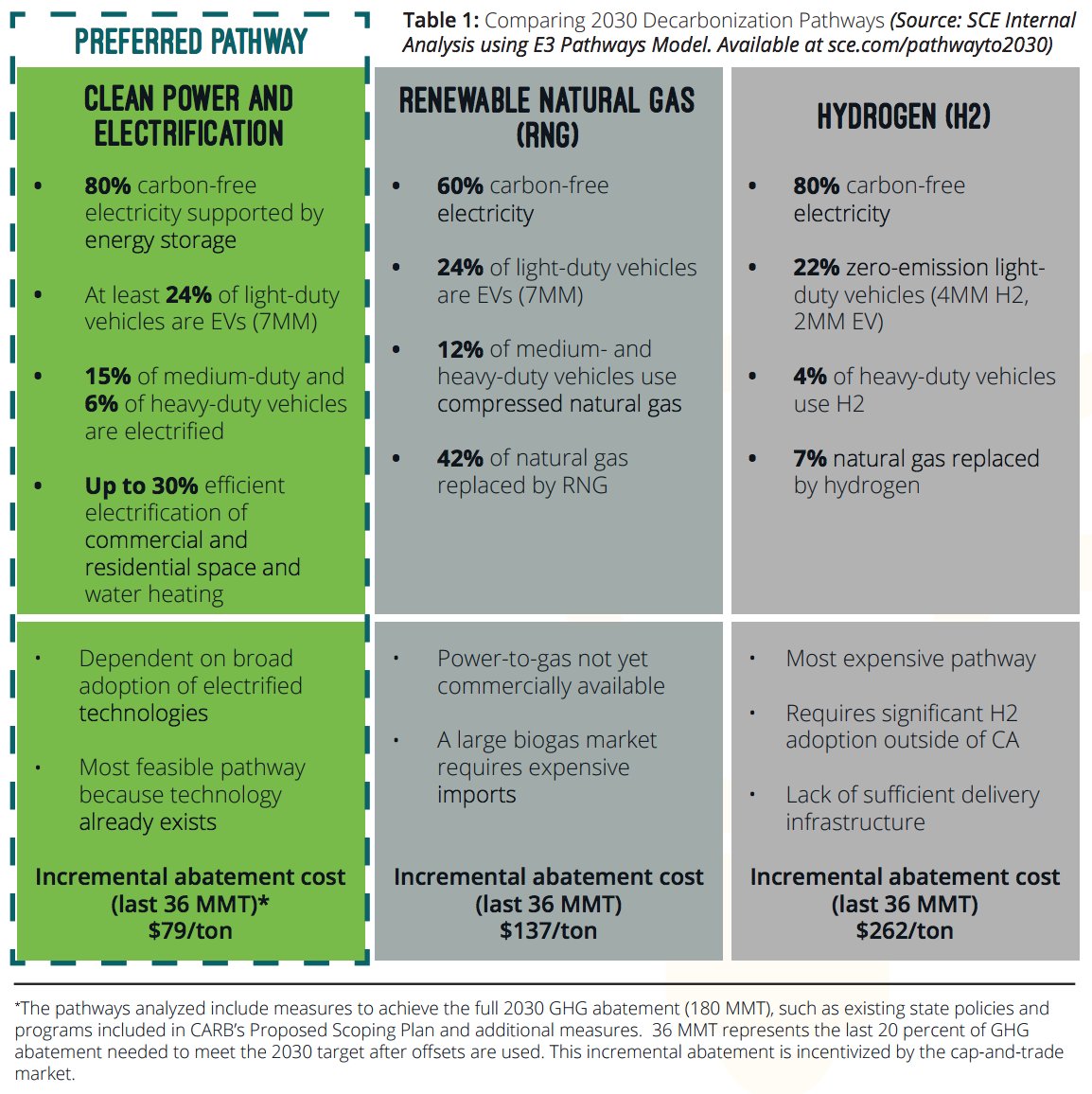

SCE evaluated three different pathways to meeting California’s climate and environmental goals. The “Clean Power and Electrification Pathway” -- perhaps unsurprisingly -- emerged as the most cost-effective and feasible path forward among the options studied. It also has the potential to create highly skilled middle-income jobs across the state, the white paper states.

By 2030, the Clean Power approach calls for:

- An electric grid supplied by 80 percent carbon-free energy, including both distributed and grid-scale renewables, supported by energy storage

- More than 7 million electric vehicles on California roads

- Using electricity to power nearly one-third of space and water heaters, in increasingly energy-efficient buildings

The electrification framework would increase power prices over time. But the other two pathways, one led by hydrogen and the other by renewable natural gas, proved to be much more expensive ways to cut emissions, according to the SCE analysis. To arrive at these numbers, SCE looked at technology availability, forecasts of technology costs, and the availability of related infrastructure, among other things.

“We have 46 to 47 percent of the state’s disadvantaged communities in our service territory; we think a lot about issues around overall cost management and equity between customer classes,” said Pedro Pizarro, president and CEO of Edison International. “So when we think about the greenhouse gas cost-reduction challenge, which we support, we want to get there for a lower cost, especially for the lower-income customers we serve.”

It’s also unclear if carbon reduction pathways that emphasize hydrogen and renewable natural gas could even meet California’s climate targets, he added.

Also, while 2030 seems far away, it’s really just around the corner when it comes to infrastructure planning, Pizarro said. What the state chooses to invest in today will have a major impact on whether or not California’s longer-term goals are met, which is why SCE decided to research and publish a framework to meet those climate and clean air goals.

When asked if the white paper is really the electric utility’s attempt to sell more of its product and shut out competing ones, Pizarro pointed me to the paper’s references -- which include EPRI, CAISO, BNEF, NREL and others -- to show that the utility really sought to take an impartial academic view.

“There are certainly a lot of different ideas for technologies that are all racing, and that’s great. That’s what markets are all about,” he said. “You definitely see folks pushing their different ideas. But in our case, we really tried to be analytical about this.”

“When we look at the cost/benefit scenario here, with electrification you have the ability to use an investment that’s already largely in place, with the grid being there,” he said. “There’s work we need to do to strengthen and modify the grid, but it’s a ubiquitous infrastructure, so you don’t need to develop a whole new infrastructure. And, frankly, that’s something that adds cost to the hydrogen path and to the renewable natural gas path."

Those are alternative pathways that California is seriously considering. The state has already invested tens of millions of dollars in hydrogen fueling stations, and players like Toyota and Shell continue to invest in the hydrogen economy. Major players, including SoCal Gas and Pacific Gas and Electric, are also pushing to get renewable natural gas on the agenda. In each carbon-reduction scenario SCE studied, it assumes there will be a mix of solutions; they differ based on which resource is emphasized and where investment dollars go.

Pizarro insisted this isn’t just the case of an electric utility pushing an electric approach. For one thing, the electricity sector powers hydrogen and renewable natural gas providers, so it’s not as though utilities are cut out of an alternative low-carbon future. Another reason is that California utilities don’t make their money by selling electrons. So SCE isn’t simply trying to get more stuff to plug in.

There is a major benefit for SCE when more customers use the electric grid, however, by enabling the utility to amortize costs over a larger customer base. Pizarro noted this also keeps costs lower for individual customers.

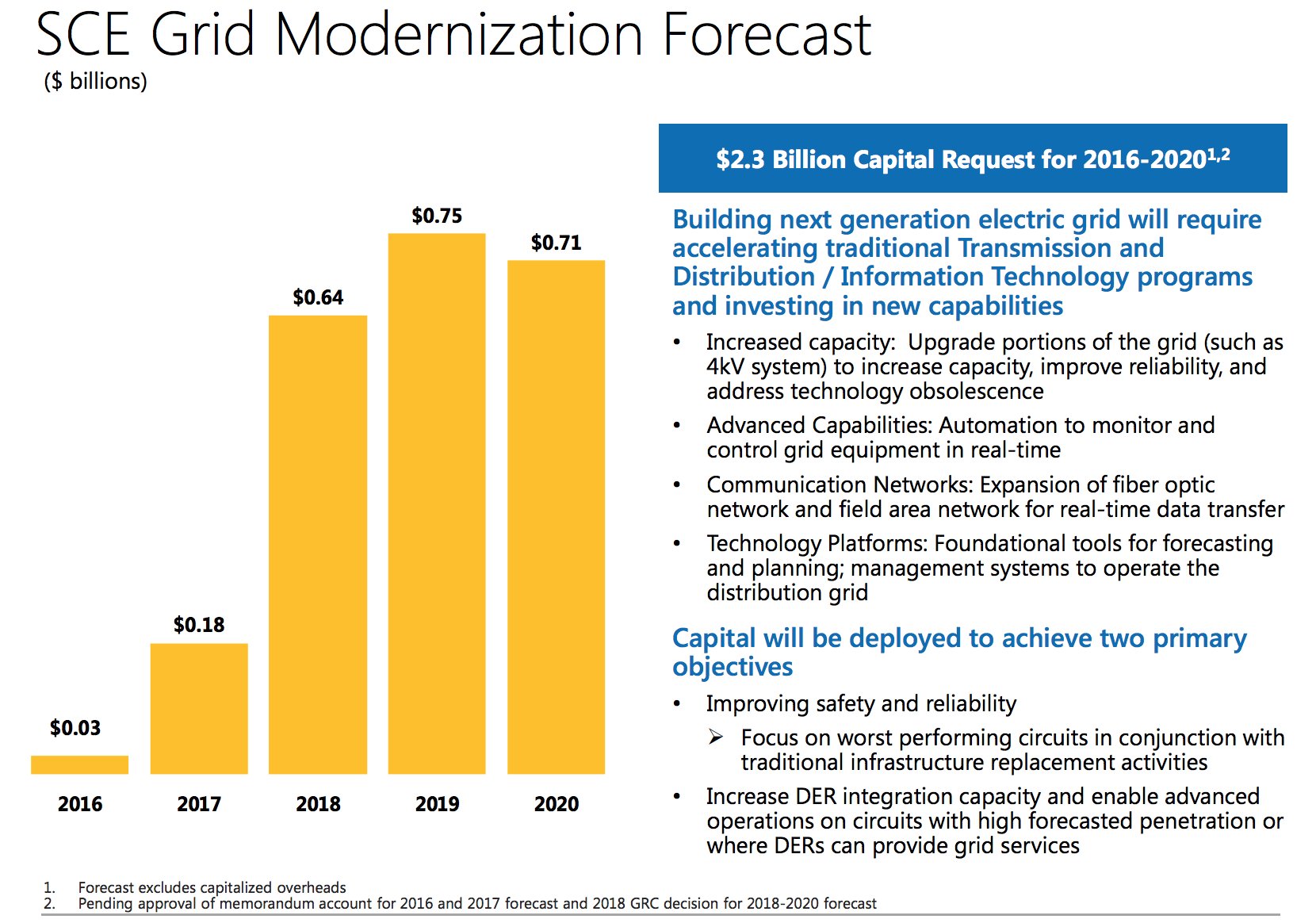

In SCE’s general rate case for 2018-2020, the utility is seeking to recover nearly $5 billion in capital expenditures per year, up from around $4 billion per year in previous years. Of the three-year, roughly $15 billion rate request, the utility wants to invest $2.1 billion in grid modernization to enable a high-tech, low-carbon electricity system. The rate request, which is currently before the CPUC, has been met with strong opposition from solar groups that say these costs are excessive and that the plan does not adequately factor in clean distributed energy resources.

From Pizarro’s perspective, when it comes to the cost creating of a clean, electrified future, he suggested that the current system -- where customers are being incentivized to purchase their own clean energy solutions, but not all customers can take advantage of those incentives -- is expensive and unfair. This gets back to the all-too-familiar net metering debate that’s plagued the residential solar sector for years. Pizarro said SCE has worked hard to make it easy for customers to go solar, bringing the utility’s initial response time down to about a day. But he also believes that current incentive levels for rooftop solar are higher than they should be.

New solar customers in California are already required to adopt time-of-use rates to help address this. The next phase of California’s NEM 2.0 program kicks off next year with the rollout of time-of-use rates for all residential customers. Pizarro implied that more changes are needed.

Looking ahead to 2030, a more ferocious policy battle may wind up being waged between proponents of electrification versus fossil fuels.

In 2015, the California state legislature sought to pass a three-pronged bill (SB 350) that included a 50 percent reduction in oil consumption by 2030. But that measure was ultimately stripped from the bill under pressure from oil lobby groups. In this context, SCE’s vision of getting 7 million electric vehicles on the road in California by 2030 not only faces challenges related to customer education and infrastructure, but could also face real opposition from entrenched interests (although it should be noted that some oil majors are starting to invest in EVs in a serious way).

The 7 million EVs target -- which amounts to 24 percent of vehicles -- is even more aggressive than the California state government’s goal. CARB is currently pursuing policies to support more than 4 million zero-emission vehicles in California by 2030.

Why would SCE propose such an ambitious goal? Because supporting 7 million electric cars by 2030 will require California to have more than 1 million non-residential (and millions of residential) charging ports. Utilities across the state have already initiated charging infrastructure pilots and are seeking additional funds to expand their EV infrastructure programs.

Additional funding will certainly be needed for SCE and other power companies to play a bigger role in electrifying transportation. Electrifying nearly one-third of California’s residential and commercial space and water heaters is also a way to keep utilities at the center of the energy system.

The utility role aside, SCE isn't alone in its assessment of how to decarbonize California. Many experts argue widespread electrification is pivotal to achieving deep reductions in greenhouse gas emissions, which is what SCE's vision ultimately comes down to, said Pizarro.

“The North Star in all of this is: Are we serious about doing something about climate change or not? This state has said it’s very serious about taking action and put 2030 targets in law, and the Public Policy Institute of California shows 70 percent support across the population for the state’s climate change goals,” he said. “We’ve got to take it as gospel -- it’s the will of the state. Oh, and by the way, it’s the right thing to do if you listen to the climate change scientists. So what’s the most effective, efficient and affordable way to get there? We did our homework, and it looks like the electric-led path is the most affordable, so why spend more?”

Ontario's new long-term energy plan

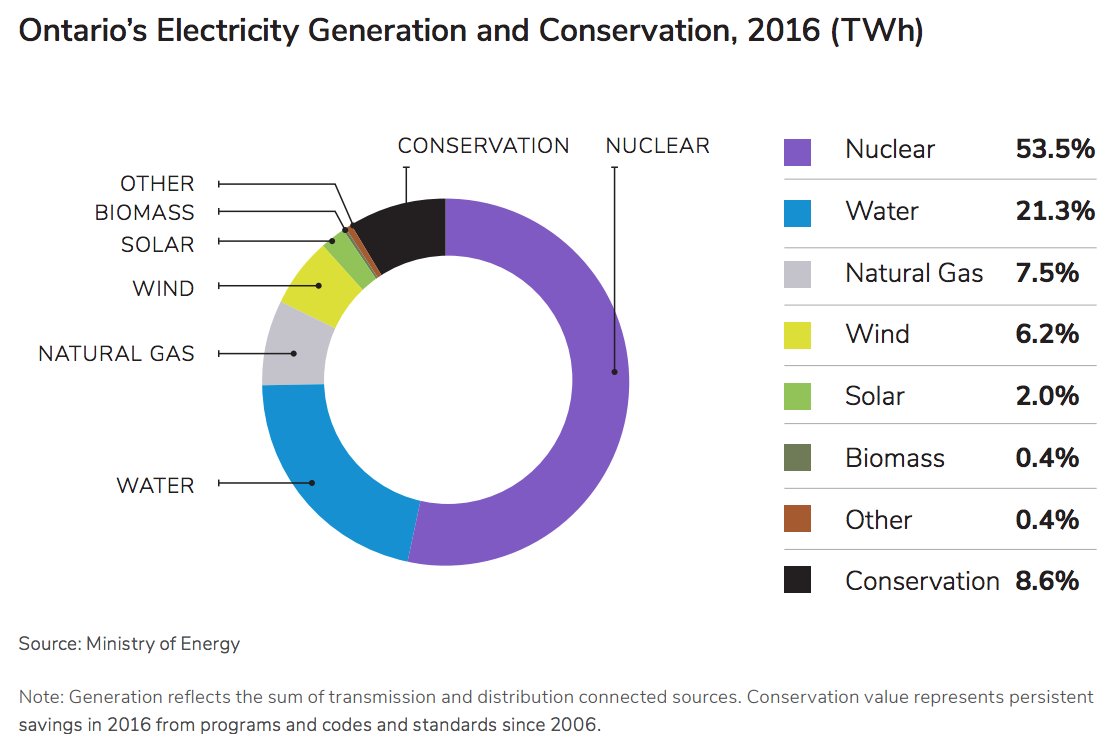

Ontario's Minister of Energy, Glenn Thibeault, recently released the Canadian province’s new Long-Term Energy Plan (LTEP), which was met with support from several power sector stakeholders.

Mike Gallagher, business manager of Local 793 of the International Union of Operating Engineers (IUOE), said the LTEP is a step in the right direction.

"On behalf of the more than 14,500 IUOE Local 793 members, I applaud Premier Kathleen Wynne and her Liberal government for showing a continued commitment to both nuclear and renewable energy projects because they provide reliable, near-endless sources of clean, low-cost electricity for families and businesses as well as long-term employment for operating engineers," he said, in a statement.

Gallagher praised the Ontario government for refurbishing six nuclear units at the Bruce Power plant and four units at the Darlington Nuclear Generating Station between 2016 and 2033. Ontario’s nuclear power plants currently provide more than 50 percent of the province’s power.

The Renewable Energy Alliance of Ontario, which Gallagher also leads (which may come as a surprise to those who consider nuclear and renewables to be at odds), was disappointed the province didn’t follow Alberta's lead (which may come as a surprise to those who only think of Alberta as home to the oil sands) in setting hard targets for the percentage of renewables included in the energy mix. But the group deemed Ontario’s new plan a “positive step” nonetheless.

Gallagher noted that the renewable energy sector has invested more than $14 billion in Ontario's economy, creating more than 200,000 good-paying jobs. The renewables sector is forecast to contribute nearly $5.4 billion to Ontario's gross domestic product and create 56,500 jobs between 2017 and 2021.

The LTEP includes the continuation of net metering, enhancing it by proposing an amendment that would allow third-party providers to own and operate net-metered renewable generation systems, while ensuring appropriate consumer protection measures are in place. The Ontario government previously removed the limit on the size of systems eligible for net metering and allowed them to be paired with energy storage technologies. Ontario is also launching new distributed renewable energy pilot programs, and will propose legislative and regulatory amendments that enable the deployment of virtual net metering projects.

The LTEP lauds blockchain and transactive energy as an “exciting opportunity.” It notes that these new business models are also being studied and developed in Ontario, and that the government plans to explore how blockchain and other transactive energy models could benefit Ontarians.

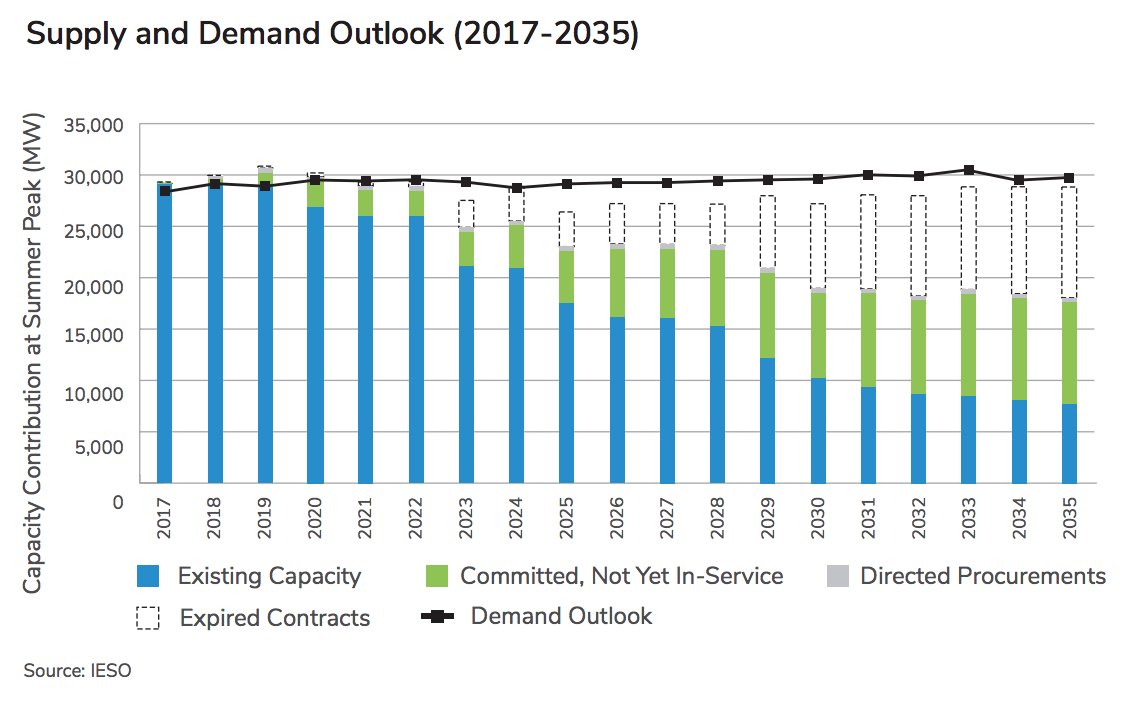

Ontario will need to get creative with its energy plans in the years to come, as it faces an electricity supply shortfall. Over the next decade, as much as 20 gigawatts of electricity supply will be removed from the system, representing close to half of all supply in the province. This includes approximately 3 gigawatts of supply coming offline at Pickering Nuclear Generating Station, as well as 9 gigawatts of expiring generation contracts.

Canada's wind industry said it's ready and able to help fill that supply gap. "Ontario's harnessing of wind power can help fight climate change while keeping electricity costs low. Without new wind energy, costs to electricity customers and carbon emissions will both continue to rise," said Robert Hornung, president of the Canadian Wind Energy Association.

Cost is a major concern. Ontario has seen electricity prices more than double over the past decade, triggering a major backlash against the Liberal Party. Under the new plan, bills are projected to rise to $197 in 2032, which is a slower increase than projected in the government's previous long-term plan released in 2013. Opposition parties view the new energy plan as a way to win favor with voters ahead of next year's provincial election.

Some of the latest state energy policy news

Regulators hear testimony on Tucson Electric Power’s proposed solar rates: The Arizona Corporation Commission is now weighing TEP’s proposed solar rate plan, following the conclusion of Arizona’s value-of-solar proceeding last year. The utility says it would increase the average bill paid by new solar customers by $14 per month, but the typical home solar customer will still be able to save about $90 a month under initial rates. The ACC is scheduled to hold hearings on Phase 2 of TEP’s rate case (Phase 1 was decided earlier this year) through November 9. The commission is expected to issue a final order sometime in February.

South Carolina lawmakers seek to block cost recovery for abandoned nuclear project: A special 18-member House committee released a new plan that would block SCE&G from charging its customers any more for the financing of two new nuclear reactors in Fairfield County. The nine-year construction effort project was abandoned July after SCE&G had already charged customers $1.7 billion in higher electricity rates to help pay for it.

PSC approves Duke Energy Florida settlement: Florida regulators have approved Duke Energy’s settlement agreement, filed in August 2017, that includes investments in solar energy, smart meters and grid modernization projects. The agreement also includes plans to install electric-vehicle charging stations and a battery storage pilot program. The company will also cease work on the Levy County nuclear project and customers will not pay any further costs associated with the project. Furthermore, the plan includes adding 700 megawatts of solar power over the next four years, accelerating Duke’s previous timeline.

PNM issues RFP for 456 megawatts, encouraging solar and storage: The Public Service Company of New Mexico has issued a request for proposals for 456 megawatts of resources under its 2017-2036 Integrated Resource Plan. PNM is encouraging renewable and battery storage options beyond those identified in the 2017 IRP, in line with the state's plan to phase out coal-fired generation.

DER oversight rules in New York: On October 19, the New York Public Service Commission issued the 92-page order in its Reforming the Energy Vision pertaining to the oversight of distributed energy resource providers. The plan was welcomed by distributed energy advocates. “The PSC’s approach to oversight of companies providing innovative distributed energy services is less heavy-handed than originally proposed, which recognizes that there currently is not a problem to be solved, and strikes a good balance between necessary consumer protection and encouraging these companies to enter New York’s market,” said Anne Reynolds, executive director of ACE NY.