An important transition is underway with the integration of renewables into the grid. But often overlooked and seldom appreciated is the tremendous potential of geothermal energy.

Unfortunately for those in the industry, this fate is justified. Geothermal is not an enticing new source of generating energy competing for attention with the ranks of distributed fuel cells, advanced solar PV or next generation wind turbines -- far from it.

The geothermal industry got started in 1904 in a steam field in Larderello, Italy when the first gas turbine was being tested. It is one of the oldest methods of making power, based on the concept of drawing heat from the earth and using that heat to drive a turbine-generator. Even today, the geothermal business remains a cottage industry with many staunchly dedicated players who have been committed for nearly half a century. But geothermal energy has a unique capability that few other energy technologies possess, and its past shortcomings may now become its greatest assets.

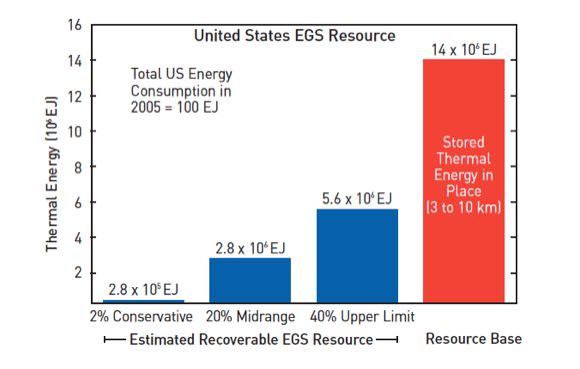

Geothermal has under-delivered on the promise because expectations have been high and returns unsatisfactorily low. The 2009 report from MIT titled The Future of Geothermal Energy estimated that on a conservative basis and with the development of “enhanced” geothermal systems, 280,000 exajoules (EJ) of domestic geothermal energy could be economically recoverable.

With our total energy consumption in the United States hovering around 100 EJ per year, this is enough carbon-free energy to last for 2,800 years. Yet even with this much potential, the country remains at a staggeringly low 0.05 EJ of annual geothermal energy, with low market growth and no unified expansion plan. However, before we bet our clean energy future on deep hot rocks, the geothermal industry must deliver on technology critical for balancing the risks and driving up the returns.

Above: MIT analysis of the future of geothermal

Few industries have generated more wealth than the exploration of oil -- so why not compare the conditions that led to such massive market growth with those that face the geothermal industry?

On one side of the equation is the insatiable demand for oil and oil-derived products, beginning with kerosene for lighting and culminating in the modern-day combustion engine for transportation. But the other side of the equation, the supply side, is defined by consistently declining risk. In the early days, drilling an oil well was entirely speculative and a “hit rate” of 10 percent was not uncommon, meaning just one out of every ten wells successfully produced oil. Today, many decades of technology development have increased the probability of success in drilling for oil to around 50 percent.

With a manageable and decreasing risk profile, combined with ever-expanding value in the marketplace, it is no surprise that investors and developers alike have rushed to develop oil resources. This highlights the question of why geothermal is so different. After all, the electricity market has many parallels, beginning with Edison’s electric lighting applications and (possibly) culminating in the modern-day electric motor for transportation.

The answer lies in the inflated risk of developing geothermal resources, which is driven by higher upfront costs. Geothermal resources are deep and hot. It is not atypical for an enhanced geothermal solutions (EGS) well to reach depths of 12,000 to 16,000 feet (2.2 miles to 3 miles). While there are many deep oil reserves, different technology is required to withstand the elevated geothermal temperatures. The average rate of success in geothermal drilling is around 20 percent today. Not bad, considering where oil began, but geothermal is a mature industry, and when this level of risk is combined with the higher cost of drilling through hot rock, the returns often do not adequately justify the capital investment.

One potential solution is to lower the cost of drilling. But cutting the cost of drilling in half would only decrease the cost of a fully installed well by around 25 percent. Another emerging solution, however, is to circumvent nonessential drilling altogether. This is accomplished with hydraulic stimulations.

While often compared to the controversial practice of hydraulic fracturing, geothermal stimulations are actually quite different. The objective is not to break open the rock and let trapped hydrocarbons flow, but rather simply to apply sufficient pressure to cause naturally occurring fractures to shift or shear, opening up small channels for water to contact the rock. Geothermal stimulations do not use the harmful chemicals or proppants typically associated with fracking, but instead rely on the injection of pure water.

The greatest attribute of stimulation technology, however, is the ability to repower geothermal reservoirs without risking the cost of a well. Rather than sinking capital into a brand new hole, one that may or may not pan out, stimulation technology can be used to add as much as 100 percent more power to an existing production well. Since the capacity of geothermal plants naturally declines over time as the rock cools and water is withdrawn, 3 gigawatts of geothermal capacity in the U.S. can immediately be turned on without drilling a single new well or building a single new power plant. Half of this potential power is already contracted for purchase by the electric utilities, making it an attractive development opportunity.

By eliminating a majority of the upfront cost, returns for geothermal stimulations are quite high, and the payback period is less than eighteen to twenty-four months. Ormat Technologies recently demonstrated the first grid-connected use of geothermal stimulations at its Desert Peak facility in Reno, Nevada.

Stimulating existing wells is an emerging approach to increasing profitability and improving the performance of operating geothermal plants, with quite a bit less risk. But the most significant potential application for EGS stimulations is in the broader use of this technology in conjunction with drilling to limit the number of wells required for new geothermal development. By providing developers with a tool for creating a geothermal reservoir where it would not naturally exist, the exploration of geothermal resources becomes less a question of where the resources are located, but a considerably more quantifiable function of at what depth they exist.

Instead of betting on hitting a naturally occurring hydrothermal heat source, stimulations are used to engineer the appropriate reservoir. Rather than depending on the natural capacity of the subsurface geology to provide energy, stimulated reservoirs achieve higher productivity by driving up the output of each well. It is estimated that this approach can be used to achieve a success rate of over 90 percent for future enhanced geothermal exploration.

Our current energy challenges would be well served by forging a new path for geothermal energy. By romancing the stone, the growth trajectory for geothermal power can be dramatically shifted from a niche renewable resource to a dependable future supply of clean, baseload power. The U.S. will retire roughly 50 gigawatts of coal and another 40 gigawatts of nuclear generation over the next twenty years, but how we fill the void remains uncertain.

In the state of California, coal abatement and the recent decommissioning of the San Onofre nuclear station (SONGS) have created burgeoning new demand for natural gas. Domestic use of natural gas is vital to the economy and securing our energy independence, but for residents of California, it means backpedaling toward a higher carbon footprint on the heels of AB 32, a progressive plan to reduce greenhouse gas emissions.

However, with a bit of work and a renewed sense of urgency, the geothermal industry can rise to the occasion and deliver an attractive geothermal solution that is not only clean and sustainable, but quite possibly may be the most economically competitive option.

***

Aaron Mandell is a co-founder and the Chief Commercial Officer of AltaRock Energy, a provider of geothermal stimulation services and leading developer of enhanced geothermal (EGS) resources.