Analysis of the U.S. residential energy storage market has largely focused on investment returns derived from the behind-the-meter value provided to the homeowner.

Although residential demand charges have recently been proposed in Arizona and Illinois, and Hawaiian Electric has proposed differential pricing for electricity exports, U.S. residential electricity rates do not presently offer any significant price arbitrage opportunity. Therefore, the resulting analysis shows minimal growth for the segment in the near term.

Yet major residential PV installers and equipment suppliers, already stretched by a rapidly growing rooftop solar market, are also planning for high growth in residential energy storage. What is motivating them?

Residential energy storage can deliver all the same benefits as other energy storage installations, but it can also directly address distribution grid control concerns to help maintain the growth of the rooftop solar PV market.

The grid impact of high-penetration PV

Hawaii, where rooftop PV is now installed on one of every nine homes, provides our first glimpse of what's to come for other utilities. Such high PV penetration levels strain traditional utility feeder controls, resulting in voltage disturbances and other power quality concerns for utility customers. This results in refused interconnection approvals by the utility and in increased downtime for PV systems on affected feeders as the voltage disturbances cause their inverters to disconnect.

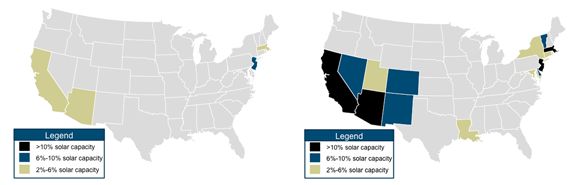

Source: GTM Research; Distributed Solar Capacity as a Percentage of Peak Feeder Capacity by State in 2013-2018

No other state comes close to Hawaii in terms of rooftop PV concentration. But little "Hawaiis" are appearing on a neighborhood level where there is high penetration and the feeder power quality is being disrupted.

The economic geography of the solar installation business combined with neighborly competition creates community-level concentrations and local feeder issues restricting further PV installations long before you get to a system-level problem. They represent the same problem being confronted in Hawaii, just in local pockets that are below the radar at an industry level but a mounting concern for installers trying to grow their business in a given region.

According to GTM Research, these high PV penetration issues will be evident in over one quarter of U.S. states by 2017: “Penetration of distributed solar is set to increase by more than 300 percent in the United States over the next four years, straining existing distribution infrastructure at the local level in at least thirteen states. In response to the increasing penetration, the market for advanced grid power electronics will surge.”

As explained in the GTM Research report Advanced Grid Power Electronics for High-Penetration PV Integration 2014, utilities can address these issues by installing and controlling advanced power electronics devices within the distribution system. However, another solution is also highlighted in the report: customer-sited energy storage.

Storage technologies provide a broader range of functionality than advanced grid power electronics, but also at a significantly higher cost. There is another very important difference between the two solutions: customer-sited energy storage can be installed and owned by anyone, not just the utility.

Installers can solve the problem as they go

There are two solutions to the local feeder penetration problem for rooftop solar PV installers: move on and wait for the utility to upgrade that feeder before returning for the remaining customers, or install energy storage alongside rooftop solar and control the problem as you go.

The install-as-you-go option supports a less risky business plan with minimal additional on-site labor. But how can the higher equipment costs be financed in the absence of behind-the-meter value for residential utility customers?

This is where the flexibility of energy storage comes into play. In addition to offering backup power to the homeowner when the grid fails, and accessing the ITC as part of the solar PV system, these residential storage systems can also be aggregated into fleets to participate in various current and emerging markets for ancillary services, capacity, and energy, generating additional revenue streams from whatever portion of the storage capacity is not required to maintain feeder power quality at any given time.

At present, it is only the big national installers that have the scale, the financing, the control and monitoring networks, the influence with regulators, and the resources to engage directly with utilities to make this solution work. But they are also the most highly motivated toward growth and account for the majority of residential rooftop solar installations today.

There are also new entrants coming into the residential storage market with financing and electricity market experience that are enabling storage deployments by independent local rooftop solar installers. They want to participate in system-level energy storage markets (like demand response and frequency regulation) and they see distributed storage deployed by solar installers as a quickly scalable and low-cost fleet deployment strategy. As compared to using fewer large dedicated sites to participate in these system level markets, installation of energy alongside residential solar results in:

- Minimal incremental labor

- No additional truck rolls

- No additional permitting and inspection costs

- No development approvals

- No real estate costs

- Simple, productized solution with no custom engineering or project management

- Quick and continuous capacity building

- Backup power delivered as value to the homeowner host

- Feeder power quality control delivered as a service to installer/utility

Impact on residential energy storage market growth

Reviewing the potential market for high-penetration PV integration solutions in this new light explains the high activity levels we are seeing among rooftop solar installers preparing for the growth in this market. At a basic level, the analysis shows a technical opportunity to solve distribution power quality issues that is over 10 times the size of the market predicted based on behind the meter value -- so there is lots of room to grow.

Using the cost of the advanced power electronics solutions required to achieve the same result as a value proxy shows that this additional value stream can justify 20 percent to 25 percent of the installed cost of distributed energy storage. The number gets significantly higher when accounting for the cost of sending a utility crew to upgrade pole equipment.

While the above is not reason enough on its own to drive storage growth, its role as a catalyst is what makes it so important. Combine these facts with the value that rooftop installers obtain from continued growth in their primary business, increased system uptime in affected areas, and the advantages first-mover fleet aggregators will achieve in the market, and motivation is crystallized. All that remains is availability of a suitable product that makes it easy for these installers to add storage to any installation and you have the catalyst for growth.

Please join Eguana Technologies at GTM’s Grid Edge Live conference in San Diego this June to get a firsthand look at the Residential AC Battery we are launching this summer. The energy storage revolution is closer than you think.

***

Eguana Technologies is the leading supplier of power control systems for residential and commercial energy storage systems. Supporting batteries from an expanding range of vendors, Eguana's AC Battery is a complete grid ready energy storage solution that accepts dispatch commands from any control network using open communication protocols. With more than 15 years of experience, Eguana is your first choice for reliable, scalable and efficient power electronics at the grid edge.