The United States is a net exporter of solar energy products, with total net exports of $723 million in 2009, according to a just-published report from SEIA (prepared by GTM Research).

This runs contrary to some data that indicate that the U.S. runs a large and growing green trade deficit. In fact, this report claims that the U.S. is in a solar trade deficit. But the devil is in the details, and methodology is crucial in a study of this nature.

SEIA's verdict on solar net-exporter status might come as a surprise to the "domestic-content" and protectionist jingoists in the audience. There is a periodic murmur from industry, trade groups and elements in the U.S. government that unfair subsidies in other countries put the U.S. at a distinct disadvantage in the solar industry. And those declarations seem reasonable.

If the primary inputs in solar manufacturing -- energy, land and labor -- are deeply subsidized, then it makes sense that there is an uneven playing field. But the real truth, as usual, is a bit more subtle and nuanced than that.

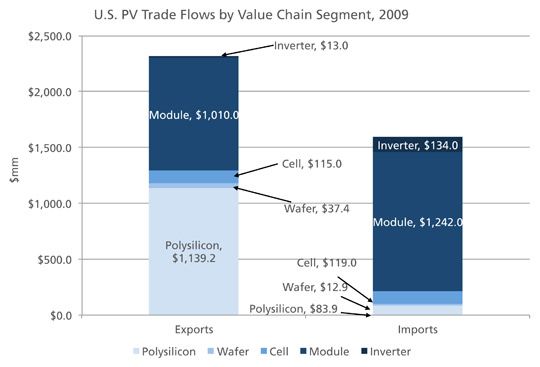

First, here are the key findings from the SEIA report:

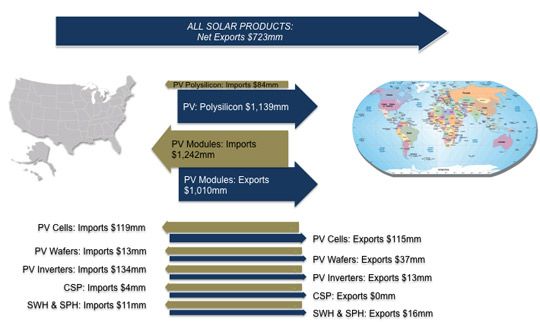

- The U.S. is a significant net exporter of solar products, with total net exports of $723 million in 2009.

- The largest solar energy product export is polysilicon, the feedstock for crystalline silicon photovoltaics, of which the U.S. exported $1.1 billion in 2009.

- 74 percent of the total value created from U.S. solar installations in 2009 came from the U.S. (despite the majority of installed modules being assembled abroad).

- Much of this value came from non-module costs and "soft" costs such as installation, legal fees, permitting, system design and engineering, etc.

- Primary import locations for PV were China and Mexico; primary export locations were Germany and Japan

- U.S. solar installations created $2.6 billion in direct value to support the U.S. economy.

- The U.S. doesn't export too many PV inverters

Note that the report makes an important distinction between pure trade balance, which is positive for the U.S. and pretty good at $723 million, and the less concrete but just as crucial category of "domestic value creation." It's domestic value creation that helps turn solar into a positive trade story.

Approximately 435 megawatts of PV was installed in the U.S. in 2009, with 71 percent of the total PV system value created domestically. The domestic value was primarily created in the areas of module manufacturing, site preparation, labor, soft costs and value chain markup for the module distributor and system installer. Soft costs include permitting, legal, engineering and financing. These soft costs comprise a not-insignificant portion of the installation and are somewhat immune to outsourcing or off-shoring.

In 2009, U.S. solar energy installations created a combined $3.6 billion in direct value, of which $2.6 billion (74 percent) accrued in the U.S.

- 81 percent ($2.1 billion) of the domestic value created by solar in the U.S. came from the PV sector

- 16 percent ($431 million) came from the SHC (solar heating and cooling) sector

- 3 percent ($76 million) came from the CSP (concentrated solar power) sector

The U.S. PV industry will grow from 435 megawatts in 2009 to approximately 1,000 megawatts in 2010. If the 1603 tax grant program stays in place, the potential exists for the U.S. market to grow to 2,000 megawatts in 2011.

The question remains: will the U.S. manufacturing base continue to keep pace with the growing domestic market or will the U.S. shift to becoming a net importer of solar products?