The U.S. could double its capacity for new wind and solar power, save billions of dollars and cut millions of tons of carbon-dioxide emissions from its generation fleets if federal incentives can be aligned to deploy a suite of technologies to unlock the full capacity of transmission grids.

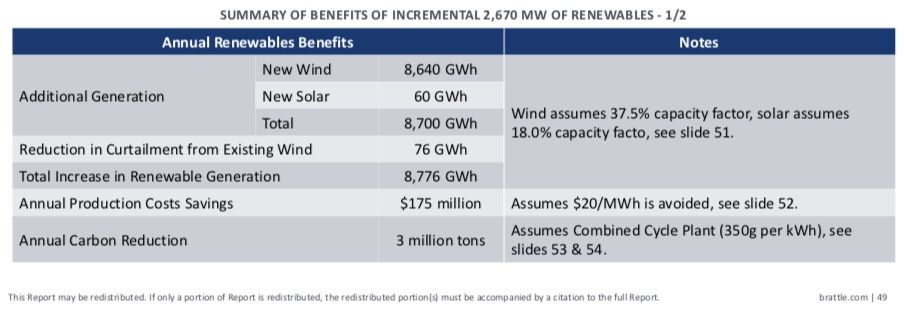

So says a new report from The Brattle Group, modeling the benefits of a set of "grid-enhancing technologies" across the wind-power-rich grids of Kansas and Oklahoma. According to its analysis, spending about $90 million to implement these technologies could yield a payback in less than a year, with annual power cost savings of about $175 million delivering ongoing benefits for years to come.

That’s because the technologies in question can drastically increase the renewable energy capacity of the grid operated by Southwest Power Pool. The report highlights tools such as dynamic line rating systems to discover the actual rather than presumed carrying capacity of transmission lines, combined with advanced power flow controls and "topology optimization" to analyze and route electricity across the least-congested lines in the network.

Those technologies could free up interconnection for the gigawatts' worth of wind and solar power projects that are being held back due to concerns that they’ll overwhelm the grid without expensive and time-consuming transmission expansions. Resolving those concerns could more than double the region’s interconnection capacity, from about 2.6 gigawatts to about 5.3 gigawatts, all without any grid upgrades.

That additional wind and solar could displace an equivalent amount of coal- and natural-gas-generated power, which eliminates the associated carbon emissions and also saves about $20 per megawatt-hour in fuel costs. That’s a conservative cost estimate, said Bruce Tsuchida, one of the Brattle Group analysts who conducted the analysis.

Kansas and Oklahoma generate about one-thirtieth of the nation’s wholesale energy, so multiplying the benefits of the study zone by 30 yields a rough nationwide estimate of $5.3 billion in annual power generation savings and 90 million tons of carbon dioxide emissions reduction. That's equivalent to 20 million gasoline-burning cars being taken off the road, he said. Expanding renewable energy development also yields local jobs, land leasing and tax benefits.

“We knew there were going to be benefits,” Tsuchida said. “We just didn’t know the magnitude.”

The report is sponsored by the Watt Coalition, a trade group representing makers of the technologies in question. These include dynamic line rating providers Ampacimon, Lindsey Manufacturing and LineVision, topology optimization provider NewGrid, advanced power flow controls maker Smart Wires, and WindSim, a provider of wind power siting and analysis software. Major U.S. renewable energy developers EDF Renewables North America, NextEra Energy Resources and Duke Energy Renewables also supported the study.

These companies have an obvious self-interest in promoting the value of the technologies they provide, as well as in pressing for incentives that could increase clean energy capacity on the grid. But the benefits shown in the report are backed by a decade of simulations and real-world tests by utilities and grid operators in Europe and Australia, and to a lesser degree in the United States, Tsuchida said.

Incentive structures to move GETs from potential to reality

Grid-enhancing technologies (GETs) have yet to be widely deployed in the U.S., however, according to Tsuchida. That’s primarily because the structure of the country’s transmission grid doesn’t incentivize their use. Simply put, utilities that own and build transmission earn a rate of return for the capital costs involved, not for how efficiently those systems are run once they’re built, he said.

Grid operators like the Southwest Power Pool, while free of this incentive toward capital investments over efficient operations, are inherently conservative when it comes to pushing the boundaries of how they run their systems, he added. That makes sense for organizations tasked with maintaining reliable service, but it can slow adoption of new technologies and methods.

At the same time, U.S. utilities and grid operators have been testing and verifying the value of dynamic line rating technologies, which can provide a better view of real-world grid-carrying capacity than the static line ratings commonly in use. The complex software and hardware needed to optimize the switching and routing of power across transmission networks have also been tested in simulations, and have started to play a role in how grid operators plan for future grid expansions and operations.

Pressure to find ways to unblock these structural barriers standing in the way of GETs is growing. Last year, 13 U.S. senators including Bernie Sanders, Dianne Feinstein, Martin Heinrich and Sheldon Whitehouse wrote a letter to the Federal Energy Regulatory Commission arguing that “conventional incentives based on return-on-equity combined with high benefit-cost thresholds are not likely to accomplish the Commission’s statutory obligation to encourage deployment of smart grid technologies.”

That “statutory obligation” is part of the 2005 Energy Policy Act, which directs FERC to use incentives to improve the operations of interstate transmission networks. In a Wednesday event introducing the report, Sen. Heinrich, a New Mexico Democrat who’s introduced legislation on transmission reform in previous sessions of Congress, highlighted the “disconnect right now between transmission access and the best large-scale clean energy resources,” and encouraged FERC and the U.S. Department of Energy to take up policies to put GETs to use to reduce that disconnect.

“The incentives are the problem,” Rob Gramlich, president of Grid Strategies and executive director of Watt Coalition, said in an interview. “There are a couple of ways FERC can help with that.”

One path would be for FERC to require grid operators to incorporate GETs in the transmission planning process, which can reduce costs and increase capacity compared to traditional methods, he said. Another would be to create incentive structures that share the savings that GETs can deliver between customers at large and the transmission owners that implement them, as suggested in a proposal to FERC from the Watt Coalition and trade group Advanced Energy Economy last year.

Richard Glick, FERC’s new chairman, has said he supports actions to expand U.S. transmission capacity. Multiple studies indicate the country will need up to hundreds of billions of dollars' worth of new transmission to meet the ambitious carbon-reduction goals set by a number of states and being championed by the Biden administration.

Renewable energy developers facing project-killing transmission upgrade costs to interconnect to the grid ought to be able to propose GETs solutions to lower those costs, Gramlich added. Some transmission owners are starting to explore these possibilities. Northeast utility National Grid is working with LineVision, Lindsey, Ampacimon and Smart Wires on a pilot project seeking to test GETs' ability to unlock interconnection capacity for renewables being built in its territories, including the gigawatts of new solar being built under the Solar Massachusetts Renewable Target program.

“There’s also a lot of talk about an infrastructure bill later this spring,” Gramlich said, highlighting the expectation that the Biden administration and Democrats in Congress will seek to follow up the COVID-19 relief bill now being debated in Congress with a broader economic stimulus package centered on infrastructure investments. “You could imagine [that GETs might receive]...direct funding in that infrastructure bill.”