If you think the world’s electricity networks lack digitally connected visibility and control, wait until you get a load of the world’s water networks. The systems of pipes and pumps, rivers and reservoirs that keep us all from going thirsty lose about half the water they start with to leakage and waste, and what water is delivered is hardly ever metered, let alone closely managed for efficiency.

That adds up to a huge opportunity for “smart water” technologies, including smart meters for water. Of course, hooking up the water “grid” with digital, two-way communicating technologies is a lot different than doing the same for smart electric meters -- such as the fact that lots of water meters, unlike electric meters, aren’t hooked up to electricity to keep them up and running.

On Monday, Bloomberg New Energy Finance predicted that U.S. water utilities will spend $2 billion on smart meters between now and 2020, nearly matching the industry’s current investment of $2.4 billion into the technology. But the industry will have to wait awhile on that investment -- BNEF also predicts a decline in sales through 2015, until rising water prices and first-generation smart water meter replacement cycles start to kick in.

Indeed, the previous wave of smart water meter investment peaked at $395 million in 2010, BNEF reports. That peak was driven, along with peaks in the electric and gas metering sectors, by stimulus funding in the U.S. -- in the case of water, both from the Department of Energy’s smart grid stimulus grant program and as part of about $1.7 billion in Environmental Protection Agency funds for water infrastructure that included upgrading and rolling out new smart meters.

GTM Research predicts that the water sector will be a bright spot for advanced metering infrastructure (AMI) vendors, amidst slowing sales for electric and gas meters. Still, the U.S. smart water meter marketplace is only one-quarter the size of the country’s electric plus gas smart meter markets, with 5.5 million smart water meters networked in 2012.

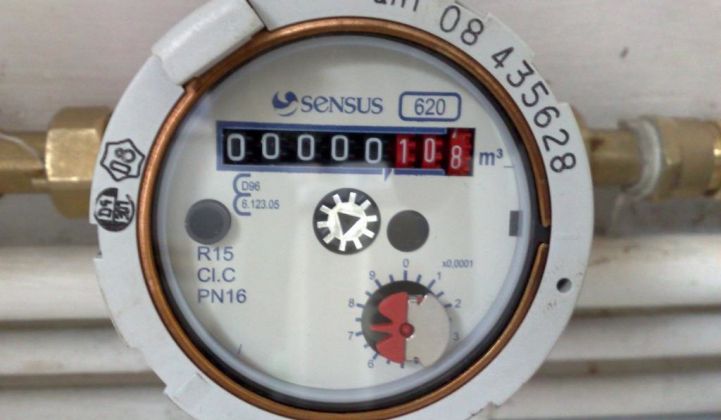

Top U.S. water meter networking vendors include Neptune, Itron, Badger Meter, Sensus, Master Meter, Aclara and Elster, according to the GTM Scott AMI Market Tracker. Not all of these companies make the water meters themselves -- Itron, for instance, builds smart communications modules that it attaches to water meters from other vendors.

Beyond the meters, of course, there’s a wider world of IT going into the water utility sector, from cutting-edge, region-wide smart water projects like IBM’s investments in projects in Malta, Australia, Japan and the United States, to small-scale water meter deployments for municipal and regional water utilities across Europe, North America and Australia.

Water tends to be quite cheap, and it’s also a necessity, making the economic justification for consumers to pay more attention to it hard to make. Still, U.S. residential consumers saw water bills rise an average of 9.4 percent in 30 major metropolitan areas last year, according to environmental organization Circle of Blue.

Utilities are also worried about their own water consumption, ranking it along environmental and regulatory uncertainty as a top concern, according to annual surveys from utility engineering and consulting firm Black & Veatch.

In the meantime, there are plenty of ways to deploy technology in the water sector besides smart meters. Leak detection is one growing field, with giants like IBM and startups like Israel’s TaKaDu applying hardware, software and analytics to the task.

Other key water technologies include filtration and reverse osmosis technologies for water purification and desalination. Greentech Media has tracked hundreds of millions of VC dollars invested in water technologies over the past several years.