Last year, Bloomberg New Energy Finance defined renewable energy as the “new normal" in its Sustainable Energy in America Factbook. This year's edition affirms that finding.

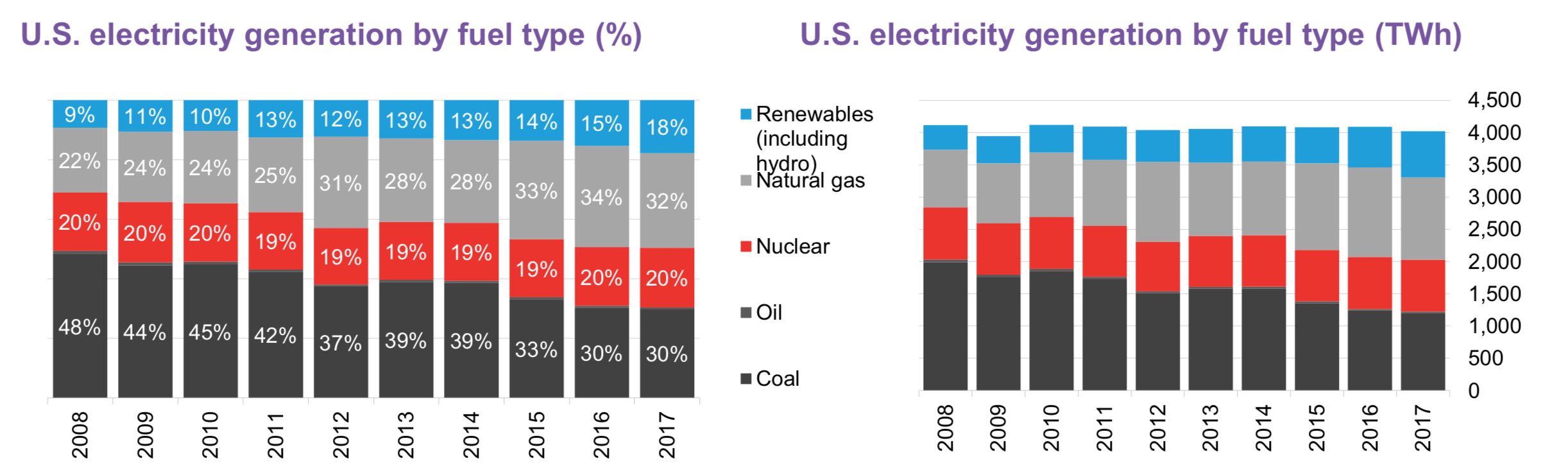

While U.S. clean energy installations lagged, a record amount of capacity brought online in 2016 drove generation from renewables (including hydropower) in 2017 -- a year of uncertainty -- to its highest level ever, at 18 percent of the overall energy mix.

Natural gas and coal still remain the top producers of U.S. electricity, but both sources experienced a slight dip in 2017. Natural-gas generation dropped 2 percent, while coal fell 3 percent.

Rachel Luo, senior analyst for U.S. utilities and market reform at BNEF, said 18 percent may not sound like much, but it brings clean energy “within striking distance” of nuclear’s 20 percent generation contribution. The jump in renewable generation stems from the 2016 construction boom as well as an easing of drought in the West, which increased hydropower generation.

“In 2017 it’s a very significant story that renewables are making a lot of headway in pushing forward the decarbonization of the power sector, even as the natural gas share decreases,” Luo said.

But, she added, “natural gas still remains the largest single contributor to the electricity mix. [Its] downtick could be from a variety of factors [such as] the increasing penetration of renewables, but load growth is also stalling and…natural gas prices have recovered a little.”

Source: Bloomberg New Energy Finance

In recent years, the switch from coal to gas emerged as a main theme in BNEF’s Factbooks, which are produced in conjunction with the Business Council for Sustainable Energy. Now, clean energy claims more of the generation spotlight. But coal still accounts for 30 percent of the country’s generation.

While electricity generation from coal did fall year-over-year, Luo said its portion of the generation mix remained flat in 2017 because of changing demand and load. Coal retirements also slowed down from eight in 2016 to six in 2017.

BNEF said next year, though, the 12.5 gigawatts of coal plants already slated for retirement nearly rivals the all-time high of 15 gigawatts in 2015. Adding to those struggles, the ill-fated Department of Energy proposal to offer coal plants compensation for resilience made it among BNEF’s top five policy developments of the year. Luo said the resource is still facing economic headwinds from the same fuel sources that have troubled the coal industry in the last few years.

“For coal there’s more of a long-term story of displacement by cheaper natural gas and renewable energy,” said Luo.

That displacement became increasingly problematic for the industry after 2015, when electricity generation from natural gas rivaled that produced from coal for the first time. In 2016 and 2017 natural gas generated more electricity than coal. In 2017, for the first time, the U.S. exported more natural gas each month than it imported -- a potentially exciting data point for the Trump administration's "energy dominance" agenda.

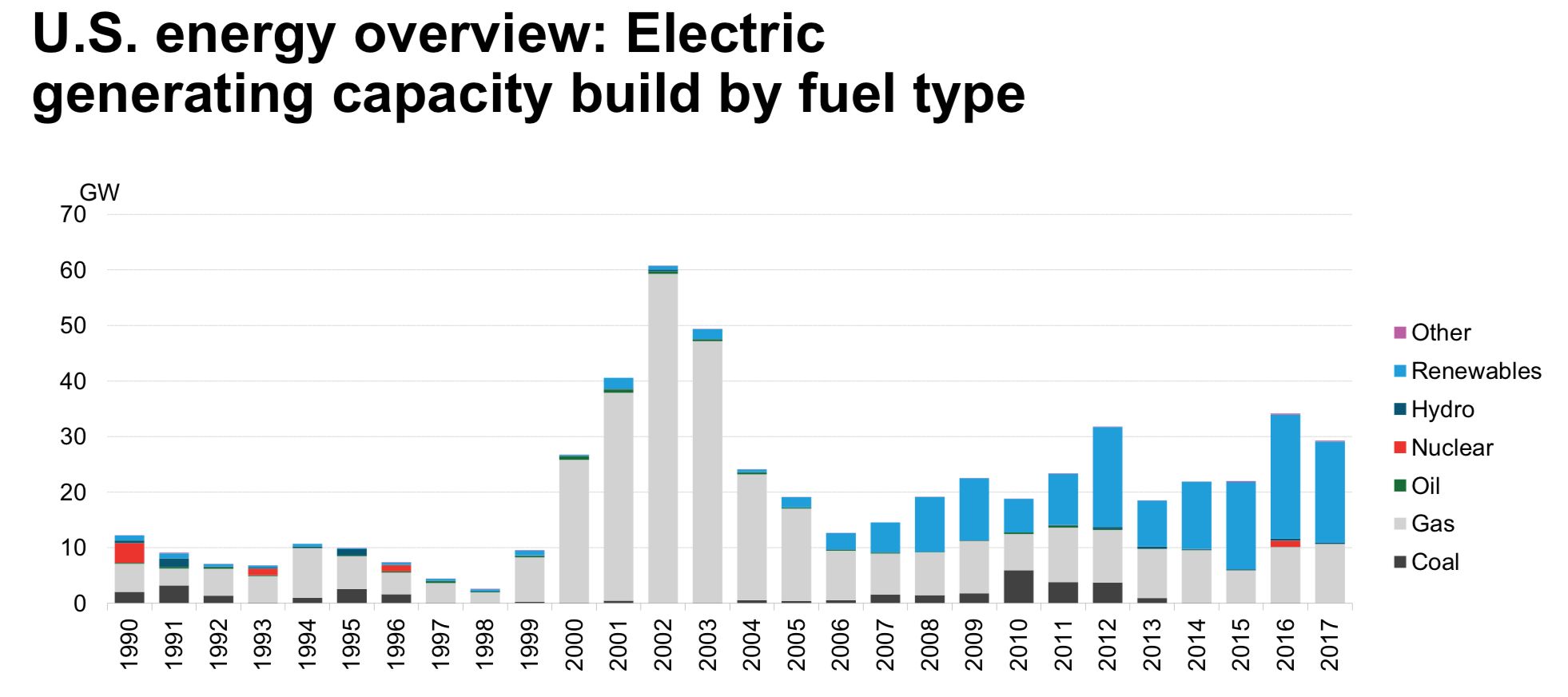

Source: Bloomberg New Energy Finance

Still, according to BNEF, “renewable additions have dominated [the] U.S. power sector build in recent years.” Last year was the same, with renewables accounting for 62 percent, the largest portion, of new generating capacity. GTM Research data showed wind and solar adding a collective 65 percent of generating capacity in 2016 and 69 percent in 2015, after a more modest 52 percent in 2014.

Natural gas buildouts, after a boom in the early aughts, have remained relatively steady per BNEF data. But in 2017 the industry saw the highest capacity of gas builds -- 10.7 gigawatts -- since 2005. In the last 25 years, natural gas and clean energy, including hydropower, accounted for a full 93 percent of all new generation -- with coal and nuclear lagging behind.

Clean energy technology prices also continued to fall in 2017. According to BNEF’s data, U.S. solar power-purchase agreements bottomed out at just over $20 per megawatt-hour and wind in the blustery U.S. “wind belt” averaged $17 per megawatt-hour. BNEF notes that some regions this year broke through "the symbolic 'dollar-per-watt' threshold."

GTM Research noted that utility-scale fixed-tilt systems reached sub-$1 per watt prices in January of last year and the Department of Energy recognized the milestone in September of 2017. Data GTM Research released in November showed average fixed-tilt system price had inched back up over $1 per watt due to uncertainty surrounding the solar trade case. But prices are expected to decline again in the coming months.

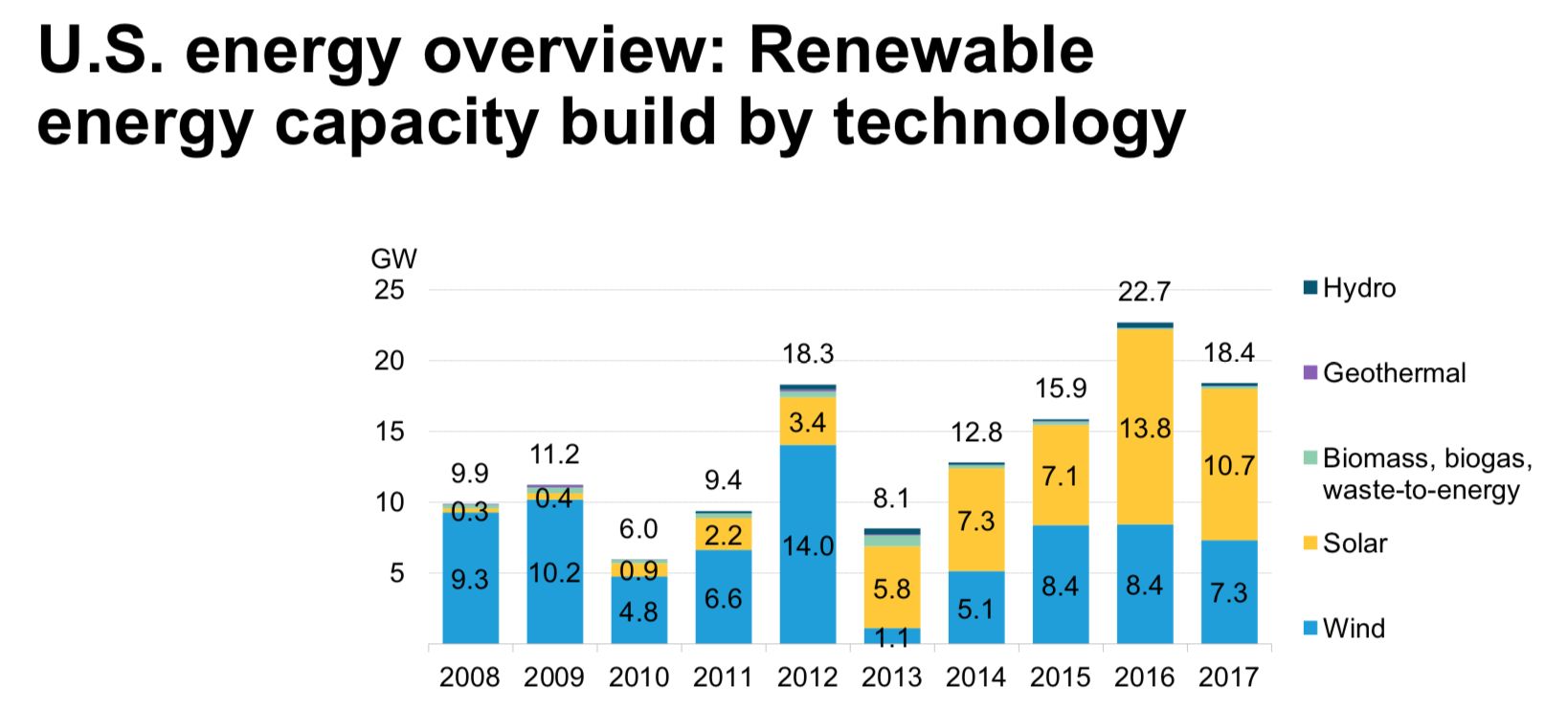

Despite the fluctuations, the long-range trend of declining costs helped along the surge in build-outs of both wind and solar, even as installations dropped 19 percent from a record year in 2016.

Bloomberg New Energy Finance

While wind projects dominated renewable energy capacity builds between 2008 and 2012, solar has since emerged as the leader. In 2017 the solar industry installed 10.7 gigawatts to the wind industry’s 7.3 gigawatts.

BNEF attributes some of the slowdown in wind projects between 2016 and 2017 to developers playing the waiting game. They need to finish projects before 2020 to qualify for the Production Tax Credit, but expected future drops in equipment prices also mean it’s advantageous to wait in order to capitalize on that cost differential.

A similar situation befell utility-scale solar developers last year. A race to slide under the wire of the now-extended tax credit deadline has developers building back their pipelines. Meanwhile, small commercial, residential and utility-scale developers must cope with the added curveball of Section 201 tariffs that took effect this month.

It was a year of “policy turbulence,” according to BNEF, with tricky tax reform measures threatening tax equity for projects and tariffs throwing many developers for a loop. Luo said the Factbook doesn’t offer forward-looking statements, but that BNEF, from a broader perspective, expects clean energy builds to recover from the 2017 downturn.

GTM Research projects the solar industry will suffer less than some anticipated from the Trump administration tariff decision, and tax equity players insist they remain interested in clean energy investments. But the industry won’t fully understand the impacts of those policies until deeper into 2018.

A lack of strong federal leadership, though Luo said it prompted nervousness, also pushed other players to take leadership in clean energy.

“In an uncertain policy environment, we’ve seen other entities step up and take more initiative,” said Luo. “Federal level action aside, we have seen subnational actors step up on climate issues…and we have also seen a lot of corporate action on renewable energy procurement and energy efficiency.”