A panel of finance experts at the Solar Power Generation 2013 conference talked about what other high liquidity vehicles might drive solar growth when the investment tax credit recedes after 2016.

The hottest possibilities, they said, are master limited partnerships (MLPs) and real estate investment trusts (REITs). Both are used by other industries, have long track records of proven effectiveness and hold the potential to bring a population of previously ineligible small investors and hundreds of billions of dollars or more, at a low capital cost, into the solar space.

Unfortunately, renewables are not now eligible for either. It would take an act of Congress to get MLPs and a special ruling by the Treasury Depart to get REITs. Given the current state of play on Capitol Hill, the notion of near-term congressional action on MLPs is somewhere between unlikely and preposterous. A Treasury Department ruling is possible but there is a question of REIT eligibility for the bulk of solar assets.

Rocky Mountain Institute Senior Consultant Dan Seif has another idea.

“There is one high liquidity market for solar rarely discussed,” Seif said. “Mortgages. Most of the time, you cannot include the value of your PV system in your assessment or appraisal. That can change.

“If you as a homeowner, when you buy your home, are able to get 80 percent of your PV system purchased inside your mortgage -- and I doubt the rate would change -- that’s substantially lower and much more liquid and such a lower cost of capital than REITs or MLPs. There is a massive liquidity story in getting PV systems valued in the home or commercial building value, though the matter of personal property might complicate matters."

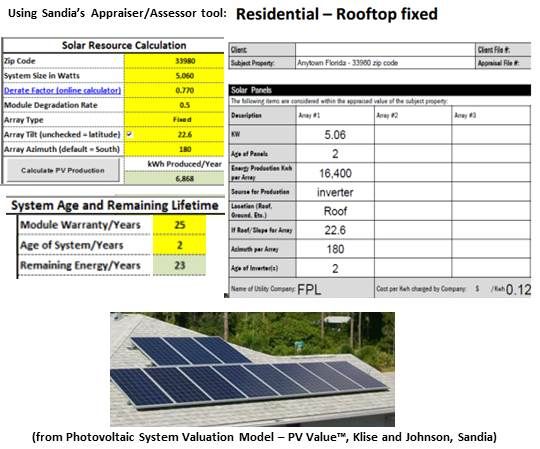

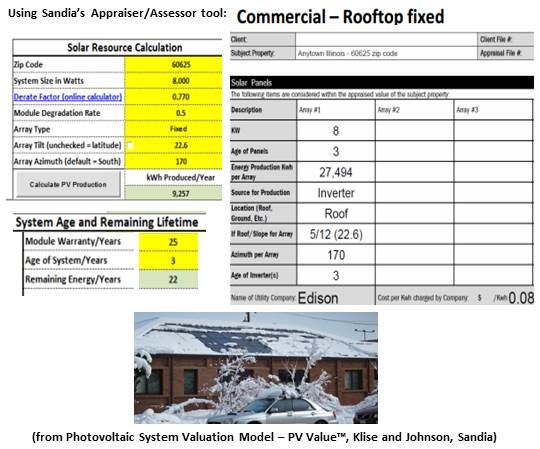

“Sandia National Laboratory has developed a PV valuation tool for appraisers and assessors," Seif went on, "and they are working on getting it into use. It is a comp system, like other real estate appraisals and assessments. Once it becomes more well-understood, it will be adopted. Swimming pools are appraised and assessed. It’s commonly done.

“It might take accelerated depreciation out of the value story, but a 3.5 percent mortgage at 80 percent is a not much higher capital cost than other investments.”

Maritime Capital Partner Terry Grant noted that major new home builders like Lennar (NYSE:LEN) lean toward including a solar system because it adds value to the house.

“It’s not a question of whether the value of the house is increased by adding the panels, because the answer is yes,” said Bank of America Merrill Lynch (NYSE:BAC) Global Energy Managing Director Partho Sanyal. “The question is, what is that worth? The way solar assets are valued is based on cash flow. SolarCity's (NASDAQ:SCTY) valuation is a promise of a payment that a customer is going to make to you now and in the future [through a PPA]. SolarCity is collecting some of that cash upfront.

“If a house were to default on its mortgage payment, what do you do with the PV panel assets? Can you take them off and install them somewhere else? Yes. There are complications, though it is not difficult. There is not a secondary market but it is easy."

“But what you really need, if the house were to default, is be able to take the panels to somebody else’s house who is willing to take on the PPA obligation. If the answer is yes, it would be easy to add value to the house because then it is not collateral value. People don’t pay for collateral value. But people will pay for the likelihood of cash from electricity being generated by the assets.”