The Australian flow battery-maker Redflow has announced a share offering aimed at raising AUD $18.1 million (USD $13.7 million) to fund expansion. The move comes after Redflow relocated its manufacturing from Mexico to Thailand last year.

The Australian Securities Exchange-listed company said the money would come through an offering of AUD $7.5 million (USD $5.7 million) to new investors and a fully underwritten, non-renounceable entitlement offer of AUD $10.6 million (USD $8 million) to existing backers.

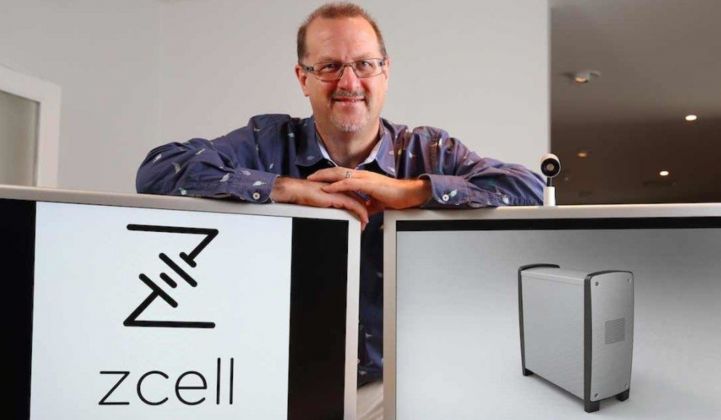

These include the company’s former executive chairman and CEO, millionaire entrepreneur Simon Hackett, who is Redflow’s main investor with a 17.3 percent share of the business.

Hackett is planning to put an extra AUD $1.9 million (USD $1.4 million) into Redflow, according to a shareholder letter from chairman Brett Johnson.

New CEO Tim Harris is also set to invest AUD $500,000 (USD $379,000) in the shares, which are being offered at AUD $0.10 (USD $0.08) each.

In a press note, Johnson said: “The current plan is to increase our manufacturing capacity in Thailand so we can manufacture as many as 90 complete batteries a month by June 2018 and, subject to demand, scale up production to as many as 250 batteries by December 2018.”

After the fundraising round, Redflow would look for potential sales, marketing and manufacturing joint venture partners, and seek to cut the cost of making its zinc-bromine flow batteries, he said.

“The build costs of the Redflow zinc-bromine flow battery will progressively reduce as production volumes increase from Thailand, due to improvements in production technique and technology over time,” Hackett told GTM.

The company was “not in a position to provide further specifics,” he said, but he noted that costs for all forms of battery storage continue to improve over time as the volume deployed increases.

An entitlement offer booklet said Redflow would aim to invest AUD $5.8 million (USD $4.4 million) in product development, AUD $5.2 million (USD $3.9 million) in sales growth, AUD $4 million (USD $3 million) in raw materials and AUD $2 million (USD $1.5 million) in automation.

The share offering, which is due to close on May 15, comes amid growing investor interest in energy storage.

Figures from U.S.-based Mercom Capital Group show venture capital backing for battery firms grew in the first quarter of 2018, totaling $299 million across twelve deals.

That was compared to $154 million in corporate funding across six deals in the last quarter of 2017, and $80 million through 10 deals in the first quarter of 2017.

Harris, who was appointed CEO in March, built up the Redflow share opportunity with talk of approaches from “several Chinese energy players” in the Australian press.

One of Redflow’s target markets is telecommunications towers, of which there are an estimated 1.75 million in China. However, the Redflow offer booklet cautioned of a wide range of risk factors for investors in the loss-making business.

The company admitted it had experienced various technical defects in 2017 but said “those specific issues have been addressed.”

Even so, investors may be wary of the fact that this is Redflow’s second cash call in nine months. Last July the company went to the markets for a AUD $14.5 million (USD $11.6 million) cash injection, also to help cut costs and scale up manufacturing.

At the same time, the company announced it was withdrawing from the U.S. and Europe. The company’s latest accounts show it made an operating loss of AUD $7.8 million (USD $5.9 million) on sales of AUD $942,000 (USD $713,000) in the nine months to April 2018.

The accounts also show estimated operating costs of AUD $4 million (USD $3 million) for the next quarter. And Brett Simon, senior energy storage analyst with GTM Research, said the company faced “an uphill battle” in commercializing its technology.

“Redflow, like other flow battery companies, sits in a tough position,” he said. “Lithium-ion storage continues to get cheaper and with each successful new project gains greater acceptance from financiers and utilities.”

Focusing on specialist markets such as telecommunications, as Redflow is doing, might help the company carve out a niche, he commented.

However, he said: “We've seen recent struggles of flow battery players such as ViZn, which will no doubt breed trepidation among potential investors.”