A record-breaking auction buoyed the U.S. offshore wind industry last Friday when a “bidding bonanza” for three lease areas offshore Massachusetts yielded $405 million in winning bids.

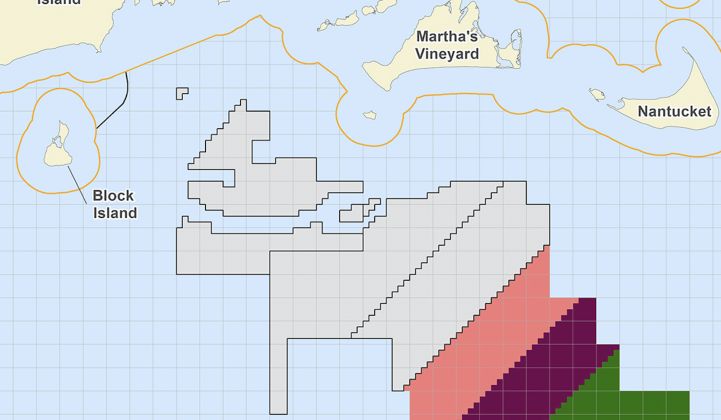

After 32 rounds of bidding spread across two days, provisional winners were announced for lease areas covering 390,000 acres (see map) in federal waters located south of both Martha’s Vineyard and Nantucket.

According to the Bureau of Ocean Energy Management (BOEM), which conducted the auction, the three lease areas can support 4.1 gigawatts of wind generation capacity.

The three winning bids each came in at $135 million. Provision winners are: Equinor Wind US, LLC, the U.S. arm of the Norwegian oil major; Mayflower Wind Energy, LLC, a 50-50 joint venture between Shell and EDP Renewables; and Vineyard Wind, LLC, a 50-50 joint venture between Copenhagen Infrastructure Partners and Avangrid Renewables.

“To anyone who doubted that our ambitious vision for energy dominance would not include renewables, today we put that rumor to rest,” said Interior Secretary Ryan Zinke in a statement. “With bold leadership, faster, streamlined environmental reviews, and a lot of hard work with our states and fishermen, we’ve given the wind industry the confidence to think and bid big.”

"I'm just going to say at this point, wow...we are truly blown away by this result," said BOEM Acting Director Walter Cruickshank, on a press call after the auction.

With the conclusion of the Massachusetts auction, BOEM now manages 15 active wind leases. Lease sales have generated a total of $473 million in winning bids for the right to develop offshore wind projects across nearly 2 million acres in federal waters. Before last Friday’s auction, the highest-grossing lease sale had been a December 2016 auction for a tract offshore New York that resulted in a $42.5 mllion winning bid.

Auction demonstrates confidence in a fast-maturing market

For industry watchers, the record-breaking auction demonstrates that the fast-maturing U.S. market is poised for explosive growth.

“These lease prices and the fact that we had 19 companies eligible to bid on these leases is great news for the overall U.S. offshore wind marketplace,” said Liz Burdock, president and CEO of the Business Network for Offshore Wind, in a statement.

She noted that just three years ago, the same three lease areas did not receive bids in the first Massachusetts offshore wind auction.

“The winners [on Friday] included both current U.S. offshore wind market winners and forward-looking energy companies new to the U.S. offshore wind space. Their significant investments in ocean space off the New England coast is an important indication of the confidence in the 10 GW pipeline of offshore wind farms committed to today,” wrote Stephanie McClellan, director of the Special Initiative on Offshore Wind at the University of Delaware, in an email.

“More importantly,” she went on, “the results signal confidence in the market for offshore wind beyond current Eastern state requirements. The investments we saw in the auction would likely not be made unless there was trust in continued cost reductions in offshore wind and the ability to deliver projects in the U.S. at a price point low enough to compete with any other form of generation.”

Anthony Logan, a research analyst covering North America wind power for Wood Mackenzie Power & Renewables, agreed that the aggressive bidding signaled developers’ confidence in future cost reductions.

“These are just the prices to get the lease areas, and there are rent payments which jump significantly when these projects come online. At these rates they start making a meaningful impact on overall project economics,” he wrote in an email.

But, he added, “another way to look at this is it’s a vote of confidence in continued LCOE [levelized cost of energy] reductions for offshore wind, and moreover, continued LCOE reductions in the United States.”

Logan noted that despite the record-breaking bids, the three lease areas in the auction are not ideal sites. They are in deep water around 75 miles from mainland Massachusetts.

Considering those factors, he said, “it’s a clear sign of what robust and stable state policies can do. These firms are betting there will be enough demand over long enough time that either they’ll eventually make the economics work with export cable cost reductions, foundation technologies mitigating the depth penalties, or that Massachusetts and neighboring states like Connecticut will keep growing their policies and will eventually need to buy from these sites.”

Massachusetts emerges as an offshore wind leader

The odds for a successful auction increased with recent efforts by Massachusetts officials to bolster the state’s early-mover status among the growing number of East Coast states jockeying for pre-eminence in the U.S. offshore wind market.

In August, Governor Charlie Baker signed a comprehensive clean energy bill that included a provision doubling Massachusetts’ offshore wind target to 3,200 megawatts by 2035.

Earlier in December, the U.S. Department of Transportation awarded the city of New Bedford, Massachusetts, a $15.4 million grant to expand its port to accommodate offshore wind project staging.

After the Massachusetts lease auction, Business Network for Offshore Wind’s Liz Burdock urged BOEM to invest some of the proceeds in offshore wind infrastructure.

“BOEM should partner with the states where offshore wind development is underway and put some of the auction proceeds towards developing grants and programs that invest in port infrastructure upgrades and support U.S. companies seeking capital investments to become part of the supply chain,” she said.

After federal regulators complete a review of the Massachusetts auction, the provisional winners will be required to pay their winning bids. Lessees will then have one year to submit a site assessment plan and an additional four and a half years to submit a construction and operations plan to BOEM.

If both are approved, lessees will have 33 years to construct and operate their projects.