UPDATE: Real Goods Solar announced yet another acquisition today, August 12. This time, the company hopes to strengthen its residential business with the purchase of Syndicated Solar. The Colorado-based installer, which also has offices in Missouri and San Jose, CA, had revenues of $7.3 million in 2012 and expects to double this year-over-year. Evidently, there was a buy one, get one half off sale on solar installers, because RGS bought the company for just $2.5 million plus 400,000 shares (approximately $3.9 million).

***

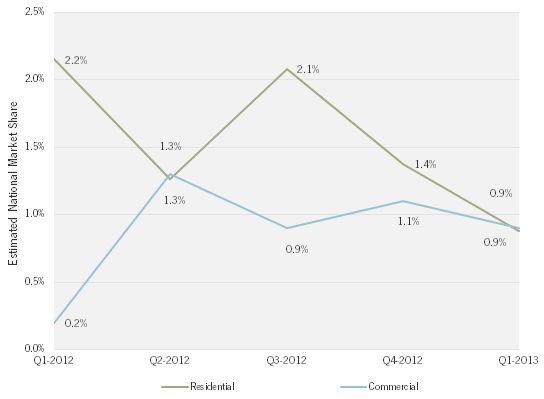

National solar developer Real Goods Solar (RSOL) announced on Friday that it will acquire New York-based Mercury Solar Systems for 7.9 million Class A shares (equivalent to $18.1 million at Friday’s closing stock price of $2.29). One of the oldest players in the U.S. solar market, Real Goods Solar has been in business since 1978 and develops residential, commercial, and utility projects. Although its residential market share has been in decline since the middle of 2012 (see below), the company has been actively expanding this market segment in the Northeast through financing partnerships with Sunrun and Clean Power Finance.

Real Goods Solar Estimated National Market Shares

Source: GTM Research U.S. PV Leaderboard

The acquisition of Mercury Solar, which develops both residential and commercial projects, “significantly expands our presence as a major solar solutions provider in key solar markets across the East Coast,” according to RGS CEO Kam Mofid. This is not Real Goods Solar’s first acquisition in the Northeast, however. In 2011, it merged with developer Alteris Renewables and took on Alteris’ head of commercial, Ron French, as president of commercial. French has since moved on from the company.

RGS Energy, the company’s commercial and utility division, has historically focused on educational institutions, though it has more recently developed projects for retail locations, including 32 Stop & Shop grocery stores, in the Northeast. The move to buy Mercury Solar indicates a further shift into both new non-residential verticals and additional key states in the region. Alteris was active primarily in Massachusetts, whereas Mercury has extensive experience developing non-residential projects in New York and New Jersey. Mercury co-founders Jared Haines and Anthony Coschigano will lead commercial sales and operations in the Northeast, respectively, at RGS Energy.

Real Goods Solar struggled financially in 2012, noting in its Q4 earnings report that this was largely due to challenges with the Alteris integration. However, in Q1 of this year the company increased solar system deployments, reduced operating expenses, and expanded a partnership with a national homebuilder. We could see a rebound in RGS’ DG market shares if the company effectively leverages its new residential partnerships and uses the acquisition of Mercury to revitalize its Northeast commercial business. RGS will release its second-quarter financial results on Tuesday.