The following is an excerpt from the November issue of PVNews, which is available as a free download:

Latin America will be a key emerging market for solar development over the next few years, and no country in the region has a larger planned pipeline than Chile. The country’s northern Atacama Desert is an ideal location for utility-scale solar for a number of reasons. Most notably, it has one of the highest levels of solar irradiation in the world and is home to a large proportion of Chile’s growing mining industry. With limited electricity generating resources and a highly volatile spot market, solar is becoming an increasingly competitive solution despite the lack of subsidies.

In light of the growing demand for new generation, Chile’s National Energy Strategy estimates that 8,000 megawatts of additional capacity needs to come on-line by 2020. Furthermore, with a 10 percent renewable energy requirement by 2024, local companies as well as large international developers are eager to cash in on what seems to be a likely solar boom. Up to this point, however, very little solar been connected to the grid. A number of smaller facilities were brought on-line this year, including a 1-megawatt project developed by Solarpack to power a mine owned by Codelco and a 1.4-megawatt plant developed by saferay.

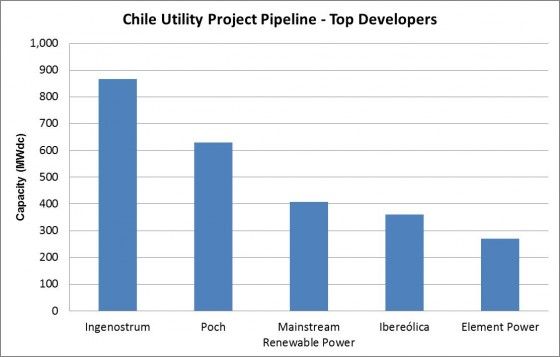

Source: GTM Research

Unlike neighboring markets such as Brazil, which is dominated by local players, or Argentina, which has an unstable government, Chile has attracted significant attention from foreign developers, EPC providers, and investors. Of the more than 4 gigawatts of Chilean projects currently tracked by GTM Research, less than one-third of this capacity has been proposed by domestic companies. One explanation for this trend is the simple fact that as an emerging market, Chile lacks established solar firms. Of the top developers listed in Figure 1, only Poch Corporation is Chilean. The company’s extensive experience, both as a hydroelectric developer and heavy construction firm, should allow it to transition into solar with relative ease. Other Chilean firms that have applied for environmental permitting include startups such as Solar Chile and Atacama Solar. Independent power producers, such as AES Gener, have also thrown their hat in the solar ring in order to comply with renewable energy generation requirements.

To continue reading about the Chilean solar market, please download the free November issue of PVNews.

***

Now in its 30th year of publication, PVNews continues its tradition as the solar industry's premier periodical. Focusing exclusively on the global PV industry and drawing on the expertise of the GTM Research solar analyst team, at only $395/year, PVNews is undoubtedly the industry's best value for in-depth market research. The newsletter includes the following key components in each issue:

· A hand-picked news digest from the solar and related industries, following key developments that are shaping the future of PV

· Market research data, insights, and analysis, drawn from the GTM Research annual solar research program

· Exclusive market trackers: Monthly SREC Prices, Monthly North American and European Feed-In Tariffs, Monthly U.S. Utility Pipeline, Annual Cell and Module Capacity and Production, Module Supply Agreements, Quarterly Company Financial Updates, and Monthly Large-Scale Project Announcements

· Market commentary from analysts and industry leaders

Subscribers around the world agree that PVNews is the best value in market monitoring, and that it's essential reading for decision-makers in the evolving global renewable energy market. Subscribe today at http://www.greentechmedia.com/research/report/pv-news.