Report author Shyam Mehta talks about solar module winners, losers, who gets acquired, and what the market looks like in 2014 in this podcast.

This is the first in a series of articles from GTM Research's just-published report assessing the global module supplier landscape, Global PV Module Manufacturing 2013: Competitive Positioning, Consolidation and the China Factor. For more information on the report, click here.

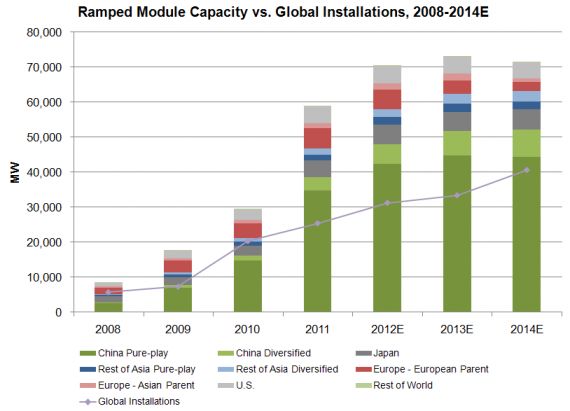

After several years of sustained profits and strong (if not always stable) growth, the PV manufacturing sector has found itself in the midst of a protracted downturn. A combination of overly aggressive capacity build-up in 2010 and 2011, along with severely curtailed subsidies in major feed-in tariff markets resulted in a massive supply-demand imbalance that manifested itself in early 2011, and is not expected to abate until at least 2014.

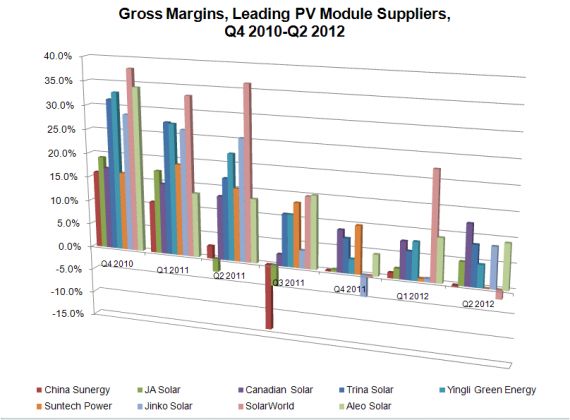

Consequently, inventories have remained high and gross profit margins for PV module suppliers have nose-dived, from peaks of more than 30 percent in late 2010, when supply outpaced demand, to low single digits as of mid-2012 for even the lowest-cost producers. The growing commoditization of modules -- that is, the perception in the minds of buyers that quality and reliability do not differ significantly from one producer to another -- has not helped matters, either.

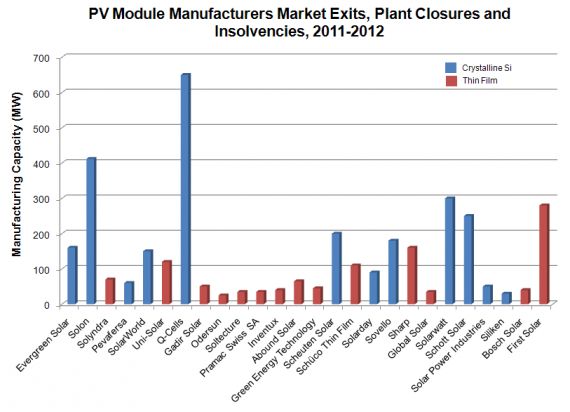

Rampant overcapacity and commoditization have led to a spate of plant closures, market exits and insolvencies in the past year and a half, shown in chronological order below. However, the victims so far have mostly been smaller producers in high-cost regions, and this has done very little to alleviate the industry’s troubles.

With overcapacity likely to persist through much of 2013 and the balance sheets of most producers under severe stress, there is very little doubt in our minds that much more consolidation is on the way, and that the global PV module landscape is headed for a significant transformation. Below, we list eight trends we expect to play out over the course of the next two years.

1. Most Firms in High-Cost Locations to Exit Market by YE 2013

Most instances of consolidation activity (market exit or plant closure) thus far have been firms with facilities in high-cost locations (primarily Western Europe and the U.S.). We expect this to continue at a rapid pace given the persistence of global oversupply in 2013. By 2015, we expect module facilities in high-cost locations to make up just 9 percent of global capacity, compared to 32 percent in 2009. The few plants we expect to still be operating in these regions will mostly be regional module assembly hubs owned by companies whose major production bases are offshore, for example, Kyocera, Panasonic, Suntech Power, and AUO. The risk factor to our view here, of course, is the imposition of anti-dumping tariffs against Chinese module manufacturers in Europe.

2. Thin Film Space to Contract to Less Than 10 Active Manufacturers by 2015

Thin film plant closures in 2011-2012 have had a disproportionately high rate of occurrence (more than 50 percent of the total) compared to their share of overall production (just 16 percent in 2011). This is strongly linked to the inferior competitive positioning of most thin film firms compared to their crystalline silicon peers, specifically with regard to plant scale, manufacturing costs, efficiency, time-in-market, and bankability. With c-Si costs expected to continue to fall to levels below $0.50 per watt by 2014 (with a few exceptions), the window of competitiveness for most existing thin film firms has closed -- irreversibly. Consequently, we believe that 2013 and 2014 will continue to see a significant number of plant closures and market exits from thin film firms. By 2014, we expect thin film to make up less than 5 percent of global module capacity, compared to 19 percent in 2009, and three suppliers -- Hanergy, Solar Frontier, and First Solar -- will make up 92 percent of the installed thin film base.

3. Aggressive Downstream Build-Out in China Will Prop Up Select Domestic Suppliers

China’s aggressive downstream deployment of late is a move to support its struggling manufacturers in the oversupplied global environment. Given that oversupply is likely to persist in 2013, we expect this to continue. Along the lines of Alex Solar, LDK, and Astronergy, select domestic firms will be awarded module supply and/or EPC contracts for several large, multi-hundred-megawatt projects by local and provincial governments, as well as state-owned developers. We believe that the large pure-play firms and diversified firms are likely to be preferred for such contracts on account of their workforce and government connections.

4. Select Struggling Pure-Play Chinese Firms Will Receive Additional Debt From Domestic Lenders

We believe that at least a few China-based firms that currently face severe near-term liquidity challenges are likely to receive additional financial support from domestic lenders. This will allow them to service their near-term debt obligations, stay solvent, and maintain employment. An early indicator for this sort of outcome was in July 2012, when it was announced that the city of Xinyu had essentially created a bailout program for the troubled LDK Solar. We do not believe that LDK will be an isolated example; on the contrary, we think that many other large, struggling Chinese module suppliers are also likely to receive similar forms of assistance from their local and provincial governments. Preference is likely to be accorded to larger, more established firms with large workforces (in the 10,000 range and above), significant and unserviceable near-term debt, and strong ties to local, provincial and central governments*.

Given the significant near-term debt owed by these companies, the “bailout” packages extended to these firms may end up being in multiple phases. For example, LDK has current (due in twelve months) liabilities of almost $4.5 billion, so the $79 million package provided by Xinyu is a drop in the bucket of required assistance. In terms of how exactly the assistance is provided, it could take on many possible forms, such as:

- Extension of the terms of existing obligations

- Rolling short-term loans (such as that provided by Xinyu to LDK)

- Additional long-term loans

- Debt/equity swaps via purchase of convertible bonds

- Forgiveness of existing debt

5. Large Chinese Firms Will Continue to Acquire European Module Companies

We noted previously how lower-tier Asian firms have acquired established but embattled European module suppliers such as Sunways, Scheuten, Q-Cells and Solon in recent months. By doing so, Asian firms such as Microsol, Hanwha and Aiko Solar hope to access the strong brand and channel penetration of their acquisitions to gain an edge in European markets. We expect this trend to continue, given that Europe will still be a 12+ gigawatt market in 2013, as well as the looming possibility of anti-dumping tariffs being imposed on Chinese components. We believe the larger European developers and integrators -- juwi, Phoenix, and Solarstrom -- could also be targets.

6. Select Pure-Play Chinese Firms Could Be Acquired by Diversified or State-Owned Chinese Firms

On the whole, the pure-play Chinese firms (even Tier 2/3 firms) are better positioned than their diversified counterparts on most key metrics, including manufacturing costs, brand, and channel penetration. At the same time, most of them are in dire need of recapitalization, and not all such firms are likely to be the beneficiaries of continuing largesse from government-owned lenders. There are thus natural synergies to be gained from the acquisition of certain pure-play Chinese solar firms by larger diversified Chinese firms – either those that are already involved in module manufacturing or new entrants, such as the state-owned enterprises.

Once again, LDK Solar could serve as a bellwether for future cases. Our sources in China report that a number of state-owned enterprises (e.g., Sinoma, CECEP, CNBM, Guodian, Shenma) have met with LDK regarding possible acquisition deals. The Chinese press also reported that Jiangxi Copper Corporation, a Jiangxi-based SOE (in LDK’s home province), has sold RMB 300 million ($47 million) worth of shares to fund the purchase of LDK shares, which could make LDK one of the first (at least partially) nationalized PV manufacturing giants.

7. Will Smaller Chinese Firms Be Allowed to Exit?

We have heard plenty of anecdotal evidence in solar as well as other manufacturing sectors about the proliferation of “zombie companies” in China. These are firms that, despite having no commercial viability, have been kept on life support by China’s banking system at the behest of provincial and central governments to maintain employment. Rather than allowing firms that have not been able to repay their debt to go insolvent, banks are forced to continue lending money to failed businesses far past the point where they demonstrate any ability to repay the debts. Admittedly, this behavior does not make any sense from a capital-efficiency perspective, and it cannot continue forever. It would require a massive expansion in Chinese installations (to the tune of 15 gigawatts in 2013), considerably beyond what we expect to occur, to keep the entirety of existing Chinese capacity in business. On top of this, module, system, and solar PPA prices in China are substantially lower than in the rest of the world, and are barely sufficient to generate a positive gross margin even for the larger firms. Still, we have yet to see any form of capacity rationalization out of China so far, even amongst smaller players.

Despite the prevailing uncertainty, we take the view that some form of consolidation amongst the smaller Chinese module firms will take place in 2013-2014. One reason is that China’s support of even uncompetitive companies is badly damaging producers that would otherwise be well positioned for success, such as Trina and Yingli. Secondly, the cost gap between the smaller and larger companies is growing, not shrinking, making it increasingly difficult to continue supporting them. And finally, we believe that the general state of China’s economy will result in a more stringent top-down fiscal policy. Chinese provinces and cities are mired in debt crises of their own, and the Chinese economy is currently besieged by an unprecedented inventory overhang that is partly caused by such lending practices.

8. Even Larger Diversified Firms Will Be Forced to Exit the Market Without Aggressive Product or Business Model Differentiation

The current module landscape is populated with a number of large, diversified, and well-capitalized conglomerates; examples are LG, Samsung, AU Optronics, Sharp, Panasonic, Bosch, and Saint-Gobain. Most of these firms entered the module market in 2009-2010, when industry dynamics were vastly different compared to the present: supply-demand balance was relatively tight, brand and bankability had a larger influence, module margins were north of 20 percent, and the global PV market was dominated by feed-in tariff markets with well-established financing and distribution infrastructures.

Today, these firms find themselves at a crossroads: they can conclude that they have no lasting competitive edge in module manufacturing and sales and exit the market, thus cutting their losses (this was the path that Schott opted to follow), or alternatively, they can compete by differentiating substantially and aggressively in terms of their product or business model. What will not work (except in a market where tariffs have been imposed on Chinese cells and modules) is trying to beat the Chinese firms at their own game -- that is, the production of plain-vanilla modules for sale to distributors and integrators. We see most such firms giving up the solar ship in 2013-2014 in the face of persistent unprofitability -- although the sunk costs of earlier investment may keep them in the game for longer than is rational.

* Since the writing of this report, the official China Securities Journal reported that China Development Bank (a state-owned lender and a large creditor to the publicly traded Chinese suppliers) is preparing to recommend stronger financial support for Suntech Power, Trina Solar, and Yingli Green Energy. It also named Hareon Solar, Shanghai Chaori Solar Energy Science & Technology and Sungrow Power Supply Co, without disclosing the other six companies in line for priority funding.

Report author Shyam Mehta talks about solar module winners, losers, who gets acquired, and what the market looks like in 2014 in this podcast.