Is public land that much more attractive for solar-thermal power projects?

It would seem so, judging by the more than 200 applications that the federal Bureau of Land Management has received in recent years to cover millions of desert land in the southwest with solar fields (see The Rush for Gigawatts in the Desert Explodes).

But working through the lengthy permitting process and the understaffed BLM offices has been akin to watching a desert tortoise cross the road. Federal officials also have expressed concerns that the rush to lock up choice lots could encourage speculators to file for permits and then sell them.

The applications are not assets that can be traded or sold because they don't guarantee rights to lease the land – the BLM could deny the applications. But buying a company that has pending applications and then moving forward with the permitting process is legal, said Peter Weiner, a partner at law firm Paul Hastings Janosky & Walker, which represents renewable energy companies.

Building on private land, on the other hand, could be a simpler process and create less heartburn. That's particularly the case if the land has already been spoiled by activities such as farming. Those properties would likely face fewer questions about endangered species and other natural resource protection.

"Don't forget about the private land. Maybe it's more expensive, but you can get a hold of private land sooner than BLM land," said Reese Tisdale, research director of Emerging Energy Research in Cambridge, Mass., at the Concentrating Solar Thermal Power 2009 in San Francisco earlier this month.

Some private landowners think so, too. One of them, Vermaland in Phoenix, even issued a press release recently to advertise its auction of 1,938 acres in Arizona. Vermaland said the land is good for 388 megawatts of solar electricity generation (see A Solar Land Auction in Arizona).

Solar thermal power developers certainly have been hunting for good private properties.

BrightSource Energy, which plans to build 2.6 gigawatts of solar power plants to deliver electricity to the Pacific Gas and Electric and Southern California Edison, recently inked an agreement to develop on private land in Nevada (see BrightSource Locks Up Nevada Land for Solar Thermal Power).

The Oakland, Calif.-based company also has pending applications for BLM land in California's Mojave Desert (see video interview with BrightSource's CEO John Woolard).

Solar thermal power companies will tell you that finding suitable private land isn't easy. For one thing, the companies are seeking hundreds of acres that are preferably flat and close to a water source (for cooling) and transmission substations.

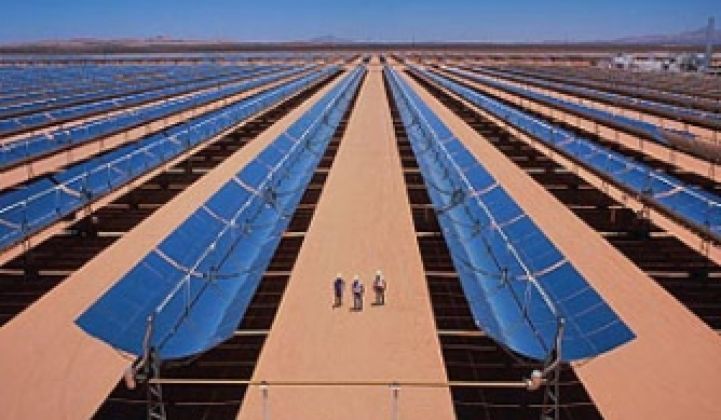

A solar thermal power plant uses a field of mirrors to concentrate the sunlight for heating up water or oil. The process generates steam, which is then used to drive turbines for producing electricity. Utilities have a keen interest in this kind of solar power plant because it adds energy storage to the facility. The power plant would heat up molten salt during the day and use it to produce steam at night.

The government owns large swaths of land in the west. Aside from the BLM land, which could be open up for mining, drilling, grazing and other resource mining (in addition to recreation), there are many national parks, national forests and state parks. Then there residential communities.

"When you look for private land, what you cannot find are large acreages in one piece, especially when you are looking around the Mojave and Palm Springs," Weiner said. "They are sold off in 1-, 2- and 5-acre parcels."

Some of the property owners also jack up the selling prices when power project developers come calling.

"I've heard about land costing $15,000 per acre, five times more than two or three years before," said Rainer Aringhoff, president of Solar Millennium LLC, the U.S. operation of the Germany company that is developing a 250-megawatt power plant in Nevada.

Developing on private land also doesn't allow developers to sidestep what could be lengthy and contentious permitting process, Aringhoff added. For example, a developer would still need approval from the California Energy Commission if he wants to develop a solar farm on a private parcel in the state.

If a developer gets a federal loan guarantee to fund a project, he would have to go through the federal environmental review process even if the project is set on private land, Weiner said.

Join experts and influencers at Greentech Media's Growth Opportunities in the New PV Market: Projects, Finance and Policy in San Francisco on July 13.