In 2018, operations and maintenance contract prices for solar remained low. While vendors continue to seek relief from price pressure by cutting costs and offering more services, price pressure is constant and expected to continue into 2019. This environment has caused stakeholders to anticipate O&M consolidation, but the market has not yet moved in that direction to the extent stakeholders predicted.

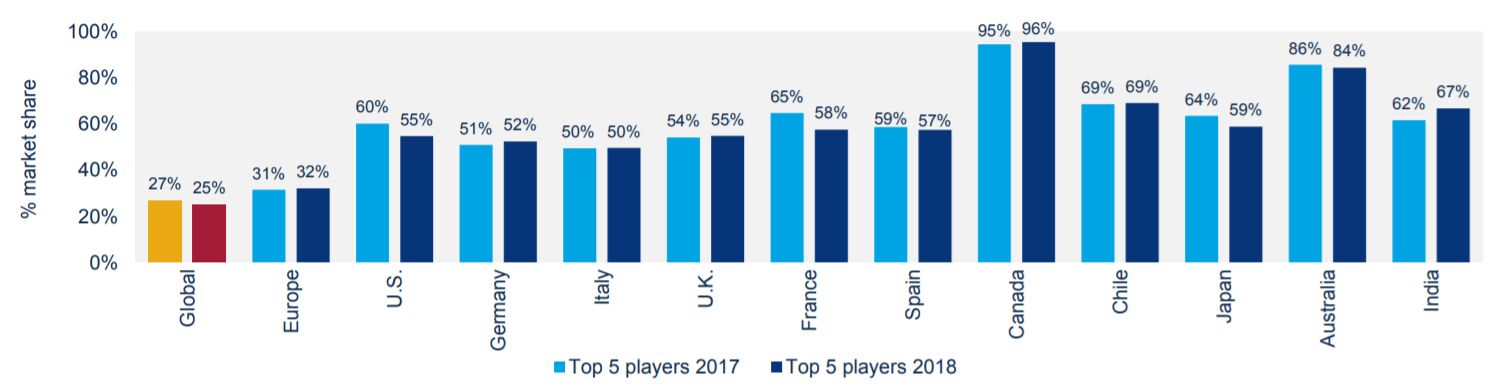

The sector’s top five global vendors held 2 percent less of the market in 2018 than in 2017. Although four of the 11 markets examined consolidated to some degree, three of those markets only consolidated by 1 percent, Wood Mackenzie notes in the new 2018 global PV operations and maintenance report.

India was the only market of those considered where consolidation increased notably, with the top five vendors growing their market share by 5 percent.

Percent Market Share of the Top Five Market Players Globally and by Country, Q4 2017 and Q3 2018

Source: Wood Mackenzie Power & Renewables

According to the research, developers entering the O&M market could be contributing to market fragmentation. Additionally, the decline in market consolidation may be due to the expansion of mid-level vendors’ portfolios. In 2018, no major O&M providers filed for bankruptcy or exited the market, although there were some mid-level players that were acquired. Major vendors will likely not exit in 2019, limiting opportunity for consolidation in the coming year. Future market consolidation could provide relief for price pressure, create economies of scale, reduce costs and help streamline service.

Regional and national players place a degree of blame on each other to some extent for ongoing price pressure. Vendors also credit price pressure to divergence between O&M costs and capital expenditures, as well as lack of contract standardization in the industry. With varying work scopes, contract lengths, locations, labor costs, etc., it is challenging to make a direct comparison between contracts, creating confusion and aggravating price pressure.

O&M prices have not kept pace with the rapid decline of solar capital expenditures. Since 2010, capex has declined by 80 percent. Despite advances in analytics and increased automation of services, O&M remains a labor-intensive industry and labor costs are expected to increase, not decrease, over time. Unrealistic expectations that O&M services would follow the decline of solar capex appear to have contributed to competition among vendors and rock-bottom prices.

In addition, an average market O&M cost and price is not yet codified. This issue is tied to the wide variety of service offerings and even definitions of O&M in the market today. Cost structures and contract pricing varies from vendor to vendor and from contract to contract, which makes comparing market pricing very challenging as the data points available do not encompass the same information. Some O&M vendors may therefore seek to win business by slimming down their contract offerings, potentially by offering lower-quality service initially and making their margins on repairs later. Some vendors claim price pressure is making it impossible to include necessary services in contracts.

As in past years, O&M vendors are seeking to drive down their costs with innovation on labor hours, vehicles and tools per photovoltaics capacity unit. Overall, automation is gaining traction but remains marginal, becoming cost-effective in markets facing specific hurdles (e.g., autonomous module-washing in extremely dry, dusty environments).

Vendors are exploring technologies such as autonomous or semi-autonomous module washing, autonomous lawn mowing and robotic security guards. Aerial thermography is also picking up momentum in the O&M space. It minimizes the number of on-site inspections and reduces the amount of labor needed, which is important seeing as how costly labor can be.

Other cost reduction drivers are increased density of projects and a decrease in hardware costs.

Looking ahead, aging solar systems and the growth of energy storage will present new opportunities for O&M players. Systems older than 10 years old will make up more than 10 percent of cumulative installed global capacity by 2022, creating opportunity for vendors to make their margins on revamping and repowering. The growth of the energy storage market could provide additional revenue streams for O&M vendors, as services provided to storage systems do not radically vary from those provided to solar systems.

See the recent Wood Mackenzie Power & Renewables report to learn more about developments in the O&M market in 2018 as they relate to trends, technologies, costs and prices.