In its first quarterly earnings report since its exit from an 18-month bankruptcy caused by massive wildfire liabilities, Pacific Gas & Electric laid out its progress on securing its grid from causing more fires and limiting the scale of future fire-prevention blackouts of the type that affected millions of Northern California residents last year.

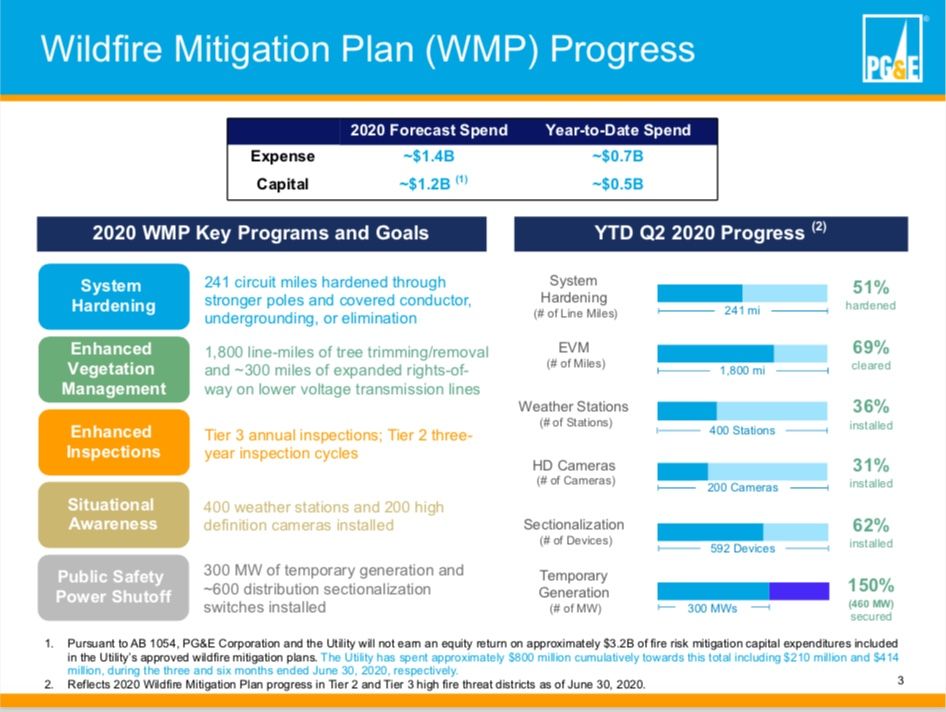

PG&E is now on track to meet its 2020 wildfire-mitigation goals, making up for slower-than-expected progress earlier this year due to the COVID-19 pandemic, CEO Bill Smith said during Thursday’s second-quarter earnings conference call. The slow rate of progress earlier in 2020 led to concerns that PG&E wouldn’t be able to complete its work by the end of August, historically the start of California’s annual wildfire season.

The utility is also working to make this year’s public-safety power shutoffs “smarter, shorter and smaller” than the widespread outages last fall, Smith said. PG&E’s grid operations staff has learned from last year’s experience to gain “improved insights to consider which circuits are considered for shutoff,” which “should result in fewer customers being impacted.”

The 600 grid sectionalization devices PG&E is installing will allow lower-risk circuits to remain on while higher-risk ones are de-energized, an effort that could reduce the scope of outages by about one-third compared to last year. It’s also making faster-than-projected progress on clearing vegetation around thousands of miles of distribution and transmission circuits.

PG&E bought a fleet of 450 megawatts of mobile diesel generators to back up communities at high risk of outages, although this is seen as a stopgap measure that California regulators insist must be replaced by cleaner backup power options in years to come. “We are pre-positioning about 360 megawatts of temporary generation to meet critical community needs” at substations, health care facilities and other locations, Smith said.

PG&E withdrew a plan to deploy hundreds of megawatts of natural-gas-fired generators at substations earlier this year amid opposition from communities and environmental groups. The scope of its fire-prevention blackouts, which were much larger than those conducted by utilities Southern California Edison and San Diego Gas & Electric last year, has also prompted a boom in backup batteries and solar-storage systems in the state.

In terms of repairing damaged circuits after windstorms, PG&E has increased its helicopter and automated drone aerial patrol capacity and has started using infrared cameras to allow restoration work to continue past daylight hours, he said. These and other improvements should allow a 50 percent faster restoration time this season, compared to the multiday outages many of its customers suffered through last fall.

Thursday’s earnings report revealed the challenges PG&E faces to execute its $59 billion bankruptcy recovery plan. On a non-GAAP basis excluding many bankruptcy-related charges, the Northern California utility reported earnings of $1.03 per share, compared to $1.10 per share in the same quarter in 2019.

But on a GAAP basis, PG&E marked a second-quarter loss of $1.97 billion or $3.75 per share, compared to a $4.83-per-share loss in the same quarter last year. The loss was driven by $2.5 billion in after-tax costs, made up mostly of $2.25 billion in bankruptcy-related costs.

PG&E reported $148 million in charges related to its potential liability for the Oct. 2019 Kincade fire, which California fire investigators have found was caused by a failed PG&E transmission tower. That figure doesn’t include wildfire insurance to cover the remaining liability PG&E may face from the fire, which is the subject of a lawsuit.

PG&E also took a $125 million charge for its contribution to the $21 billion state fund meant to shield it and California’s other investor-owned utilities from facing crippling liabilities from future wildfires. This fund, which PG&E gained access to after it emerged from bankruptcy last month, is meant to cover only catastrophic wildfires that can’t be covered by other insurance.

Numerous cities and counties oppose PG&E's plan to take advantage of a state law that will allow it to issue recovery bonds to securitize about $7.5 billion in 2017 wildfire claim costs and retire about $6 billion in temporary debt. State law AB 1054 allows utility wildfire costs to be passed on to ratepayers in this manner.

But PG&E must win approval from the California Public Utilities Commission through a “stress test” to determine whether this route serves the public interest. The CPUC has broad oversight over PG&E’s financial and safety performance in the years to come, with powers that include forcing it into state receivership if it fails to improve. The utility is also barred from rate recovery for $3.2 billion of the $7.8 billion it plans to spend on fire-mitigation work over the next three years.