Connecticut boosts its renewable portfolio standard and cuts net metering. Washington, D.C. proposes a first-of-its-kind distributed energy authority. Colorado passes an energy storage bill. And performance-based regulation begins to take off across the nation.

This week's State Bulletin features a good, old-fashioned roundup of the latest clean energy policy trends and updates.

Big regulatory shifts

Performance-based ratemaking is beginning to take hold in the U.S. power sector. The State of Hawaii made history last month when Governor David Ige signed a bill to better align the century-old utility business model with the integration of renewable energy resources and other advanced technologies. The Ratepayer Protection Act (SB 2939) sets a 2020 deadline for the state Public Utilities Commission to establish different incentives and penalties that link electric utility revenues to the utility’s success at hitting various customer-focused performance metrics. Hawaii is the first state to have performance-based ratemaking mechanisms in statute.

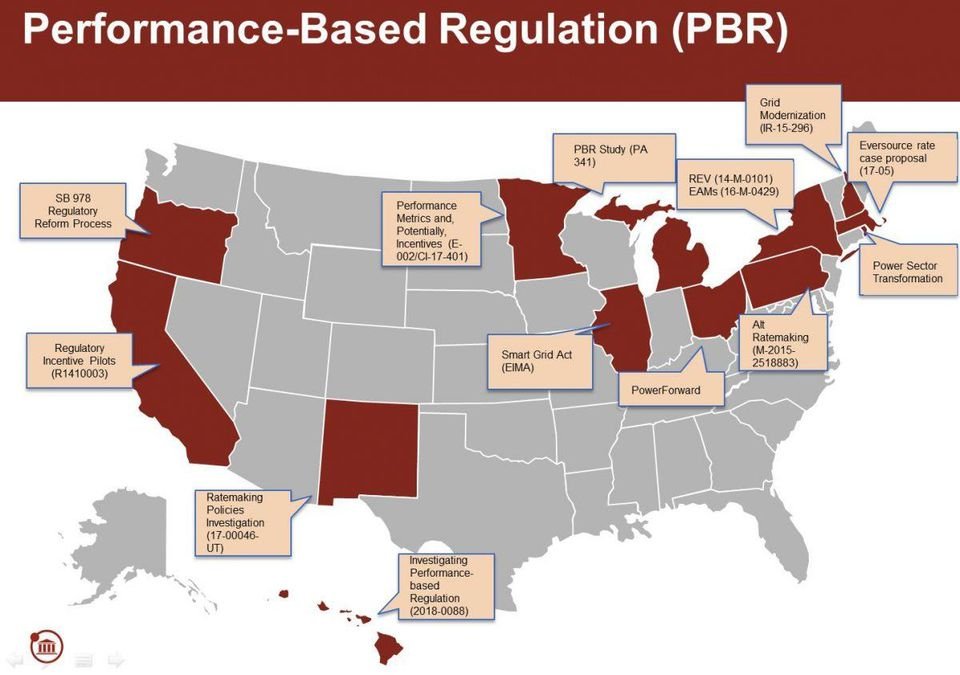

But Hawaii isn’t the only state pursuing performance-based regulation (PBR) that rewards utilities for evolving to meet customer demands and avoid unwanted consequences. As of this month, 13 states are discussing or moving forward with PBR through regulatory channels, according to state utility dockets compiled by America’s Power Plan, accessed via Advanced Energy Economy's PowerSuite.

Utility Dive’s 2018 State of the Electric Utility survey found that more than three-quarters of utility professionals said they wanted PBR to form at least part of their model, and 32 percent said preferred a predominantly PBR-based business model.

Mike O’Boyle, power sector transformation expert for America’s Power Plan, recently wrote that “though the theory underlying performance-based regulation for utilities is sound, transitioning from theory to practice can be difficult and risky.” A successful business model transition benefits from common features like inclusively educating stakeholders, creating a robust record for commissions and stakeholders to draw upon, and cataloguing the historical performance and existing incentives of utilities. U.S. regulators can also look to the U.K. for a real-life example of PBR that’s been put into practice.

Nevada regulators voted to adopt a report on the state’s Energy Choice Initiative that finds moving to a competitive electricity market would increase rates over the next decade and negatively impact Nevada’s rooftop solar market. The initiative would allow Nevadans to pick their energy supplier, effectively removing the state’s role in regulating the energy market, which the report says would expose Nevadans to “market volatility and profit-driven ratemaking practices.” Supporters of energy choice, including solar advocates, say the report lacks evidence to back its claims. A recent poll found that a majority of Nevadans say they will vote in favor of the initiative on this fall’s ballot.

Washington, D.C. seeks to create first-of-its-kind DER Authority. City Council members Mary Cheh and Charles Allen introduced a bill last month to create a Distributed Energy Resource Authority, a first-of-its-kind regulatory body that would be empowered to undertake traditional utility planning functions. The new DER Authority would have the ability to assess any proposed utility grid investment greater than $25 million and open it up to competitive bids. According to consulting firm ICF (which wrote a detailed blog post on the topic), there are four issues worth watching:

- The DER Authority — not the utility — would have significant ability to plan the local grid system. The new authority would have the authority to submit a Distribution Resources Plan detailing how the utility should accelerate integration of DERs and reduce rates, among other things.

- The DER Authority would oversee a separate process for all grid investments over $25 million.

- The DER Authority would be able to administer a market for distribution system investments, with the power to issue requests for proposals, solicit offers and select winners, including for non-wires alternatives projects.

- The regulatory body — not the utility — becomes the platform for A) integrating DERs, B) sharing information and C) providing market services.

Virginia regulators have rejected Dominion Energy’s 100 percent renewable energy plan for large-scale customers. In a final order released Monday, the Virginia State Corporation Commission determined that Dominion "has not established that its proposed tariffs will result in just and reasonable rates" and that "there is simply too much uncertainty and subjectivity in the tariffs for the Commission to find that they will result in just and reasonable rates." While the proposal appeared to offer more clean energy choices to commercial customers, renewable energy advocates pushed back against Dominion's filing. Under current Virginia law, third-party companies can sell 100 percent renewable power directly to customers, unless the customer’s incumbent utility offers a separate 100 percent renewable tariff, like the one Dominion put forward. Clean energy groups and retail suppliers argued that approving the utility program would effectively eliminate third-party competition.

While this week’s decision blocks Dominion from offering commercial customers a 100 percent clean energy plan, it doesn’t prevent the utility from tweaking the proposal and filing again. "We are already reviewing the issues raised by the State Corporation Commission in order to develop a plan to address those concerns and expand our offerings to meet our customers’ needs,” Dominion spokesperson Le-Ha Anderson wrote in an email.

New York announced new energy efficiency standards and clean energy regulations. Governor Andrew Cuomo unveiled an efficiency plan last month that called for investor-owned utilities to achieve annual efficiency savings equal to 3 percent of sales by 2025. The energy efficiency target should help the state achieve nearly one-third of its climate goal to reduce emissions by 40 percent by 2030. New York regulators also approved several initiatives to advance the state’s clean energy goals last month, including Standardized Interconnection Requirements, a registry to give the public online access to customer-load data for the state’s major utilities, and a pathway for distributed energy storage projects of up to 5 megawatts to connect to the grid.

Rooftop solar and net metering

New California building codes require all new homes to have solar panels starting in 2020. The California Energy Commission (CEC) voted unanimously to adopt the policy this week as part of the state’s Building Energy Efficiency Standards. Around 15,000 new homes are built each year that include solar panels, according to the CEC. When the new standards take effect, that number is expected to jump to around 100,000 new solar homes per year. The Solar Energy Industries Association anticipates the change will amount to an additional 200 megawatts of solar deployed in the state annually. While adding solar is expected to cost homeowners an additional $10,000 on the cost of their home, they’re expected to save a net $40 per month in avoided electricity costs. Despite these savings, several energy experts have taken issue with the new rules, arguing that large-scale solar is a more cost-effective way to reduce California’s carbon footprint. We’re still digging into the details of the code and will have additional coverage coming shortly. More information on the new rules is available here.

Connecticut legislature passes bill to end retail-rate net metering, while boosting the state’s RPS. State senators voted 29-3 to approve SB 9 on Monday, which would increase Connecticut’s renewable portfolio standard to 40 percent by 2030, up from 28 percent by 2020. But the bill would also hurt the distributed solar sector by dismantling retail-rate net metering, and setting rates for excess solar generation from rooftop systems to the wholesale market value for energy, plus renewable energy credits. Eighteen solar companies and advocacy groups with significant operations in Connecticut have condemned the Senate version of the bill and called on House members to amend the language with “simple and gradual reform” for net metering. SB 9 passed in the House on May 9 and is now headed to the governor’s desk. So far this year, net metering has also been dismantled in Michigan and Maine.

Peter Rothstein, president of the Northeast Clean Energy Council and the NECEC Institute, praised the increase to the state’s RPS target, but called the bill a mixed bag for clean energy overall.

“[SB 9] included counterproductive provisions that will significantly harm the state’s rooftop solar market,” he said. “The bill limits customers’ ability to use the power they generate by requiring that it be credited as it’s generated or within a day. Unless the utilities provide customers with metering and communications, and time-varying rates, which will give them the information they need to match usage to production, customers will not be able to manage and reduce their energy costs by adopting solar. Net metering, a key driver for residential and commercial solar adoption and the significant job growth that comes with a robust rooftop solar market, will essentially be dismantled. Significant work will be needed to overcome the new barriers to customer adoption of clean energy in Connecticut.”

“NECEC urges the Department of Energy and Environmental Protection (DEEP) and the Public Utility Regulatory Authority (PURA), which is charged with implementing the new solar programs, to work collaboratively with customers and the solar industry to establish cost-effective, fair solar compensation and rate structures that will enable clean energy and solar to continue to flourish in Connecticut.”

In addition to ending NEM, the Connecticut bill creates only a modest community solar program, going from the current 6-megawatt pilot to a 25-megawatt per year program. Solar advocates noted there are some worrisome issues in the community solar component, including a requirement that customers must demonstrate they can't put solar on their homes in order to participate. If SB 9 is signed into law, PURA and DEEP will be charged with establishing rules for the community solar program, including rules for determining customers' ability to have an on-site solar system and what credit customers receive for the generation of the system.

“Going forward, there are several aspects of the program that need to be addressed and improved to create equity, ensure customers’ ability to choose solar, and foster community solar investments in the state,” said Jeff Cramer, executive director of the Coalition for Community Solar Access. “The community solar industry looks forward to continuing to work with all stakeholders over the coming year to build on this pilot program with the goal of establishing a truly robust program that meaningfully expands access to solar across the state.”

Vermont regulators scale back rates for net-metered solar projects. The state Public Utility Commission set a lower rate for new net-metered projects in the state earlier this month, as part of a biennial update to the NEM program (18-0086-INV). According to SunCommon, one of the state’s largest solar installers, the new rules will decrease the value of a homeowner’s solar system by $750. Renewable Energy Vermont argued “now is not the time to hit the brakes or slow solar adoption.” But regulators pushed back against critics of the rate change, stating: “This argument conflates net metering with solar development generally. As the Department and the distributed utilities pointed out, there are more cost-effective ways for Vermont to develop solar resources than continuing the current net-metering incentives.”

South Carolina lawmakers have added a measure to a budget bill that would raise the state’s net metering cap from 2 percent to 4 percent. Amendment 9 was a last-minute addition to the bill, giving solar companies newfound hope they'll be able to maintain the policy, with time running out on the legislative session and the current net metering cap approaching. Having passed in the State House of Representatives, HB 4950 will head next to a budget conference committee, where the bill will have to be reconciled with the State Senate's version, which does not include the solar measure. The last day of the South Carolina legislative session is May 10. However, the budget bill can remain in negotiation until June 30.

Florida regulators approved Sunrun’s request to sell solar leases in the state. Up until the petition was granted last month, households in Florida were unable to lease solar systems due to restrictions on electricity sales from third-party providers. However, Sunrun has yet to officially enter the Florida market, CEO Lynn Jurich said on the company’s earnings call this week. With the positive ruling from regulators, other companies are expected to soon consider similar requests.

Grid edge technologies

Colorado legislature approves energy storage bill (SB 18). The bill directs state regulators to come up with mechanisms for the procurement of energy storage by the state’s utilities, and ensures customers have the right to install, interconnect and use energy storage systems. The bill determines that energy storage is in the public interest. "The threat of interruptions in electric supply due to weather, malicious interference, or malfunctions in centralized generation and transmission facilities makes distributed resources, including energy storage systems paired with other distributed resources, an effective way for residents to provide their own reliable and efficient supply of electricity," the legislation states.

Nevada utility regulators approved new rules Thursday that allow NV Energy to play a central role in building electric vehicle charging stations. The utility was directed to set aside $15 million in existing incentive funds to help build out the state’s charging infrastructure. Clean energy advocates applauded the decision, while the state's consumer advocate objected, arguing the rule could increase costs to ratepayers.

Ohio regulators approve American Electric Power’s EV charging station plan. The approval allows AEP to spend up to $10 million on rebates and incentives to encourage the development of up to 375 EV charging stations through 2024 — which is roughly double the current number of chargers in the state.

Governor Andrew Cuomo announced a $4.2 million expansion plan this week to install more high-speed EV charging stations along the New York State Thruway. The plan will allow electric-car owners to drive the length of the state without having to exit to recharge. The NY 2.0 electric vehicle initiative will help the state achieve its goal of installing 10,000 charging stations by 2021.