The Northern California smoke is gradually thinning, and now I'm off to Durham, North Carolina to give a talk Friday on grid modernization with a leader from Duke Energy. If any of you Squares are in the region, please stop by! It's free, and storage will definitely be on the agenda.

This week saw some notable advances for storage around the world, driven by China (see below). This comes a few months after Great Britain announced its own spending package to accelerate the uptake of storage technology.

It will be worth monitoring how these sweeping national programs actually perform, once we have time to evaluate the adoption they incite. Back in the States, though, storage policy can't seem to crack into the national debate, and multimillion-dollar federal storage subsidies rank only slightly more feasible than renaming the Washington Monument.

Over here, it's a state-by-state battle, if not county by county or town by town. California tried to cut some of that headache with a newly passed bill to standardize and digitize storage permitting. This seems sensible, and something other states may want to consider.

Chalk that one up to the theory of states as laboratories of democracy. The flip side of that theory stipulates that the clever inventions of those laboratories will take a long time to break into all those other laboratories nationwide.

China goes big on battery support

China's central planning body announced a major national initiative to boost storage deployments in the coming years.

The leading energy consumer has fast-tracked its switch to cleaner fuel sources, but grapples with a resource imbalance: much of the new wind and solar capacity lies in the sparsely populated west and needs to get to the densely populated coast.

The National Development and Reform Commission wants to use storage to time shift clean energy production and prevent it from getting curtailed. To that end, the body plans "to issue subsidies to energy storage companies to spur the construction of new power-saving facilities," Reuters reported.

The effort will also include pilot projects to try out experimental battery chemistries and other technologies, like pumped hydro and compressed air. Those should be online by 2020, to enable larger scale deployment over the following five years.

These policies will feed demand for storage in China, which the industry will no doubt welcome. It remains to be seen, though, how the subsidies will be distributed. If all that money goes to domestic firms, for instance, they'll get a hand in scaling their business and cutting costs while international competitors have to fend for themselves.

Chinese government assistance of PV manufacturers prompted a series of U.S. trade cases. Is it possible something similar could happen for Chinese energy storage?

The gorgeous battery video you didn't know you need

Battery storage sites reward a seasoned observer, but it's hard to think of them as eye candy.

Not so with the mostly forgotten but hugely substantial pumped-hydro facilities. I stumbled on this hi-def drone footage of one such plant in Switzerland and was blown away by the sparkling Alpine waters, sharp peaks and idyllic mountain towns.

I'm not sure how exactly it appeared on our site. It seems to be a well-produced infomercial for GE's Digital Twin service. Whatever its reason for existing, the scenery is enough to transport you for a few minutes.

AMS nabs grid services specialist Ryan Hanley from SolarCity

Ryan Hanley spent the last few years trying to nudge SolarCity's rooftop solar business into a more sophisticated grid service platform business, using the companies installed energy assets to create decentralized resources for the grid.

That project hasn't yet achieved fruition. In any case, it's a heavy lift to take a company built around one business model (rooftop solar installations) and change its center of gravity. When Tesla absorbed SolarCity, grid services got bumped even further down the priority list. Scaling Model 3 production and keeping Model S and X humming along take up most of the air right now.

Now we've learned that Hanley has relocated to a company that takes the decentralization of grid assets as its prime objective: Advanced Microgrid Solutions.

He joins the exodus of what feels like every other high-ranking leader at SolarCity following the merger. The wave of departures may be related to Tesla erasing the SolarCity brand and rejecting its key strategic decisions, but who really knows?

At AMS, he's filling a gap from two high-profile departures.

Co-founder and Chief Commercial Officer Katherine Ryzhaya left early this year to join the leadership team at solar-plus-storage developer Lightsource North America, the new U.S. arm of the British company. Then, in June, residential solar company Sunrun hired away Audrey Lee, AMS' vice president of analytics and design, to serve as that company's vice president of grid services.

That's just in time, because the company's landmark deal with Southern California Edison, totaling 90 megawatts, starts phasing in November 1.

AMS made a name for itself by nabbing that deal before it was really a known entity. Now it's had a few years to build out systems, hone its development analytics and fine-tune the operational software. The real test begins when it hands over dispatch control to SCE, and we get to see if the batteries respond like they're supposed to.

The Amazon overlords will take care of EV drivers

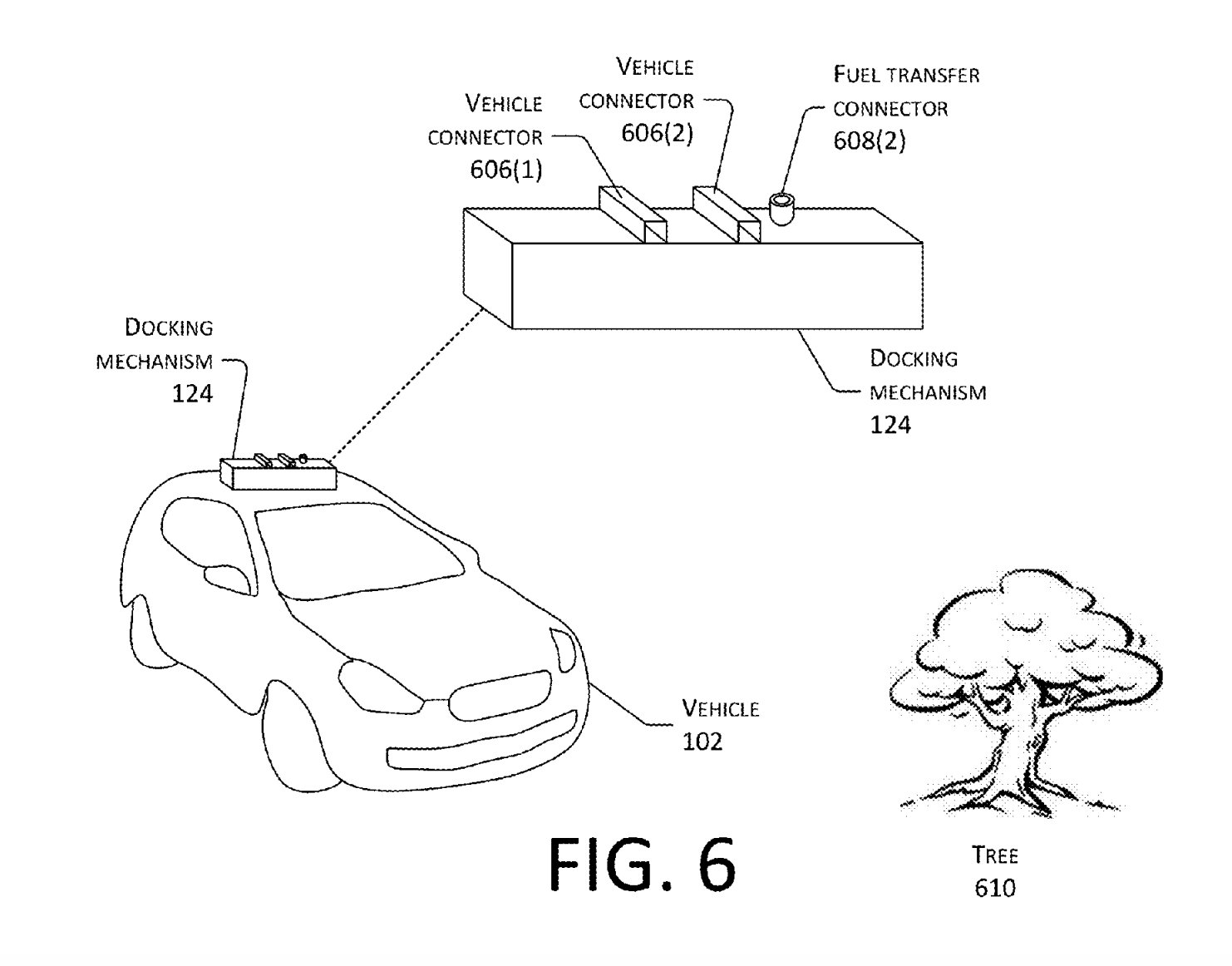

One of the more stirring developments in electric charging IP has to be Amazon's new patent for a drone that tracks down electric cars that run low on battery, docks with them while they drive and loads up the battery. It's like those Air Force in-air refueling planes depicted in the opening credits of Dr. Strangelove, but accessible without a Pentagon-sized budget.

Apart from the wild-eyed science fiction element here, this could be a big deal for eliminating range anxiety. Don't worry about running out of power -- Amazon's ubiquitous drone fleet can assist you.

Whether this actually works will depend on the costs of charging and dispatching said drones relative to what drivers will expect to pay for a fuel-up. There's no currently operating business of this kind to compare with. Amazon does know how to package valuable services into subscription payments, so it's possible this will be featured in some future version of Amazon Prime.

Got a sounds-crazy-but-it-just-might-work EV charger concept? Hit me up at [email protected].

Storage advice from an old-school solar pioneer

I’ve been working with the team at Oakland’s clean energy incubator Powerhouse to launch a speaker series and podcast where cleantech founders tell their personal story of the ups and downs of running a business in this industry. It’s called -- wait for it -- Watt It Takes.

The first event featured SunPower founder Dick Swanson, who recounted how he dodged several bankruptcies on the way to an eventual IPO. I summed up his lessons in this story.

He started his solar technology company in 1985, when exceedingly few people bought that stuff. In today’s market context, his insights resonated more with the young energy storage industry than contemporary solar concerns.

Before demand for his solar products took off, Swanson paid the bills by manufacturing all manner of gadgets entirely unrelated to his core product: barcode readers for cash registers, optical retina implants and CT scanners for GE, to name a few.

This story made me think of the more recent energy storage pioneers, who had to talk their way into a market that didn't yet exist. The challenge is particularly acute for the exotic chemistries and technologies, like flow batteries: Not only do you need to get a customer comfortable with the concept of storage, you have to sell a type of storage that's rarely ever implemented.

These startups need to survive long enough for their initial pilots to prove the soundness of the technology in the eyes of potential buyers and investors, while improving the product through R&D. Balancing those demands is not easy.

It's heartening to hear that an established player like SunPower made it through a similar dilemma. On the other hand, the analogous advice for a battery startup is less clear.

Does flow battery expertise lend itself to any other useful products? If you devote energy to a side product to pay the bills, does that decrease the odds of succeeding in your main endeavor?

The better interpretation may be a less concrete one: Think about creative ways to draw income before your ideal market really exists.