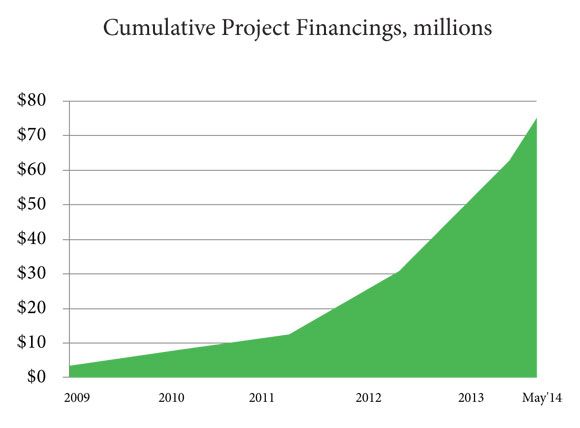

From coast to coast, money continues to roll in for property-assessed clean energy loan programs.

Florida’s PACE Funding Agency recently announced that $200 million is now available through its EVest Program for both residential and commercial projects.

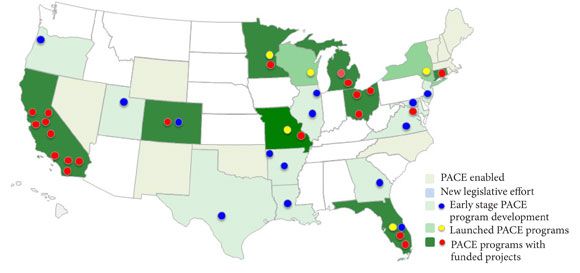

PACE programs allow investments in energy-efficiency retrofits and distributed renewable generation to be paid back through property taxes, which lowers the risk for both lenders and owners and can potentially open up a far larger swath of the energy efficiency market.

In Florida, wind-resistance improvements are also eligible for the PACE program. As Greentech Media noted in January, south Florida is a growth market to keep an eye on for residential PACE this year. Nationwide, about two-thirds of projects to date have been for energy efficiency, according to PACENow.

The agency’s financial advisors Public Financial Management, First Southwest and Southeastern Investment Securities worked with CounterPointe Energy Solutions to secure the funding from a large institutional investor that was not named.

Florida is part of a movement that also includes states like Connecticut and New York which are moving to on-demand financing, according to Kristina Klimovich, director of communications for PACENow.

“The advantage of funding on demand is obvious: no waiting. On-demand programs can quote rates and fees, which make it easier for property owners to make a decision,” she said.

Just one day after Florida’s PACE financing program was initiated, New York announced it had secured $75 million from Bank of America Merrill Lynch for the state-based Energy Improvement Corporation’s Energize NY PACE program.

“We were thrilled to have received seven bids from qualified investors to provide financing services for the Energize NY Finance Program. Bank of America’s bid was accepted based on their understanding of our unique credit and market opportunity, and their intent to provide capital for these very secure obligations at attractive rates,” said Mark Thielking, chairman of the EIC board, in a statement.

New York’s recently formed Green Bank will provide a letter of credit that will allow Energize NY to offer commercial PACE funding to jurisdictions throughout the state. Todd Karas, head of Energy Services and Renewable Energy Finance for Bank of America Merrill Lynch, said that the program was a “terrific fit” and a “key focus” moving forward as part of the company's ten-year, $50 billion environmental business initiative.

In April, New York’s Green Bank announced it was open for business, offering $200 million for a fairly open-ended solicitation for cleantech and energy efficiency projects. Ultimately, the bank hopes to be an enabler of PACE projects, but also to fund other projects directly by leveraging private dollars. The goal is to eventually reach a capitalization of $1 billion.

Just over the border in Connecticut, which has the country’s most successful green bank so far, the state’s PACE program recently securitized $30 million in loans. By selling the assets to PACE finance provider Clean Fund, the state’s Green Bank can now replenish the capital and make more loans available.

“The sale of this initial portfolio of PACE liens to Clean Fund is the latest step in our effort to attract and deploy private capital here in Connecticut supporting energy efficiency and renewable energy opportunities,” Bert Hunter, chief investment officer of the state’s green bank, said in a statement.

There are another 75 projects in the pipeline in Connecticut, and financing of up to $75 million is expected by the end of this year.

Not to be outdone, Renewable Funding secured a $300 million credit facility to fund residential PACE projects earlier this month in California. California is still the most active state for PACE in terms of funded projects, but with funding flowing in other states, and Texas rolling out its PACE in a Box program, California has plenty of welcome company.