To view this report's press release, please click here.

The global PV materials market, which encompasses more than a dozen major materials before the module, is forecasted to hit US$12.8 billion by 2014 according to GTM Research’s latest report. This forecast, which excludes polysilicon feedstock, points to 50% growth over the 2010 market value. This trend is based on both scaling module production globally and a more acute focus from material vendors on developing stronger relationships with module producers via customized solutions and optimized fab placements.

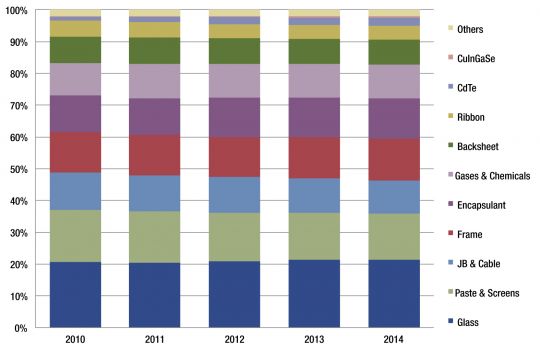

GTM Research’s PV Bill of Materials Outlook: 2010-2015 analyzes the economics, opportunities and players active in the global materials market, considering the key components for both crystalline silicon and thin-film modules. The report presents supply and demand dynamics along with cost forecasts for the following materials: glass, pastes/screens, junction boxes/cables, encapsulants, frames, gases/chemicals, backsheets, ribbons, and thin-film feedstock. By 2014, each of these materials markets will individually comprise global markets in excess of $1 billion.

"Until now, the solar market has primarily focused on polysilicon as the major PV material since it represented the bulk of module costs,” says Shyam Mehta, GTM Research Senior Analyst, “but with cost declines in polysilicon leveling out, there is a growing emphasis on the collective PV materials market as a vehicle for further declines."

GTM Research forecasts cumulative PV material costs to drop by 15% by 2014. As single revenue streams, the glass, paste/screen and frame sectors will represent the majority of materials opportunities; these sectors have already begun to attract new market entrants and technology innovations as module producers look to form stronger ties with these specialized vendors. The fastest-growing PV material markets will be those for CdTe and CIGS feedstock, which will grow at annualized rates of 32% and 45%, respectively, due to increases in the price of tellurium and indium.

The report concludes that winning PV materials suppliers will have to work in close conjunction with capital equipment vendors and component producers to enable cost improvements going forward, with successful materials solutions likely to be optimized based on the specifics of the technology and module manufacturer in question. Mehta points to Canada-based 5NPlus as an illustrative example of a PV materials success story.

“As First Solar’s major supplier of cadmium telluride (CdTe) feedstock, 5NPlus has a significant amount of devoted demand for their material. Their recent move to construct a cadmium telluride recycling plant in proximity to First Solar’s module factory in Malaysia demonstrates the importance of material vendors working in close conjunction with their module customers in order to achieve relevant cost reductions.”

FIGURE: Total PV Materials Revenue Share (Crystalline Silicon and Thin Film), 2010–2014

(Source: GTM Research)

For more information on PV Bill of Materials Outlook: 2010-2015, please visit the report's web page or see www.gtmresearch.com for information on additional GTM Research reports.