Opower, the energy management startup with the lead in U.S. utility deployments, had just expanded again. On Tuesday, it announced 15 new utility customers, bringing its list to 75 total, and six new expansions with existing customers like NSTAR and Consumers Energy.

Looks as if the Arlington, Va.-based startup with about $64 million in venture capital investment is cementing its lead as the startup to beat in the field of connecting utility customers to their energy use and efficiency options. Last week, it announced it had reached its goal of 1 terawatt-hour of energy saved for its customers.

Competitors include Boulder, Colo.-based Tendril, which has more than 30 utility pilot customers (and a few full-scale rollouts coming this year), and Aclara, whose customer web portal now runs at about 20 utilities across the U.S. Canadian startup Energate partners with Silver Spring Networks and is also reaching millions of homes in Ontario province. Efficiency 2.0, a startup with software to get homeowners to save energy via coupon giveaways and contests, was bought by C3 earlier this month.

All of these contenders are facing a slow-to-develop market for their services, of course. Most homeowners aren’t willing to spend more than $50 or so, if anything at all, to better manage their energy use. Utility pilots are struggling to prove they’re worth their cost in terms of efficiencies and customer payback.

Still, Michael Sachse, vice president of regulatory affairs for Opower, told me that utilities are typically doubling their deployments when they expand, or even better -- National Grid has scaled from 100,000 to 650,000 homes in the New England region, and is adding web services to Opower’s core paper-mail reports, he noted.

Beyond growing its core business, Opower’s been up to a few more things in the past few months. First of all, it’s moving outside the United States. Opower launched a pilot project with U.K. utility First Utility last year, and earlier this month added web services to the list. Sachse told me Opower was working on up to three additional projects outside the United States, though he wouldn’t provide details.

Second, it’s starting to ramp up its intriguing smart thermostat project with Honeywell. The two now have about 1,000 homes testing out Honeywell’s Wi-Fi smart thermostats and cloud platform running Opower’s customer management and data analysis software, Sachse said, though once again, he wouldn’t provide more details.

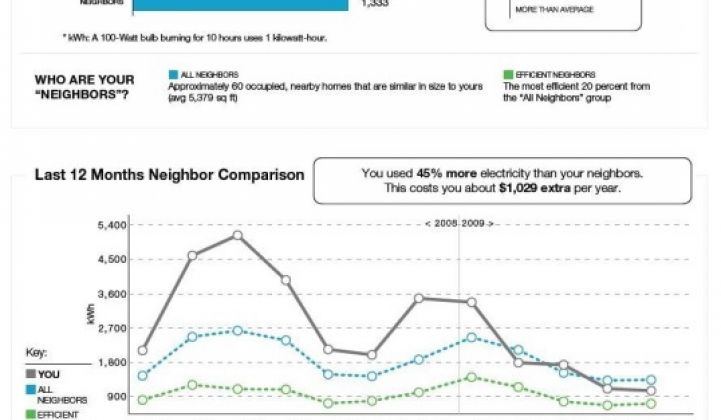

That’s going to be a closely watched project, since it combines a giant in the thermostat field (and one that’s proven it’s willing to go after the competition with lawsuits) with a startup that’s gained a lot of traction in the business of getting customers to save energy. Opower’s mailed reports have been able to yield 2 percent to 4 percent reductions in energy use across the 35 million or so households it serves.

That figure is respectable, but it’s still a lot lower than what you can get with a smart thermostat that turns off when you leave the house and other such automated energy-saving features. Those can push efficiency gains into the 20 percent range or greater, which is what Opower is aiming at with Honeywell, and other competitors are claiming as well.

As for market share, it’s important to note that while Opower analyzes data from about 35 million households (7.4 million from these new customers), its web portal users number only about 10 million, and “active” users of the mail, email, text and website channels that Opower provides only number about 4.5 million.

There’s a simple reason for this: most people don’t care enough about their energy bills to do anything about them, a fact that’s borne out by competitors as well. Aclara, for example, has about 8 million utility customers with Web portals delivering them Green Button data, but only about 1 million of those customers actively engage with their portals today. Getting more people to sign up for active, online participation with their energy use is the next step for startups and utilities.