Earlier this week, the German inverter manufacturer SMA announced it will lay off 1,600 workers due to pricing pressures and a slowdown in European demand.

We keep hearing stories about how yearly solar project investments are increasing, so why is SMA shedding one-third of its workforce?

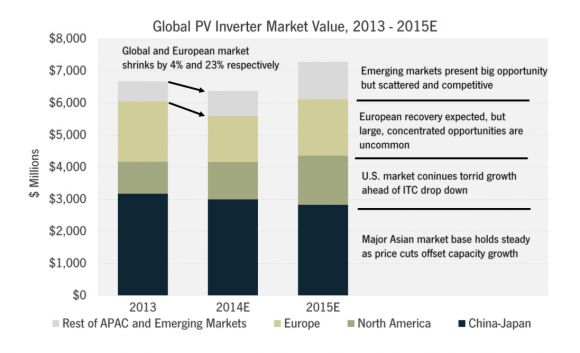

In 2014, the European market dropped by 23 percent year-over-year, as major feed-in tariff programs either evaporated or just dropped below economic values. Everyone knew this was coming. There was some optimism that Germany and other European PV markets would be more resilient, but it didn't turn out to be the case.

China and Japan were the big growth stories of last year. However, price reductions offset any growth in capacity and kept the market value flat there.

From 2013 to the end of 2014, the value of the global PV inverter market fell by 4 percent and the European market fell by 23 percent.

Source: GTM Research

For SMA specifically, its forays into China and Japan have both been disappointing. While North America (primarily the U.S.) has been an extremely positive investment for SMA, similar pricing pressure in the commercial string and utility space meant that growth in the U.S. couldn't offset declines in Europe.

And while SMA has some big wins in emerging markets in Latin America, South Africa and Thailand, these regions are thus far dwarfed by the aforementioned major markets. Furthermore, SMA has always viewed itself as a premium brand, worthy of commanding a significant price premium. While many are willing to pay extra for for reputation, reliability and a long track record, competitors are continuing to chip away at SMA's business.

GTM Research doesn't share the pessimistic view that many have about the inverter market for 2015. Yes, there will continue to be significant pricing pressure, especially from reputable Chinese vendors. In fact, due to continued shifts in the market and price reduction, we expect globally blended inverter ASPs to drop by 13 percent year over year.

SMA's opportunities are strongly matched to the global landscape. But again, the company will continuously be hounded by competitors who have lower cost structures or are simply setting prices lower.

We continue to see the Chinese and Japanese markets flat-line as modest capacity growth is offset by continued pricing reductions. However, we see a case for market recovery in Europe, with 2014 being its nadir. Furthermore, another strong year for the U.S., joined by scattered growth from markets like Chile, India, Mexico and South Africa, will present a healthier market overall.

New opportunities are more diffuse than ever before, and the best-positioned inverter companies are those that can quickly react to shifting geographies, advanced grid integration requirements, and fast service response without breaking the bank on operations.

After 2015, the market will shift again. We see the incoming step-down of the U.S. federal Investment Tax Credit having a ripple effect through the global landscape as utility project opportunities crash in the U.S. Similarly, interconnection concerns in Japan will slow down the market, creating a two-fold hit on global demand. Our view is that, while shipments will grow modestly from 2016 to 2017, the dollars available may once again fall.

***

GTM Research wil be releasing The Global PV Inverter Landsape 2015 this month. Contact Zack Munsell ([email protected]) for more information on timing, pricing and what's inside the report.