Near an old, remote frontier post in Lancaster, Texas, S&C Electric Company, Schneider Electric and Oncor unveiled one of the most advanced microgrids in North America, bringing the technology one step closer to widespread deployment.

S&C and Schneider Electric built the microgrid in six months at Oncor’s System Operating Services Facility (SOSF). The system is designed to seamlessly integrate energy storage and renewable energy resources with cutting-edge hardware and software to showcase how microgrids can enhance reliability for Oncor customers.

“We are looking at the changing nature of our industry, and especially customers’ changing needs,” said Don Clevenger, senior vice president of strategic planning for Oncor, in an interview. Since no one can predict exactly what the future of the power sector will look like, Oncor believes the grid needs to be “as flexible and adaptable as possible,” he said.

“What we’re doing with this microgrid is getting a firsthand view of how these technologies work, how the microgrid works, so as our customers’ needs change, we will be ready to deploy these [solutions],” Clevenger said.

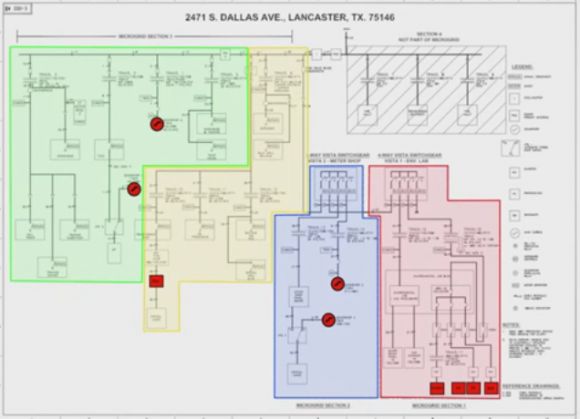

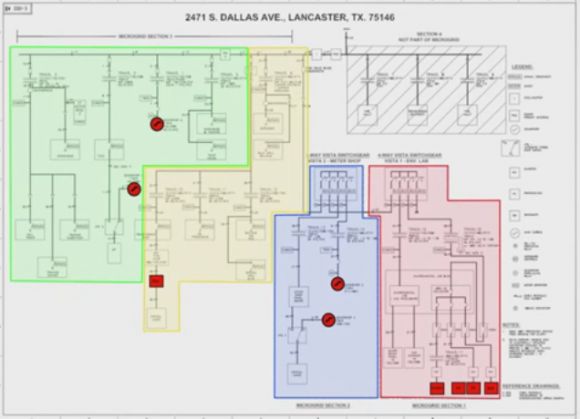

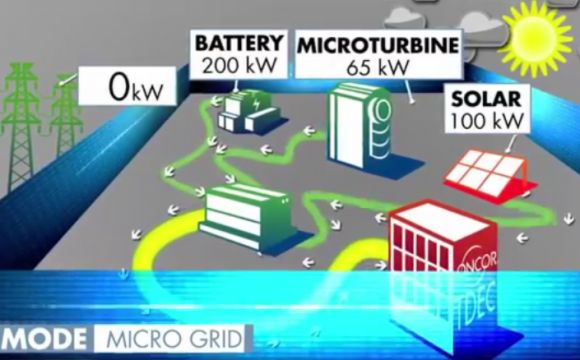

The grid-tied system consists of four interconnected microgrids and nine different distributed generation resources: two solar PV arrays, a microturbine, two energy storage units, and four generators. The system has a total peak capacity of 900 kilowatts, but could theoretically scale to meet just about any need.

At Oncor’s SOSF site, the main priority was to keep the site’s telecommunications center operational at all times. The second priority was to test a range of new generating sources at Oncor’s new Technology Demonstration and Education Center (TDEC). The best way to do that, they decided, was to build “pockets of reliability,” said David Chiesa, director of microgrid business development at S&C.

“We can break the single microgrid down into four microgrids that can be controlled individually, combined, operated in parallel, in tandem, or independently as one large microgrid,” he said. “That’s really what makes this site unique among others.”

In the event of a power outage, S&C’s IntelliRupter PulseCloser fault interrupter tests to determine whether the failure is permanent. If it is, it puts the facility into island mode. The system then uses S&C’s Scada-Mate CX Switches and Vista Underground Distribution Switchgear to reconfigure the distribution system. Schneider Electric’s Microgrid Controller (MGC) then switches the system onto alternative distributed power sources.

All of these components work together autonomously, without any human intervention.

Microgrids are the new smart grids

Energy storage is the backbone of the system. The two batteries, which store energy from both the utility feed and the facility’s own generation sources, enable the integration of intermittent solar power, provide voltage control and are the first responders in the event of a power outage.

One of the batteries is from S&C. The other is from Tesla Motors, which drummed up some excitement among Tesla enthusiasts. Clevenger said Oncor has a good relationship with Tesla, but that it's just one of several battery companies the utility wants to work with.

The microgrid can operate at its peak capacity of 900 kilowatts for two hours, and eventually drops to a baseload of 550 kilowatts as solar generation falls off at night and the battery assets drain.

Theoretically, the microgrid serving the telecommunication center and the microgrid serving the TDEC can run indefinitely on sunshine and propane-powered generators, as long as there’s access to fuel. To maximize the amount of run time, the system uses a load-shedding algorithm from Schneider Electric to power down the other two non-critical microgrids.

Schneider Electric also deployed its new StruxureWare Demand-Side Operations (DSO) technology -- a first for North America -- as part of the Oncor project. The DSO platform improves the economics of distributed energy resources by leveraging ERCOT market signals, weather and forecasting information, historical energy usage data and real-time building information.

“Oncor is seeing increasing levels of distributed generation and predicts more and more distributed generation on the grid,” said Chiesa. “So they didn’t want to make it easy on us in this regard. They wanted to demonstrate that you can interlace these distributed generation pieces effectively.”

“Few microgrids have as many bells and whistles as this one,” said Omar Saadeh, senior grid analyst with GTM Research. “While microgrids remain a relatively nascent market, the development of this system will help break down technological barriers so we can one day see wider commercial adoption.”

Microgrids currently represent a relatively small market segment for switching and protection providers, but both S&C and Schneider have seen significant traction with their distributed energy management solutions. The Oncor microgrid is an opportunity for these companies to show off their most advanced technology.

“One of the things that we’re trying to show…and one of the reasons we’re excited Oncor asked us to participate, is we’re trying to teach customers that microgrids are at a stage that smart grids were 10 or 15 years ago,” said Chiesa. “Microgrids are as new now as the smart grid was then. And if you think about it, the smart grid has been...inculcated into the way utilities and people view the grid.”

Changing the regulatory landscape

For Oncor, the SOSF project will test its ability to operate a microgrid on the utility side of the meter, so that one day it can deploy microgrids in ratepayer territory.

“911 call centers, hospital districts, those pieces of critical infrastructure are what we see having a need [for microgrids] sooner rather than later,” said Clevenger.

If Oncor were to start building these types of microgrids, “We could see that being part of the rate base if it’s a public need,” he added.

The Lancaster microgrid was built in a single six-month stretch, rather than in pieces over time as some university campuses have done. Oncor also paid for the microgrid in full, without any government grants or subsidies. The utility did not, however, reveal the price tag.

Oncor has been one of the more progressive utilities when it comes to adopting grid-edge technologies. Perhaps most notably, Oncor sought regulatory approval last fall for up to $5.2 billion in distribution-grid-connected batteries -- representing one of the largest potential energy storage procurement opportunities in the country -- with deployment starting in 2018.

The $5.2 billion figure stems from a Brattle Group study that found the Texas market could support up to 5 gigawatts of distributed electricity storage, based on the presumption that battery prices will fall to $350 per kilowatt-hour, about half the cost of the cheapest lithium-ion batteries available today. Oncor confirmed to the Dallas Business Journal last that it is working on a multi-billion-dollar battery storage project with Tesla.

The storage announcement stirred up some controversy between Oncor, a regulated transmission and distribution business, and its sister companies, retail electricity provider TXU Energy and power generator Luminant. TXU and Luminant, both of which compete for customers in Texas’ competitive market, have strongly contended that because batteries act like generation resources, they should not be rate-based.

A policy change is necessary for Oncor to own batteries for anything other than grid reliability purposes. Last week, the Texas legislative session came to a close without any lawmakers filing a bill to change the current market structure.

They way Clevenger frames it, this isn’t a big setback. Oncor didn’t have a specific energy storage goal; the Brattle study was merely an economic analysis of where the Texas market could go, he said. And in anticipation of market changes, the utility will continue to have conversations on how policy should also evolve.

“There’s a lot of discussion because of the deregulated market in Texas...and laws that would have to change to allow the utilities to deploy batteries and capture all of the benefits in one place, while not disrupting the deregulated market,” said Clevenger. “We’re still having those conversations with regulators and legislators and all market participants."

Clevenger underscored that Oncor isn’t interested in owning generation sources. It’s just the battery piece that will need to be addressed because of how energy storage can interact on both sides of the merchant and T&D systems.

“Right now, we can own the battery for reliability and voltage support and all of those T&D type of functions. But to get the most out of the battery, the notion would be [that] we would auction off the capacity to the merchant generation or other third parties, and they would use batteries as kind of a warehouse to store their electrons,” he said. “They would be completely in control of that; we would just own the electron warehouse, so to speak.”

"I can't wait to get past the demonstration projects"

As technology costs continue to fall, an increasing number of utilities are exploring opportunities to improve grid reliability through microgrids, where energy storage could play a major role.

San Diego Gas & Electric has been adding to its inland desert Borrego Springs microgrid since 2009. Duke Energy has established a coalition to test interoperability on a microgrid at its Mount Holly, N.C. test lab. And ComEd recently backed a proposal to invest $300 million in six microgrids at various critical facilities in Illinois. If approved, ComEd could become the first utility to coordinate and employ grid-connected microgrids to improve the overall distribution network.

At this point in time, there isn’t a need or an economic case to build microgrids in middle-income, single-family-home neighborhoods, said S&C’s Chiesa. But there are specialized locations where microgrids make sense today. The Oncor microgrid proves that the technology is ready to be deployed. “What I’m waiting for is more customers like Oncor to really take it and pay for it themselves,” he said.

At the same time, it’s important to take stock of how far microgrids have come in terms of technological development and commercial deployment. Two years ago, almost all microgrids were located on military bases. Today, several utilities are proactively researching how microgrids will affect their grid network and impact the rules of how grids operate.

“Now we see quite a number of utilities, the forward-looking ones, coming to us and asking us for a demonstration project,” said Chiesa. “As the director of microgrids, I can’t wait to get past the demonstration projects and move into the real commercial, viable ones, but that’s still a year or so off.”

***

This year's Grid Edge Live pre-conference seminar will focus specifically on microgrids, taking a deep dive on the policy, economic and technical models required to achieve more widespread deployment.

Grid Edge Live will bring together an emerging ecosystem of power industry thought leaders, including utilities, innovators, regulators and policymakers in San Diego, California from June 23-25. Attendees will discuss and debate the latest issues and opportunities impacting tomorrow’s distributed energy system, and examine the latest trends and innovation happening at the grid edge. Register here.