About a year ago I listened to investor Vinod Khosla comment on wind power at PARC, the Palo Alto Research Center.

According to Khosla, at that time, wind turbines from GE and Vestas are nice, but there was little upside for innovation, the Betz limit is being approached, and the availability of viable sites is declining. Furthermore, without storage capacity, wind turbines don’t provide spinning reserve. At the same event, Khosla also took swipes at photovoltaics, hybrids, biodiesel and zero-emission buildings.

Solar PV, wind and biofuels are “little markets," according to Mr. Khosla’s audacious worldview. In his opinion, the new green is “Maintech" not “Cleantech," and as such, we need to go after huge markets like engines, lighting, appliances, cement, water, glass and buildings and not fritter away our time and effort on PV and wind.

Vinod has since overcome his objection to wind and made a major investment in wind start-up, Nordic Windpower. Hey, we're all entitled to change our minds. And there's certainly a difference between a technology that solves the "Chindia" problem and a good VC investment.

VC in Wind

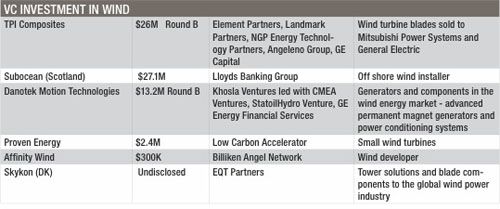

Here's a table of wind investment in Q4 of last year.

Compare that to the 24 deals and more than $150 million of VC put into solar in Q4.

Compared to the wind power market, solar gets the headlines and the lion's share of venture funding. But the wind power industry is roughly triple the size of solar, and it is growing with almost as much strength as PV. Both solar and wind have the advantage of zero carbon emissions when in operation, though both suffer similar weaknesses in terms of intermittency and low capacity factor.

Global Wind Market (from Emerging Energy)

Giants like General Electric, Vestas, and Siemens still dominate the wind field; the sheer size and scale of wind turbine projects acts as a deterrent to VC investment and entrepreneurial activity.

Nordic Windpower Innovates and Wins Funding

I spoke with Prakash Ramachandran, the CFO of Nordic Windpower, at a financing panel I moderated on Wednesday in San Francisco. The firm recently closed a $38 million round from Khosla Ventures, NEA and Novus Energy Partners, and that's not the only funding they've garnered lately. They are the only wind turbine company in the U.S. to get a DOE loan guarantee -- $16 million under the innovative renewable energy program. Nordic also received "significant" funding from Goldman Sachs in 2007.

Their innovative 1-megawatt 2-blade turbine design challenges the traditional wind turbine design paradigm. Its flexible construction and the use of a "teeter hub" results in a simpler, more lightweight design that requires fewer bulky, rigid nacelle components. This design has the potential to decrease capital costs and, importantly, maintenance costs. Repairing multi-ton nacelles 200 feet in the air is often an expensive proposition.

Other companies have used teeter hubs, but Nordic claims that none have solved the problem of harmonic loading, which becomes critical in controlling the eigenfrequencies of the assembly and avoiding harmonic loads in MW-class turbines.

Here's an example of a quality-control problem in a wind turbine.

Wind Links

American Wind Energy Association

Wind Energy in the US: A State-by-State Survey, AWEA

Wind Maps

North American Windpower Magazine