The latest Residential Energy Consumption survey offers some good news for the electric vehicle industry.

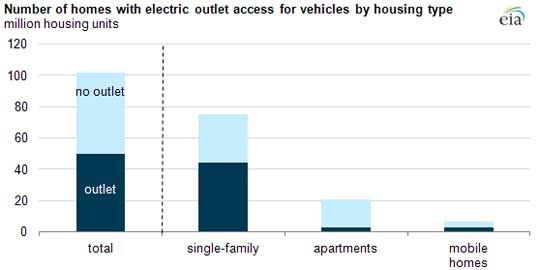

Sixty percent of respondents in single-family homes report parking within 20 feet of an electrical outlet. The data is less rosy for apartment dwellers, who had far less access to outlets. In multi-family units, only 14 percent of respondents were near a plug.

Of course, not having a standard outlet is not a problem if electric vehicle chargers are available, which can also cut the time of charging. All electric vehicle charging companies make a 240-volt Level II charger, which can slash charging time from about eight hours to four, and many are also selling Level III chargers, which cut charging time to less than an hour.

The new data from the U.S. Energy Information Administration is good news for EV charging companies, which can provide the access to charging in buildings where none currently exists.

For single-family homes, there was significant variation by region, with the Midwest having 20 percent more respondents that have access to an outlet compared to the Northeast.

The EIA noted that for all-electric vehicles, which have a limited range, the charging situation could be a limitation for those who live in cities, since the majority of charging happens at home.

But car companies and municipalities are aware of the problem, and many places are working on installing charging infrastructure. The public charging infrastructure is big business, big enough that ECOtality is suing California over its agreement with NRG to provide 200 eVgo charging stations in commercial and retail locations.

The need for charging will not just be an issue in the U.S. In many European and Asian cities, there will also need to be significant charging infrastructure if people are going to own EVs or plug-in hybrids. Coulomb Technologies recently added Toyota Tsusho Corp., the trading arm of the Japanese auto giant, to its long list of investors.

Coulomb is just one startup in a field that also counts General Electric and Schneider Electric as competitors. For many of the smaller companies, strategic partnerships are key, such as ECOtality’s licensing agreement with ABB, or Coulomb’s marketing agreement with Siemens, or AeroVironment's partnership with Nissan.

Currently, charging is something of a chicken and egg problem, since sales of EVs are limited. But there are far more vehicles coming on the market, which means that the charging debate -- and competition -- is likely to heat up starting later this year.